Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

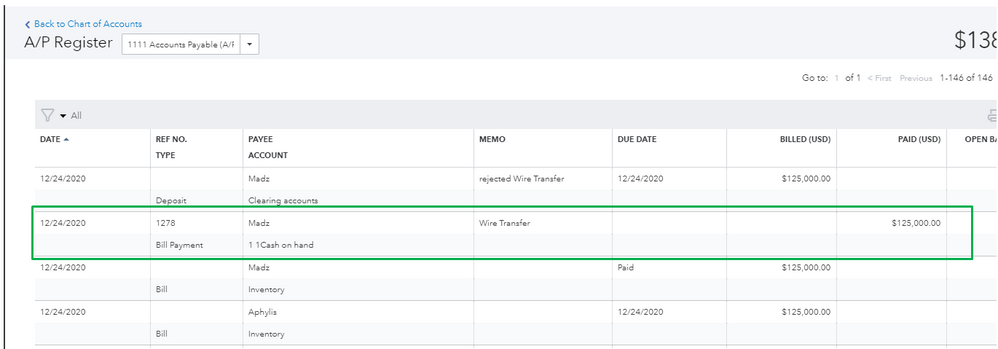

We wired the expense that belongs to 2021 in December 2020 by mistake. When we run P&L 2020, that expense is shown on our P&L 2020, but it is deductible in 2021. Since we are on a cash basis, and expenses are shown in the year when they are wired, we have a problem with automatically running P&L. Is there a way to move this expense to be automatically shown in 2021?

Solved! Go to Solution.

I can help you settle this transaction, @socexahmed.

Thanks for taking the time to visit the Community. I’m here to provide information, so this expense transaction will be displayed under 2021 records.

