You made the right decision in asking help from the Community, don35.

There are a few reasons why taxes are not calculating on paychecks. It's either, the employees are not meeting the taxable wage base, or they are set to Do Not Withhold taxes in the employee setup.

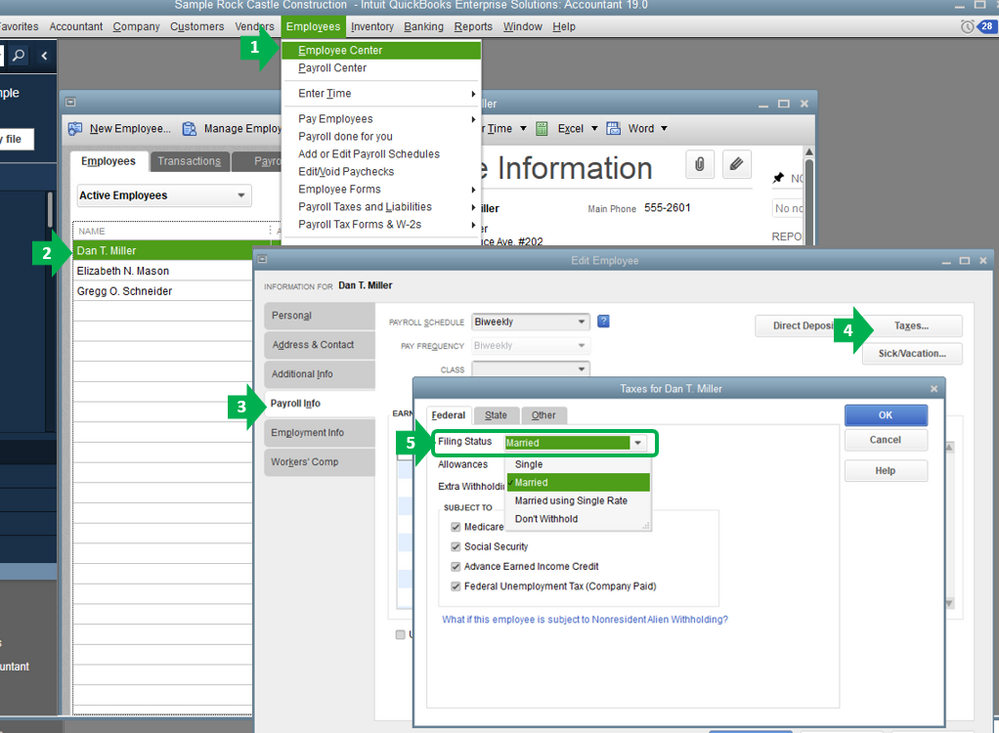

To verify the your employee's filing status, please follow the steps below:

- Go to the Employees menu, then select Employee Center.

- Double-click on the employee’s name.

- Go to the Payroll Info tab.

- Select Taxes.

- Check the Filing Status under the Federal and State tabs. Once verified, click OK.

To know more about the reason for taxes not calculating in QuickBooks Desktop, feel free to read through this article: No income tax withheld from paycheck.

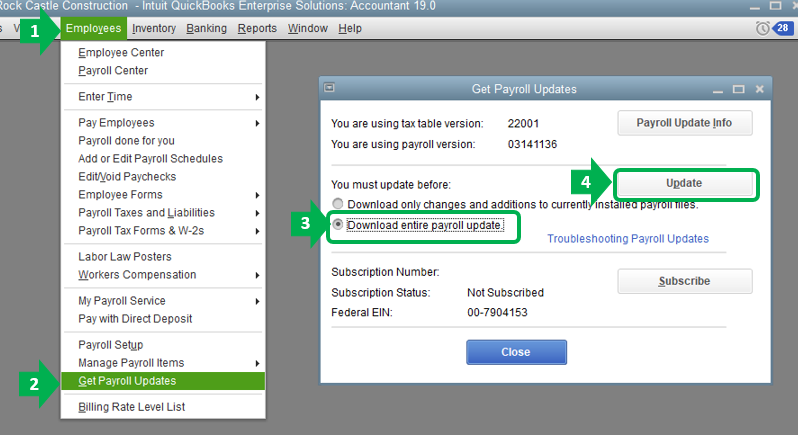

If none of the reasons mentioned above fits your current situation, I recommend updating your payroll to the latest release. This is often use to fix payroll issues and downloads the most current tax rates and calculations in the your account.

Here's how:

- Go to the Employees menu

- Select Get Payroll Updates.

- Fill in the Download Entire Update checkbox.

- Click Update. A window appears when the download is complete.

Once done, you can delete and recreate those paychecks were taxes are not being withheld. By doing so, the updates will be synced and applied to the newly created paychecks.

Here's how to delete:

- Go to the Employees menu and choose Employee Center.

- Select the employee.

- Under Transactions, open the paycheck.

- Click the Delete icon.

- Hit OK.

Or, if you haven't saved the paycheck, you can simply revert it. This will help refresh the paycheck for the taxes to calculate properly. I'll walk you through the steps below:

- Go to the Employees menu and choose Employee Center.

- Click off the employee name or hit the Tab key on your keyboard, the employee's name is highlighted with a yellow background.

- Right-click an employee name in the Enter Payroll Information window and choosing Revert Paycheck.

Here is the support guide with the steps about reverting paychecks in QuickBooks Desktop.

Leave me a reply below if you require more assistance regarding this or if you have other questions. I'll always be around to help. Have a nice day and take care!