Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Followed your directions, and when I print 2018 W-2, they have 2019 on the form, with 2018 wages.

That's not much help??

This does not help much, when 2018 wages print on 2019 Tax forms.

Any other suggestions?

Let me help you with printing your 2018 W-2, FMI.

The QuickBooks Desktop will print your previous W-2 using the form for the current filing year. That's why it's showing 2019 instead of 2018 even though it has the 2018 data.

If you archived this form when you file it last year, you can pull it up in the Saved Filings tab. This will give you the 2018 W-2 form.

In addition, you can also download the 2018 W-2 form from the IRS website and manually fill it out. You can just pull up a tax worksheet from QuickBooks for your reference.

I want to share this article about printing W-2 and W-3 forms for more details.

Feel free to post again here if you need more assistance. I'll be glad to assist you.

IRS & SSA sent me a letter stating they need a copy of our 2018 W-2 & 2018 W3. However, when I go into quickbooks it only saves 2019 W-2s & 2019 W3

Gives me a errror message of

Notice:

You are about to create forms for 2018, but you have already received an updated version of the form for 2019. QuickBooks only stores one version of each tax form.

You may be able to use the newer version of the form for the previous year. Check with the Social Security Administration for additional instructions.

- If you choose to print your forms on blank paper, they will include the year "2019", because the year is part of the government-approved form.

- If you chose to print your forms using preprinted forms for 2018, QuickBooks might not print the information in the correct locations, because the layout may have changed. QuickBooks will print the form details aligned for the 2019 form.

I do not want to miss up the 2019 forms that has been created. So how do I retrieve the 2018 W2's & 2018 W3 to supply to the IRS & SSA

Hello there, @NormaPayne.

To give you the best assistance, I recommend calling into our Desktop Support. They can make sure that your tax records won't get messed up and help you through the process of getting your 2018 W-2s and W-3s. Here's how to get in touch:

You'll hear from an agent in no time!

Let me know how the conversation goes! I'll be on standby if you need further assistance. Have a beautiful day.

I am looking at the pdf of last year's W2 in quickbooks desktop 2018

When i click on the printer icon to the top left of W2s or when i click on the word print in the row across nothing happens

how do i print these W2s from last year

Thank you for joining the thread, @kklee.

I'm happy to guide you today so you can print the last year's W2 form.

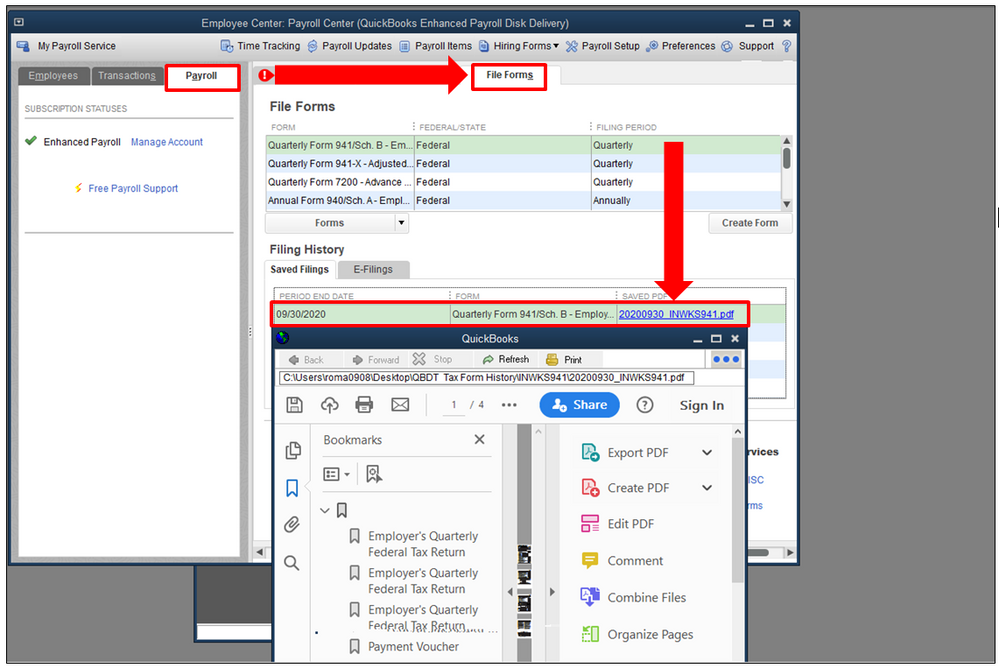

There are two ways you can print the last year Form W2. You can access it through the Filing History in the Payroll Center or prepare a new form for 2018 then print it for your records.

