Announcements

Get unlimited expert tax help and powerful accounting in one place. Check out QuickBooks Online + Live Expert Tax.

- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Other questions

- :

- Business Loan for Real Estate Purchase, Renovations and Equipment

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Business Loan for Real Estate Purchase, Renovations and Equipment

We've Purchased a Building for 160,000.

Equipment & Renovations 101,700

Paid 16,000 Down

How do we set-up this loan in QB Desktop?

Solved! Go to Solution.

Labels:

Best answer March 12, 2022

Solved

Best Answers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Business Loan for Real Estate Purchase, Renovations and Equipment

I'll be glad to walk you through how you can record a loan, @KingDeuces.

You'll need to set up a liability account for the loan fist. From there, you can keep track of the loan. Here's how:

- Set up a liability account from the Chart of Accounts.

Set up the vendor (Bank/lending company).

Set up an expense account.

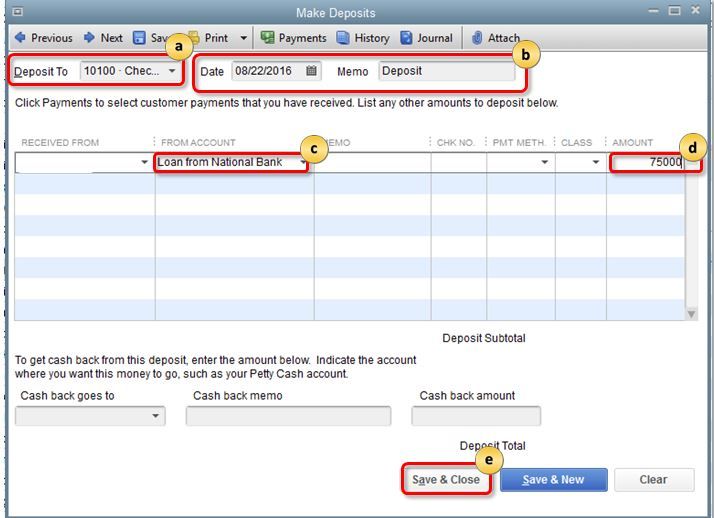

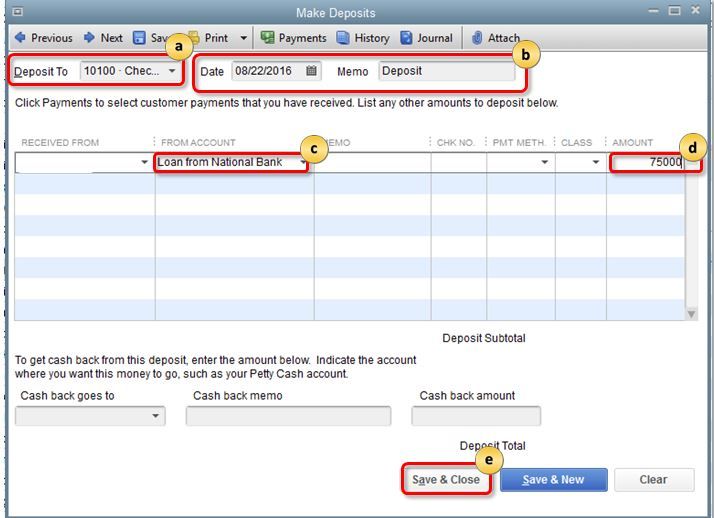

Record the loan amount.

For details about the process, check out this article: Manually track loans in QuickBooks Desktop.

With the above steps, you're able to record and keep track of your building and equipment loan.

I've also added this link here in case you need help managing expenses in QuickBooks Desktop. It has topics with articles that'll guide you through the process: Expenses and vendors.

Please drop a reply anytime below if you have other questions or concerns with loans. I'll be around for you. Take care and have a great day ahead.

6 Comments 6

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Business Loan for Real Estate Purchase, Renovations and Equipment

I'll be glad to walk you through how you can record a loan, @KingDeuces.

You'll need to set up a liability account for the loan fist. From there, you can keep track of the loan. Here's how:

- Set up a liability account from the Chart of Accounts.

