Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHey all, 1st time posting.

I am building an RV park in TX and went out for a loan to finish building the park, this included a refi on my current loan for the property. The total loan is for $600k, the bank has already sent the money to my first loan and paid it off, now I will get invoices from my subs and submit them to the bank, they will cut checks for my subs. What would be the best way to set this up in QB online.

Thanks in advance,

Jim

Solved! Go to Solution.

The advice given by @JessT will not work regarding your bank paying your subs. Since the bank is paying the subs, this is not impacting your bank account, it is increasing your loan balance, correct? If that's the case, you will need to create a bank account in QB called 'Clearing Account'. When you receive the bills from your subs, enter and pay the bills using the Clearing Account. Then, move that balance to your loan payable account. To do that, make a journal entry (New > Journal entry), debit Clearing Account and credit Loan Payable. You will now have the expense booked as well as an increase in your loan balance.

Hi Jim!

It's good to see new faces in the Community! Warm welcome! I'll guide you through entering your loans and the check payments to your subcontractors.

I want you to feel at ease when entering transactions because you can always edit or delete them if you miss something. Aside from that, we're here to guide you along the way.

Step 1: Create the first loan account

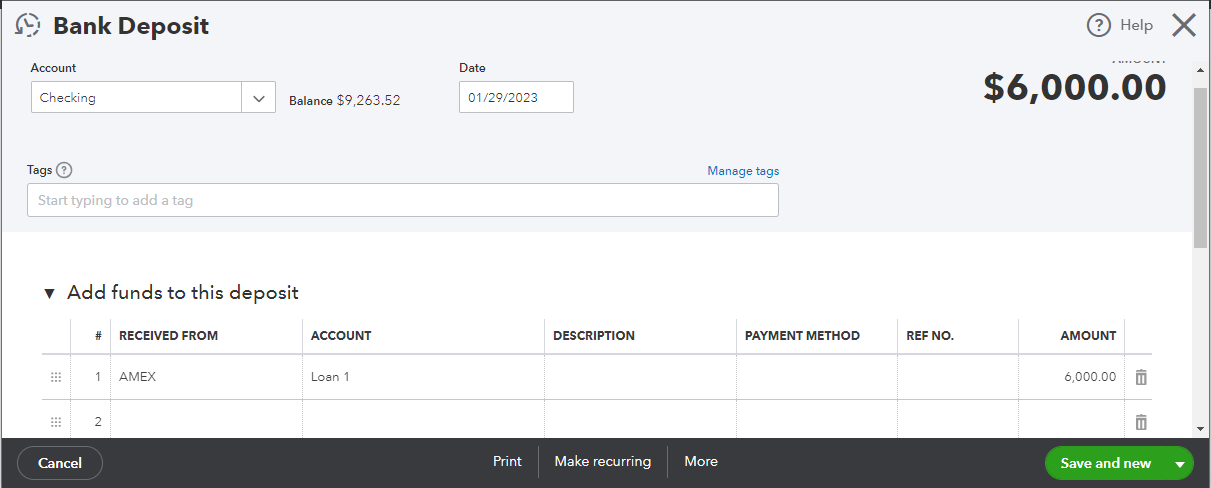

Step 2: Enter the amount you received.