To access and print them:

If you wish to prepare a new form for 2018:

If nothing happens when clicking the Print icon, you can perform the troubleshooting steps from this article to fix any damage data on your file.

That'll do it. If you have other questions about the saved tax forms in QuickBooks Desktop, let me know by adding a comment below. I'm a few clicks away to help. Keep safe, @kklee!

I had a situation where the client's W2's from 2018, for some random reason unknown to me, downloaded all but one employee's 2018. I went to the Company files on the C drive and found the tax history and forms folders which had W2's from 2019. Went to an old computer's C drive and the 2018 forms were there but not the one employee. Of course I couldn't print in the current file because only 2019 format available. Read somewhere to change computer system date so I tried that no luck. In the end, as suggested above I went to the IRS website, download 2018 fillable PDF and took the information from the Payroll Summary CY 2018 for that employee. Thank goodness. This was after hours of trying though.

I always save the payroll filings in QB. However, I noticed if I upgrade or restore a back-up the history is gone and the the folders on the C drive with tax and forms history only provide the current version filings. I'm wondering if there is something I can do to make sure that all historical tax form information is saved somewhere? I know I can download to PDF and save in my files, but if there is anyway to keep history in QB that would be great. Don't want to go through this exercise again. Also, I found out the Workforce paycheck portal keeps W2's one prior year only?

Hi there, @dso0216.

In QuickBooks, we have a feature where your historical tax form information will save under in that filed forms. In that way, you can open your tax form anytime. The Workforce paycheck will be saved in E-file ss long as the Company was Active or any W2's that have been generated during the usage of QuickBooks.

Let me walk you through on how to set up your e-File in your QuickBooks Desktop. Here's how:

First, you'll have to get the information needed in enrolling your IRS e-File.

Step 1: Change the filing method of your Federal Forms to e-file

You can read this article as your reference to complete the setup. Please proceed to Step 2: Set up your Federal Forms 940, 941, and 944 for e-file in QuickBooks Desktop.

I've also added an article to help you e-file 940, 941, 944 tax forms in QuickBooks Desktop.

If you have other concerns, please don't hesitate to leave a message in the comment section. I'm always around here in the Community to help. Take care, and have a great day.

Thank you Rejeil, I am set-up with efile, and have a form 8655 as the authorized processor/signor for the clients payroll. I have an EFIN pin number as well. The issue is really with the prior years W2's and not the 941's or 940.

Thanks for getting back to this thread, @dso0216.

Allow me to provide you more information in regard to restoring all of your tax form info in QuickBooks.

Once you upgrade or restore a backup copy, it will automatically replace all of your historical information. This is the reason why the previous data in your company file is gone.

Also, QuickBooks Desktop (QBDT) will automatically save the filing history in your company file. You can check this is out in the Payroll Tax Center. Here's how:

Please take note that once you upgrade your version, it will automatically create another file directory. This will serve as another location to save your new Filing History data in QBDT.

However, you can always create a backup whenever you file your taxes. This way, we make sure that all of your tax form information is safe.

In addition, I recommend creating a separate folder and store a different backup copy in your other storage device. This will help you safeguard your data in case of hardware or software failure.

I'm always here to help if you have any other concerns or questions. Just tag my name in the comment section and I'll get back to you as soon as I can. Have a great weekend.

Im an employee. I would like a previous years w2 but I dont want to involve my employer. The fact that I can not easily print this myself is either because you make money by charging for that feature in some way or your program just sucks. Either way, as an employee, I should not have to bother my boss over something that should be so easy to access and print. You get an F.

Thanks for joining this thread, yoursoftwaresucks.

