Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowFFCRA and Cares Act payroll payment taxable for FUTA? Quickbooks computes as taxable on the paystub but not on the 940 form.

I appreciate your time posting your concern here, @cr15.

Once you run the report with the paid leave, you should be aware of how it affects your taxes. Under the FFCRA, you'll get credit towards your Federal Tax deposit for the wages and paid under this act.

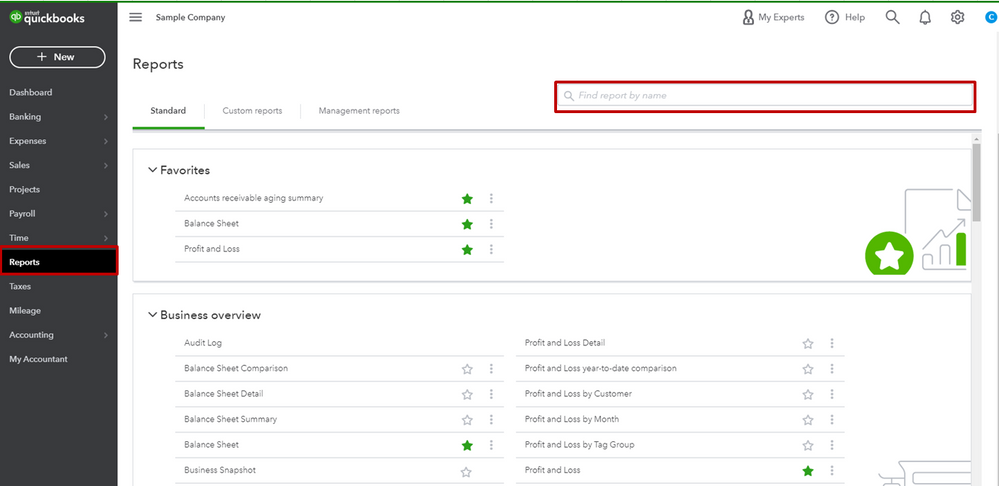

Let's review your payroll reports in QuickBooks Online. This way, you'll see how many hours you've used in these tax credits. Here's how:

Know that the 940 forms are based on the paychecks you run. If you see this in your reports but not in your 940, I'll suggest contacting our support team. This way, they can help you perform payroll corrections.

You'll want to personalize payroll reports. You may consider checking out this article: Customize reports in QuickBooks Online.

Keep me posted if you have other queries. I'll be around to help you. Have a wonderful day.

I believe this is a quickbooks computation error not something set up wrong.

I, too, am having issues with my 940 and the Covid Payments for sick leave. After re-reading QB's info page for the umpteenth time, and making sure all the related accounts were set up as instructed (they all were!) and making sure I didn't miss something about taxes being marked or unmarked, I have been searching the internet to find out if the Covid payments for sick leave are actually subject to FUTA or not. Not having any luck there, so far, either. So yes! If anyone knows if these payments are actually subject to FUTA or not (seems like not, as the other employer taxes were excluded, like SS and Medicare payments), please let us know!

I want to make sure your taxable payments for FUTA is accurate, @thaliramos.

Since we want to ensure if COVID payments for sick leave are subject to FUTA, I suggest reaching out to the IRS for more details. This way, they can give more information about COVID-19 related tax credits for required paid leave.

You might want to check out these IRS articles to know more about the Coronavirus-related paid leave for workers and tax credits businesses:

Keep in touch if you need any more assistance with this, or there's something else I can do for you. I've got your back.

Instructions for the 940 do not show FFCRA wages as a reduction but QuickBooks does. Is QuickBooks right or wrong?

Hello again, @cr15. Let me help you with this.

If there's a reduction applies, it'll show on line 11 on your form 940. The system populates this line by calculating the amount for line 2a of Schedule A, in which QuickBooks does the ff:

To verify the result showing on your QuickBooks account, let's run the Tax and Wage Summary report for the year to check the amount.

For more information about Form 940, see this article: How QuickBooks populates the 940.

For future help, here's some resource to help you get ready during tax season:

Please let me know if there's anything else that you need. I'll be here to keep helping. Take care and stay safe @cr15.

Thank you, but I had already read through IRS guidelines and no mention of FUTA tax is made. it says "Employer Share" of taxes assessed on the wages, which the FUTA tax is a part of, but it only specifically mentions the employer share of Medicare and Social Security taxes. So, I can assume that FUTA is not assessed on it, as it is a tax assessed only on employers, but as no specific mention of FUTA is made, I am very hesitant to act on that.

In addition to my previous response - I rechecked my tax settings, and noticed that the "Employer" portion of Medicare is checked (as in taxes assessed) for the National Employee Paid Leave, even though the IRS specifically says that taxes should not be assessed on the employer portion. But when I uncheck it, QB automatically unchecks the Employee portion, as well, which it should not do. However, when I recheck the Employee portion of Medicare, then it also rechecks the Employer portion. In other words, QB does not allow me to assess one with out assessing the other.

Thanks for keeping us updated, thaliramos.

You'll need to do this under the FFCRA act in QuickBooks. This way, you'll get credit towards your Federal Tax deposit for the wages paid.

QuickBooks released an update on how to track paid leave and sick time due to the coronavirus.

Feel free to browse the following articles as it provides updated information about how Families First Coronavirus Response Act works in QBO:

To make sure that you've tracked it correctly you can run these payroll reports, which includes your tax credit:

Know that you're always welcome to post here in QuickBooks Community if you have any other concerns.

Thank you, but after consulting with my CPA, we determined it was an issue with coding for the 940 form in QB, as everything was set up correctly. I saw this morning that a new payroll update was released, and after updating, I no longer have that error on my form.

940 Form in QB has been updated! After running payroll updates, the form 940 now calculates correctly with no errors.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here