Hi there, accuratesealcoat.

I'd like to share the possible reasons why there's no income tax withheld when printing the paycheck and help you sort it out.

It could be that the employee is not meeting the taxable wage base, or he/she was set to Do Not Withhold in the employee set up. I would encourage visiting the IRS Publication (Circular E), Employer’s Tax Guide to review the federal and state income tax requirement. The best thing we can do first is review their gross pay, tax status, and their set up.

Below are the steps to follow in checking if your employee was set to Do Not Withhold. That could be the reason why it's not showing when printing the paycheck. Here's how:

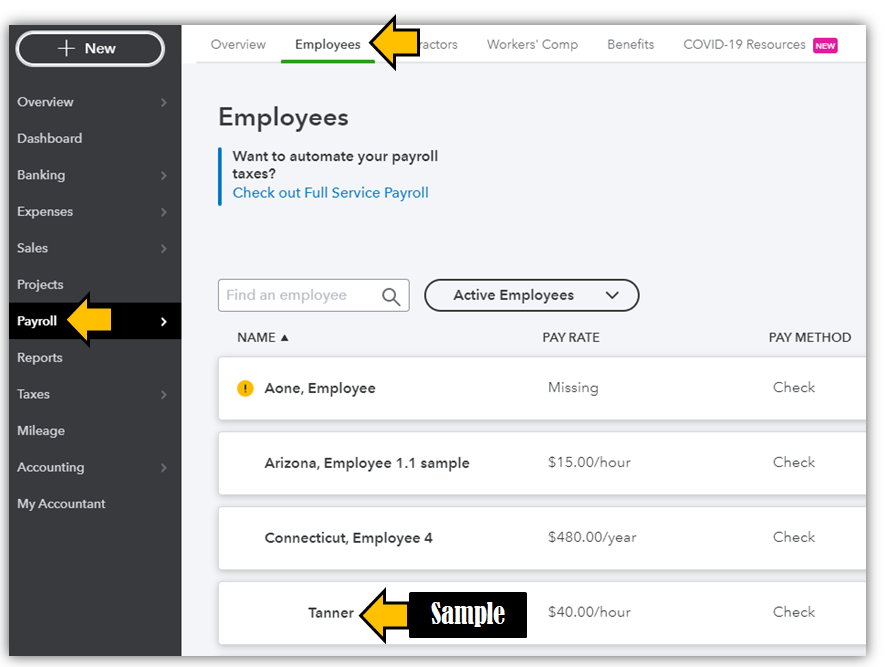

- Go to Workers or Payroll on the left side.

- Select the Employees tab.

- Find the employee's name.

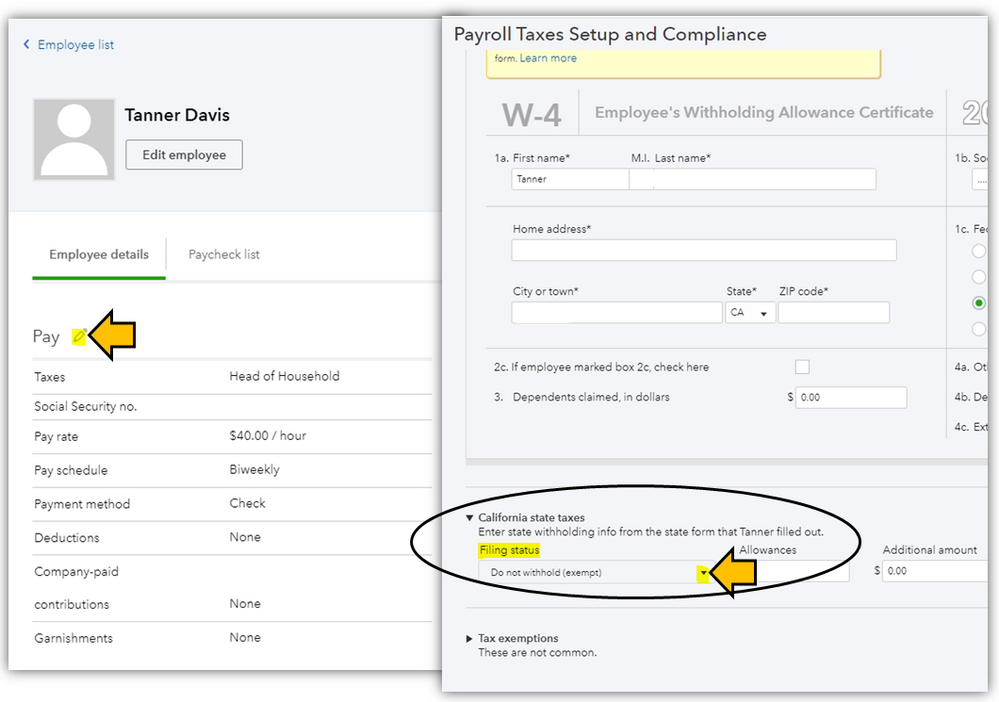

- Click Edit next to Pay.

- Hit the Edit icon in the Withholding section.

- Click the State tax name, and review the Federal Filing Status. If it's set to Do Not Withhold, change it to the appropriate one.

Once done, let's try printing the paycheck again. If the employee meets the taxable wage base and not set to Do Not Withhold, but there are still no federal income taxes taken out. We can troubleshoot it by using this article: Troubleshoot printing paychecks, pay stubs, and forms. We can use this as our guide for the successful printing of paychecks.

Let me know if you have follow-up questions after trying the recommendation. I'll be here to assist you further. Take care!