Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Let me share you some details about this error, @Sue3.

The system detected that the tax deduction entered is incorrect, that is why you have encountered this error. It reminds us to enter the correct SS deduction amount in the employee's prior payroll. For example, the employee's gross pay is $500. Since the SS percentage is 6.2%, the deduction amount must be $31.00.

You can also see the discussion in this article about entering historical paychecks in QuickBooks Online: Set Up a Prior Payroll.

I'm just one comment away if you have any other concerns. Glad to be of assistance. Take care.

I am converting my existing Quickbook Desktop to Quickbook online and all of my other employee's amounts were perfect. Thank you I will check Quickbooks desktop for issues with the tabulations. I only wish I could move forward in my account without getting an Error message.

I'm having the same issue, $10,022.70 in piecework plus wages amounts to $621.41 in SS and $145.33 in Medicare.

Hi there, @DeluxeTransport.

When you received an error message "The amounts you entered may be incorrect. Social Security and Medicare taxes (FICA) are expected to be percentages of an employee's taxable earnings" it means that you enter incorrect tax deduction.

Let's click on the percentage hyperlink and re-enter the correct Social Security and Medicare. Also, let's make sure that the Net Pay must equal the values entered for wages minus taxes and deductions.

Also, to learn more about the 2020-2019 wage base limit, please check out this article: Payroll tax wage bases and limits.

If you have additional questions about payroll deduction, please let me know. I'll be here to lend a hand. All the best.

If I am taking this information from the last pay stub, how do I fix this?

Vanessa Q

We'll have to manually enter a prior payroll, Vanessa Q.

Both Medicare and Social Security are based on a fixed rate. That said, we'll have to make sure that the taxable amount for Social Security is 6.2%. Then, for Medicare is 1.45%.

You can check this article for the detailed steps: Set up a prior payroll. In the Provide the payroll total for one of your past pay dates this quarter page, enter the correct taxable amount.

Feel free to take a look at payroll tax wage bases and limit for more information.

There you have it. Stay well!

I am putting in the correct amount. 250.00 at 6.2 15.50. I don't know anything else to do. I can't seem to get through the process up setting up employees.

I am having the same problem. I checked and both SS and Medicare are the correct percentages, and my net pay is accurate. It still generates an error message. Could this be because there was a delay in the employee cashing a paycheck? (taxes were paid on payroll 3/31, employee did not debit earnings until 8/1)

Let's find out why you're getting the error message, WinnLawPC.

One of the reasons is if you do any manual changes on the employee's paycheck because of the delay in cashing it. QuickBooks tries to automatically correct the calculation on the next pay period. If you previously did some manual changes of some information, the program won't be able to auto-correct it. You can run the Payroll Tax and Wage Summary report so you can go review your paychecks.

For future reference, Please check this article for other available reports in QuickBooks Online: Run Payroll Reports.

Reach out to us if you need anything else. I'd be happy to help.

I didn't manually change the amount of the payment to the employee, the payment was just made some time after the taxes were paid. Also, I am just trying to set up payroll for an employee now for the first time. Prior payrolls were run by an accounting co. So I don't think the reports will help.

Thanks for the clarification, @WinnLawPC.

I understand how important it is to run your payrolls correctly. Let me route you to our best support available to this get sorted out right away. I recommend contacting our Support Team to securely look into your account and investigate the cause of this issue.

To reach out to them, you can follow these steps below:

I also recommend checking our Support Hours page to know the best time to contact them that’s convenient for you.

For additional reference in running payroll for your employee, you can read this article for guidance: Process or run payroll.

Let me also add this article that you can use for future reference: Set up an employee for direct deposit.

Tag me in if you need further help in managing your employee’s payroll in QBO. I’m just a post away from you.

I stated a LLC in January of 2020 and I'm just now setting up the payroll and have to go back and enter previous amount which i didn't hold the taxes out on.

I entered all info and states percentages are not righ

Is there something i need to do special in my situation?

Thanks!

