Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Trying to prepare Massachusetts Paid Family Leave Quarter End Reporting. Under the File Forms Menu I can generate a PDF worksheet but Massachusetts requires an excel upload. Under the Menu Tax Forms in Excel I can generate the Paid Family Leave Worksheets but the Column for YTD Payroll is missing. Suggestions?

Thanks for coming to the Community, cjenkinsn411bc.

I appreciate your efforts in trying to generate the Massachusetts Paid Family and Medical Leave worksheet. Let me share some information about running the tax form worksheet.

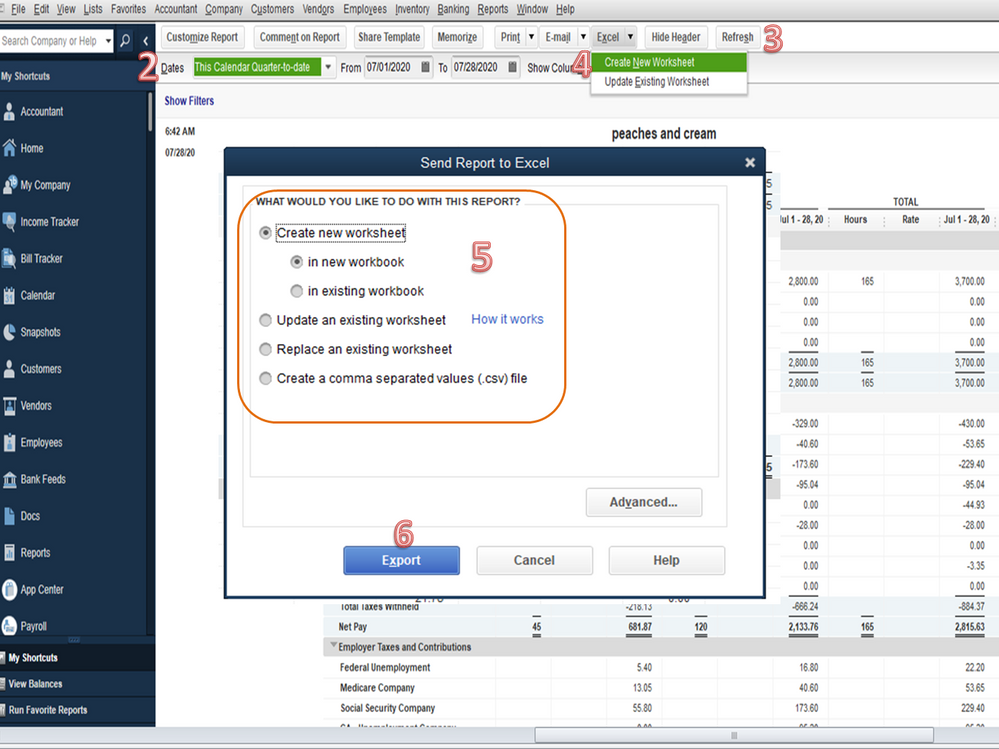

The YTD Payroll column is currently unavailable on the worksheet. As a workaround, open the Payroll Summary Report and export it to Excel. This way, you can easily transfer the year to date payroll to the other spreadsheet.

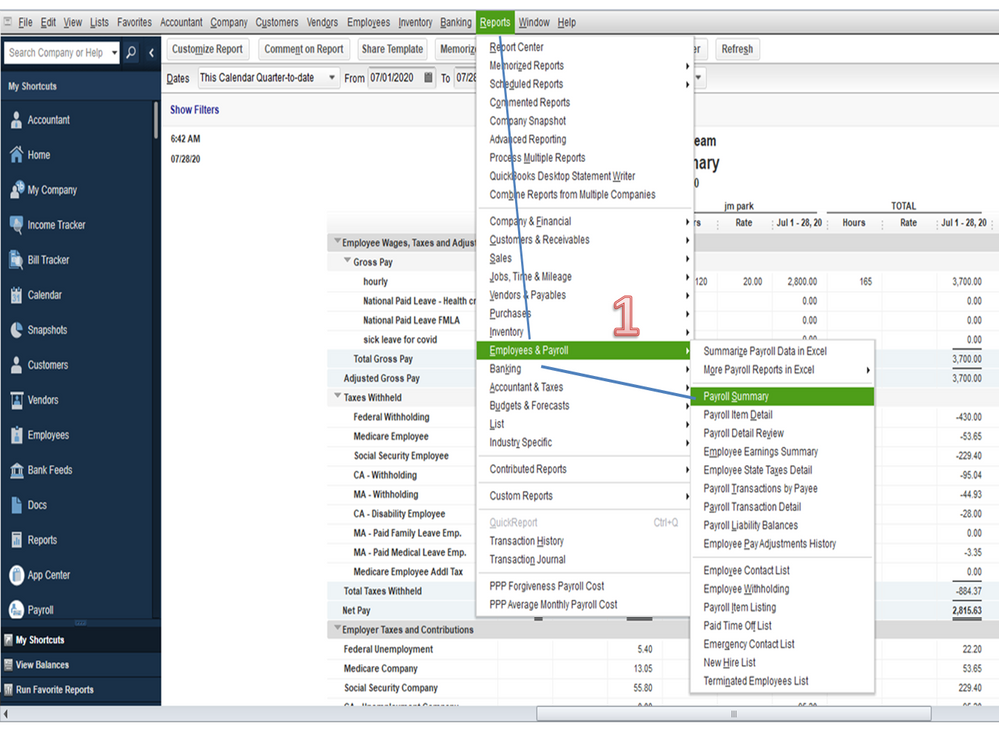

Allow me to show the steps on how to perform this task in QuickBooks. To open the report, check out these steps.

Open the spreadsheet and filter or sort the information. Once done, manually copy the data to the tax form worksheet.

With these steps, the quarter ending report will show the YTD column.

You can bookmark the Excel-based payroll reports article for future reference. It lists all Excel reports available in QBDT as well as instructions on how to build each one.

Keep in touch if you need some help with any of these steps. Please know I’m always ready to assist further. Enjoy the rest of the day.

Has this been addressed yet? The problem with the solution offered is the year to date totals may include employees who are no longer paid in the fourth quarter and don't show up therefore cutting and pasting does not work.

I've got you covered, @cjenkinsn411bc.

Currently, the YTD totals column is unavailable on the Massachusetts Paid Family and Medical Leave (PFML) worksheet. For now, you can consider following the suggestion given by my peer above.

I recognize your need for this feature. Thus, I suggest checking our Firm of the Future site to get you in the loop about the recent news and product improvements.

To ensure compliance with the state payroll tax regulations, you can review this article for additional inputs: Massachusetts Payroll Tax Compliance.

When you're all set, you can start paying and filing your payroll taxes.

Fill me in if you have more payroll-related or any QuickBooks concerns. I'll be here to assist you always.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here