Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHello - (1) I just ran my 1099s, but it sent them using my personal name and it would not allow me to change it to my Company Name in the 1099 Company section or by using the gear icon and going to Account & Settings. An error "Changing filing name will disable eservices ( Tax Setup eservices Will Be Disabled Warning)" comes up every time. I called customer service and they remote viewed and had me try several different things to no avail. The rep then told me she asked tech assist and they said we cannot change our Company name because we no longer use QB Payroll. She also said no changes can be made during tax season. Does anyone know if this is correct and why wouldn't QB let us make these changes if the company name is incorrect? This does not make sense. How can we change our Legal name to "same as Company name" to be used on 1099's, etc? (2) Also, when the 1099's were finished, the email address they are sending a notification to is our old bookkeeper. She is no longer in users or anywhere I can see, and our email addresses are correct in Account settings. How can her email address be where they send the 1099 notification? I also called QB, but the customer service rep did not know how to fix it. Does anyone know how to correct this? Thank you.

Welcome back to the QuickBooks Community, lp_mi. I appreciate you for sharing detailed information about what you've done to fix the issue. With this, I'll be sharing details to ensure you'll be able to change the company name. Then, route you to the right support team to assist you further on this matter.

You'll have to update your business details in your payroll product to ensure that the company info on your payroll tax forms is accurate. It should match the federal and state agency records. That said, once you’re enrolled in e-services, it stops you from updating some of your business info. You'll need to turn it off first and turn it back on once you’re done updating your business info or company name. To see further details and how to perform the process, you can open this article: Update your business info in online payroll.

If the issue persists, I suggest contacting our QuickBooks Support Team again. They have the tools to pull up your account in a secure environment which we're unable to do it here in the Community. This way, they'll be able to investigate the cause of the problem and change the company name as soon as possible. They can also provide details to make sure you'll be able to change the email address for 1099s.

You may refer to each article below to see details about printing 1099's and how it works in QuickBooks. Then, what forms or boxes do you have to choose when filing 1099 so your tax form stays accurate.

If you have other questions about 1099, you can hit the Reply button below and I’ll be happy to help. Have a great day.

Thanks, but I received no fix from QuickBooks links, phone or chat reps.

I figured out how to change my Legal Co Filing Name myself:

1 - Click on gear icon then choose Payroll Settings - Even if you no longer use QB Payroll

2 - Click on the edit icon to right in General Tax section and update the Filing Name

3 - Update any other sections as needed

*Quickbooks - Please give this info to your customer service reps so they can help others quickly without sending them on a wild goose chase*

I still can't figure out how to stop notification emails to my old bookkeeper, but will let you know when I do. Please let me know if anyone else has a solution to this. Thanks.

I’m glad that your filing name is now updated in QuickBooks, @lp_mi. Let me help here so your old bookkeeper will no longer receive email notifications.

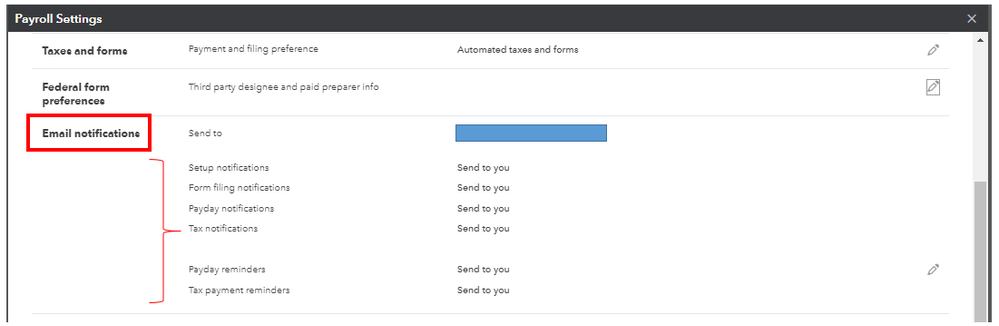

Aside from the Account and settings, also ensure the email address is set up correctly in your Payroll settings. This way, your old bookkeeper won’t receive any QuickBooks notifications after processing your 1099s.

Here's how:

If the email is incorrect, follow the steps in this article to update your information for Payroll:

In addition, here's an illuminating guide in preparing and filing your Federal 1099s: Create and file 1099susing QuickBooks Online.

You can always come back if you need more help with updating your account information. I’ll be here. Always take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.