Set up the vendor (Bank/lending company).

Set up an expense account.

Record the loan amount.

For details about the process, check out this article: Manually track loans in QuickBooks Desktop.

With the above steps, you're able to record and keep track of your building and equipment loan.

I've also added this link here in case you need help managing expenses in QuickBooks Desktop. It has topics with articles that'll guide you through the process: Expenses and vendors.

Please drop a reply anytime below if you have other questions or concerns with loans. I'll be around for you. Take care and have a great day ahead.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Business Loan for Real Estate Purchase, Renovations and Equipment

Thank you for the info @ShiellaGraceA. I now understand how to account for the property & interest. However, how do I account for the renovations & equipment portion of the loan? Or am I just reading too much into it?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Business Loan for Real Estate Purchase, Renovations and Equipment

Thank you for getting back to us, @KingDeuces.

About the renovations & equipment loan, you can still use the expense account. You can review the article provided by one of my colleagues above, @SheillaGraceA. Here is the article: Manually track loans in QuickBooks Desktop.

You can also manage and keep track of your loan payments. Check this article for more information about the process: QuickBooks Loan Manager.

If you have additional questions about recording your loan process, you can click the Reply button below. Have a great day.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Business Loan for Real Estate Purchase, Renovations and Equipment

Shellie I have the same situation. I'm using Intuit QB Enterprise Solutions: Manufacturing and Wholesale 22 and just purchased a building. I know in the past there was "loan manager" but it appears to no longer be a part of QB.

Purchase Price - $1,500,000.00

Closing Cost - $32,404.10

Earnest $$ Paid - $15,000.00

Paid at closing - $305,306.32

I have a long-term liability account set up and also set up the bank under vendor. Do I need to set up an interest account as well? I set up long-term liability account with opening balance of $1,532,404.10. Do I write a check for the pmt and put the principal to the long-term liability account and interest to an interest account? So is this in essence a manual process each month and I don't need to enter the interest rate in any place?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Business Loan for Real Estate Purchase, Renovations and Equipment

I’ll address each of your concerns so you can track loans accurately in QuickBooks, @tapelady.

Yes, the QuickBooks Loan Manager feature was discontinued in QuickBooks Desktop 2022. It’s only available in previous, currently supported versions.

You’ll want to set up an Interest or Expense account. This way, you can track interest payments and charges. To do so, please follow these steps:

- Go to the Lists menu, then select Chart of Accounts.

- Right-click anywhere, then click New.

- Select Expense, then Continue.

- Enter the account name (Interest).

- Press Save & Close.

You can contact your accountant if you need help in choosing the appropriate account to use.

You’re correct. You’ll need to write a check to enter the payments. QuickBooks records them for the principal amount as a deduction to the liability account. Once you complete the payments, the amount of the liability account will turn to zero. The program also records the interest payment as a company expense.

There’s no need to enter the interest rate. After selecting the interest expense account on the second line of the check, you enter the payment for the loan interest.

For complete instructions, check out this guide: Manually track loans in QuickBooks Desktop.

If you want QuickBooks to automatically enter the payment for you in the future, you can memorize the transactions.

If you have any other questions or concerns besides tracking loans, don’t hold back to drop a comment below. The Community team is always here to help you out. Keep safe!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Business Loan for Real Estate Purchase, Renovations and Equipment

Yes, you are correct in your process: the process of making the monthly payment is a manual process each month of allocating the principal and interest portions of the payment. The interest portion should be assigned to an interest expense account which should be set up if you don't have one yet. And, as you mentioned, the principal is assigned to the liability account.

Your liability account balance doesn't look right. Your liability account should be $1,212,097.78 ($1,500,0000 + $32,404.10 - $15,000 - $305,306.32), unless I'm missing something.

Get answers fast!

Log in and ask our experts your toughest QuickBooks questions today.

Related Q&A

Featured

Small businesses are the vibrant heart of our communities.From your

favorit...

Launching a small business can be an adventure filled with excitement

and t...

Join us today on SmallBizSmallTalk as we discuss practical strategies

for d...