Where is this percentage hyper link

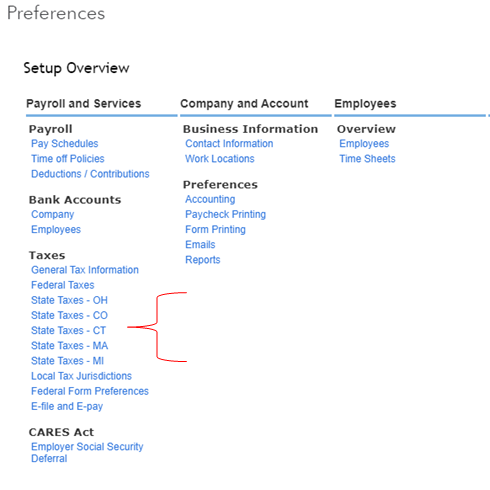

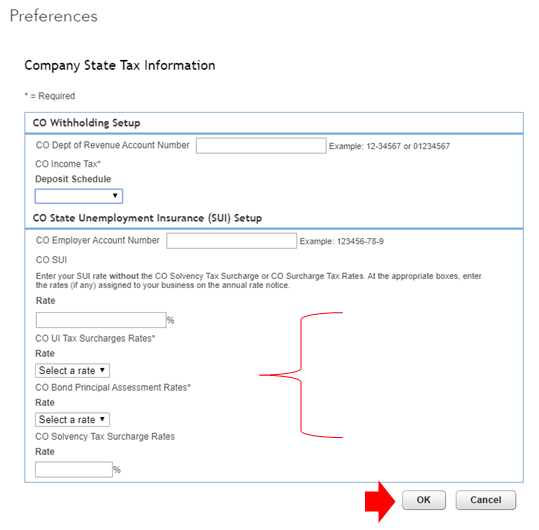

You’ll want to update the state tax rate in QuickBooks Online, @SandlinDesign.

Since your state percentages are incorrect, you can modify your Payroll settings. This way, the system will calculate and display the right information.

Here's how you do it:

You can check this article for more information on how to enter State Unemployment Insurance (SUI) Tax Rates.

In addition, here’s the basic information on processing payroll in QuickBooks. This includes tax forms and your obligations as an employer. I’m sure you’ll find it helpful.

Leave us a message if you need further assistance. I’ll be here to help anytime. Take care.

Frustrated with this error message. The net pay base doesn't include bonuses and incentives and I am getting error messages, possibly because the YTD information is higher than the net pay base? But for others I am still getting the error message and everything is correct after checking 3 times. What is the issue? Please help

Hey there, @error message with payroll ytd.

Thanks for sharing your concerns.

I recommend reaching out to our payroll support team. They have the tools available to review your account in a secure environment and investigate the error further. I've included the link to chat with our payroll team below.

Please let me know if you have additional questions or concerns. You can reach out to the Community at any time. Take care!

Hello,

I have a part time employee who actually did not have to pay any federal taxes because of the small paychecks.

I am entering manually from desktop to online. So the entry is for Jan. 1, 2020 up to today.

I must get this done today. thank you.

this is my error message:

The amounts you entered may be incorrect. Social Security and Medicare taxes (FICA) are expected to be percentages of an employee's taxable earnings. Check that the amounts you entered are correct.

I appreciate you for sharing the error message you received, @yvonne99.

The error message occurs when you’ve entered the wrong amount in your employee’s taxable earnings. To avoid this in the future, you’ll want to ensure you’ve selected the correct amount in their taxable earnings.

For more details and guidance about this, you can click the percentage hyperlink for reference.

Also, since you’ve mentioned your employee doesn’t have to pay any federal taxes, you’ll want to tax-exempt them. This way, you will not be prompt with the error message again when you run payroll for that employee. Let me guide you how.

You can also read through this article for more details: Employee payroll tax exemptions

Once done, you can now run payroll to your employee seamlessly.

If you need further assistance running payroll or filing your payroll taxes in the future, let me know in your reply. I’ll be around to help you. Keep safe and have a great week ahead!

I am getting this error message as well. The amounts you entered may be incorrect. Social Security and Medicare taxes (FICA) are expected to be percentages of an employee's taxable earnings. Check that the amounts you entered are correct.

I tried using the year to date gross and the current gross income and qbo gives me an error message. I am getting the information from a cpa who previously did the payroll and sent me the last paystub for all employees so I can pick up from there.

How can I fix this for their next payroll which is in 2 days.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here