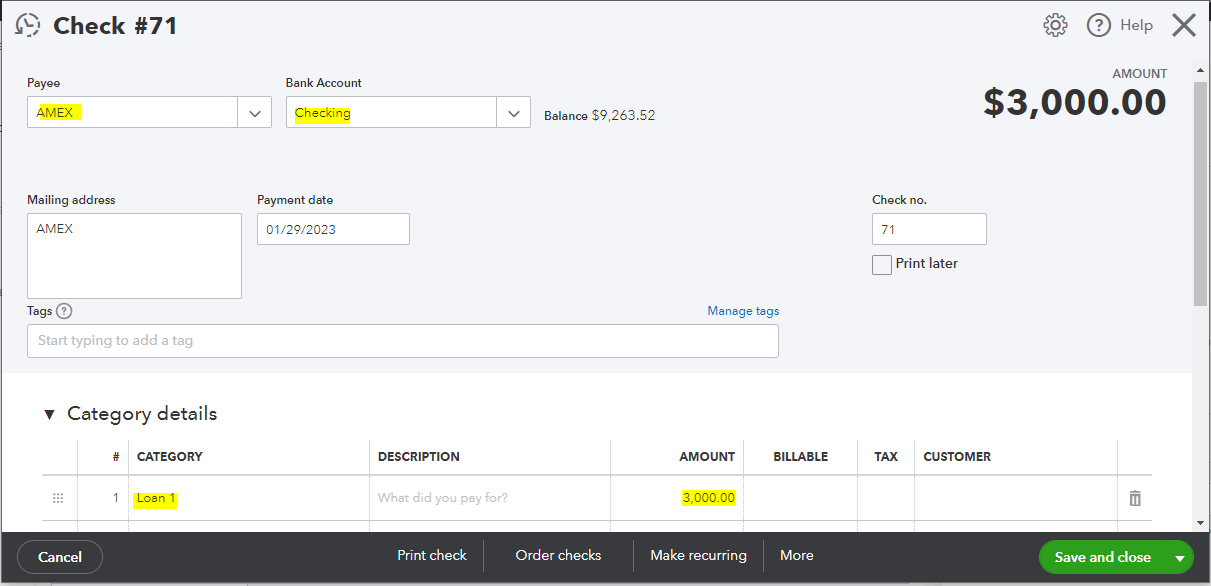

Step 3: Record your repayments to your first loan via check transaction.

Step 4: Create the second loan account, using the steps in Step 1. We'll name it as "Loan 2" in this case.

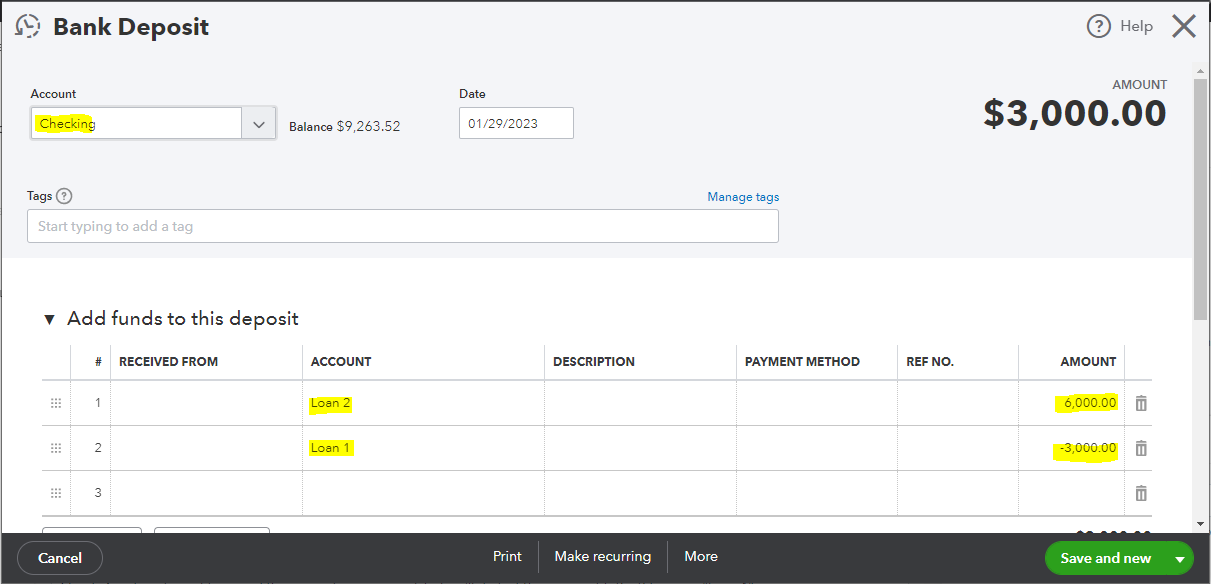

Step 5. Create a deposit to record the amount you received, but we'll deduct the payment (offset) to repay "Loan 1".

When you check your Chart of Accounts, Loan 1 should have a zero balance and Loan should have the full balance.

About paying subcontractors, you can record the bill in QuickBooks. Then, pay them using your bank account. Just add a note saying it was paid by the bank.

Feel free to go back to this thread if you have other questions in mind.

Thanks Jess,

I appreciate your quick response, let me put this in action and see how it works.

V/R

Jim

The advice given by @JessT will not work regarding your bank paying your subs. Since the bank is paying the subs, this is not impacting your bank account, it is increasing your loan balance, correct? If that's the case, you will need to create a bank account in QB called 'Clearing Account'. When you receive the bills from your subs, enter and pay the bills using the Clearing Account. Then, move that balance to your loan payable account. To do that, make a journal entry (New > Journal entry), debit Clearing Account and credit Loan Payable. You will now have the expense booked as well as an increase in your loan balance.

Correct, I didn't receive any money from loan 2 it paid off loan 1, the amount paid to loan 1 is my starting balance on loan 2. Now when I receive invoices from my subs I send them to the bank and bank cuts a check that will increase the balance on loan 2.

It makes much more sense now with your help.

Hi again, Rainflurry.

I appreciate you for always sharing your knowledge about QuickBooks. This will definitely help other users as well in the future. Please keep on posting here in the Community.

Keep safe and have a great rest of the day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here