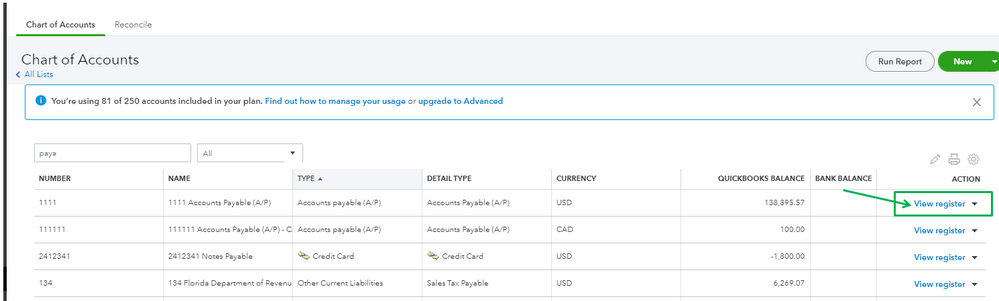

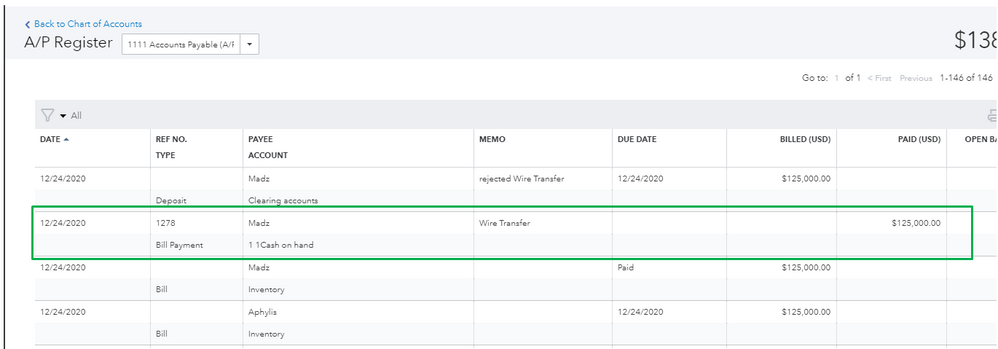

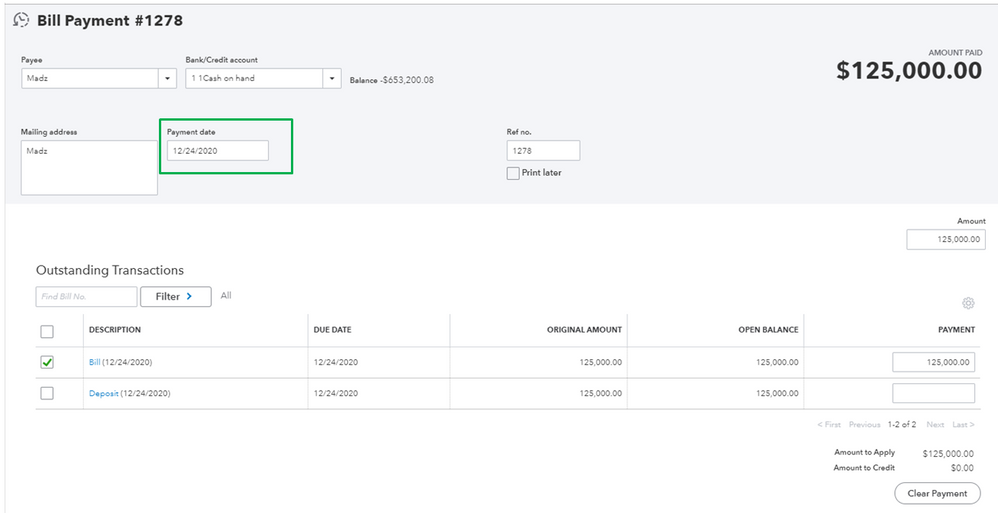

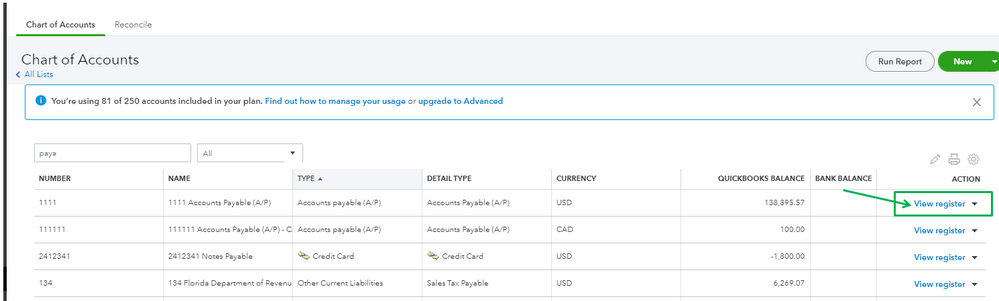

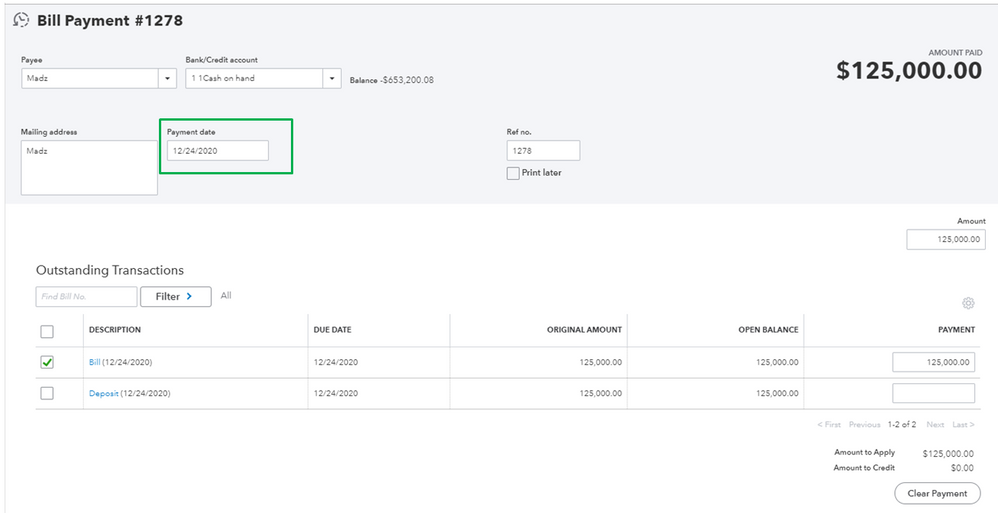

When running financial reports, QuickBooks will base on the transaction date. We can manually edit this event so it’ll fall to the correct period. I’ll show you how:

After this process, you can run the Profit and Loss report. That way, we can make sure everything is appropriately recorded. You can use the customize feature to view the specific details that matter the most.

Don't hold back to drop a comment below if you have other QuickBooks concerns. It's my pleasure to be of great help. Take care!

Thanks for getting back to us, @socexahmed.

Since you already changed the transaction dates to January, all you need to do is to click the Clear filter option on the Reconcile page. This will show all the transactions including December. Then, you can now manually select them to complete the reconciliation process.

Here's a sample screenshot from my test account.

Also, it'd be best to consult your accountant for other options you may consider when reconciling.

To learn more about how the reconciliation works in QuickBooks Online (QBO), check out this article: Learn the reconcile workflow in QuickBooks.

I'm also adding this article that tackles fixing issues when reconciling for future reference: Fix issues for accounts you've reconciled in the past in QuickBooks Online.

Please let me know if you have any additional questions or concerns in the comment section below. I'm always here to assist. Have a wonderful day!

I can help you settle this transaction, @socexahmed.

Thanks for taking the time to visit the Community. I’m here to provide information, so this expense transaction will be displayed under 2021 records.

When running financial reports, QuickBooks will base on the transaction date. We can manually edit this event so it’ll fall to the correct period. I’ll show you how:

After this process, you can run the Profit and Loss report. That way, we can make sure everything is appropriately recorded. You can use the customize feature to view the specific details that matter the most.

Don't hold back to drop a comment below if you have other QuickBooks concerns. It's my pleasure to be of great help. Take care!

Thanks for the answer. That resolved the problem with P&L. But when I want to reconcile December, it shows me a discrepancy because bank payment and QB payment are different. How to reconcile? The actual payment was in December, but I moved the payment date to January 1 in QB.

Thanks for getting back to us, @socexahmed.

Since you already changed the transaction dates to January, all you need to do is to click the Clear filter option on the Reconcile page. This will show all the transactions including December. Then, you can now manually select them to complete the reconciliation process.

Here's a sample screenshot from my test account.

Also, it'd be best to consult your accountant for other options you may consider when reconciling.

To learn more about how the reconciliation works in QuickBooks Online (QBO), check out this article: Learn the reconcile workflow in QuickBooks.

I'm also adding this article that tackles fixing issues when reconciling for future reference: Fix issues for accounts you've reconciled in the past in QuickBooks Online.

Please let me know if you have any additional questions or concerns in the comment section below. I'm always here to assist. Have a wonderful day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here