I can help walk you through the steps on how to print your old W2's without hesitating your employer.

You can log in to your QuickBooks Workforce account and view your W-2s, paychecks, and other information. Just make sure that your employer has granted you access to this website.

Here's how:

But if you're not invited yet, you'll need to ask your boss to send you an invite. They can follow these steps to add your account.

For more information, visit this article: Set up QuickBooks Workforce for your QuickBooks Desktop.

Once your employer has invited you to QuickBooks Workforce, then you'll need to set up your account. After that, follow the steps above on how to print the forms.

I've also attached an article that helps you in managing your QuickBooks workforce.

Let me know if you have any questions. I'm always here to help.

Hi there, @ GAMBLE5223.

You can print the W2s from 2018. Allow me to explain in the steps below how to do this.

That's all there is to it. You can check out Print W2 and W3 forms for more details about printing these forms.

Please let me know if there's anything else that I could do for you. You can always reach back out to the Community or me anytime you have questions or concerns. Take care and enjoy your weekend!

I followed your instructions and have used that same method many times. However, with the 2021 updated Quickbooks payroll, when I click print, it will not print. I have tried 5 times now. There is something wrong with the Quickbooks 2021 payroll updates. I had the same printing problem with my 1099's and ended up hand writing them. Please fix this printing problem. I am able to print payroll forms, checks, reports etc but cannot print a previous tax form

Thanks

Shirley

I pull my w-2 from the tax filing history, but it will not let me print. This problem started ocurring when I upgraded to Quickbooks 2021 payroll . I am doing everything right but when I click the print icon to print out old w-2 for an employee who lost hers, it will not print. There is something wrong with the 2021 version.

The print icon is not working to reprint old w-2. This starting happening when we upgraded to Quickbooks 2021 payroll.

Helping you get those Form W-2s printed is my top priority, @shirley66.

I have more steps we can try so you can get your payroll forms printed. Let's run our Print & PDF Repair Tool. This fixes most of the common printing issues. Let me walk you through the steps.

Once done, go back to your payroll forms and try printing again.

You can refer to this article for more recommended solutions: Troubleshoot PDF and Print problems with QuickBooks Desktop.

In case you need help with other tasks in QBDT, browse this link to go to our general topic with articles.

Keep me posted if you still have questions or concerns. I'm always here to help.

I have a former employee asking me for his W-2s from 2018 and 2019. I sold the business in December of 2019 and no longer have a Quickbooks account. How can I retrieve the W-2s?

We're unable to get your employee's W-2 data for 2018 and 2019. However, your employee can order a copy of the entire return from the IRS for a fee. You can reference this resource for more details: Transcript or Copy of Form W-2. Then click the Can I get a transcript or copy of Form W-2, Wage and Tax Statement, from the IRS? information.

You can also contact the new QuickBooks Online company owner to get a copy of your employee's prior W-2s.

Alternatively, you can check if you still have access to your previous QuickBooks Online account. Then check the Archived forms to download the employee's W-2 for 2018 and 2019.

Additionally, you can contact the IRS for more details on how to get the employee's W-2 copies for 2018 and 2019 since they got access to it.

Let me know if you have other questions regarding the W-2 forms. I'm always around to help. Have a great day!

where can i find prior year w2 forms?

I can help with finding your prior W-2, maoteri.

For QuickBooks Online:

For QuickBooks Desktop:

The steps are sure to help you locate your previous W-2 in QuickBooks.

I've also added these links for additional reference about W-2:

Please get back to me if you have any other questions about W-2. I'll be sure to help.

This is not true for the new version of QB online. Go to TAXES > PAYROLL TAX > FILINGS > FILING RESOURCES > ARCHIVED FORMS & FILINGS.

Please update your answer.

Thank you

Welcome to the Community, @TaxPrepSystem.

Thank you for sharing the steps to find prior W-2. I would also like to add insights about this.

The two articles provided by my colleague GlinetteC include both old and new interfaces.

I'll add the same articles for your reference:

Let me know if I can be of more help with W-2. I'm always here to help.

our QB act was closed and now I have no way of getting copies

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here