Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am a small construction company. I use item numbers for project categories such as Item #10 is Builders Risk. I received a refund for overpayment of Builders Risk on a project. How do I deposit this refund and have it show up on a project report under the correct item category (#10) so that actual amount paid for the Builders Risk is accurate. There is no Item # space on any deposit forms that I've found. It will post to correct project, but not to a specific item#. Thank you in advance!

Solved! Go to Solution.

Hi there, @Weber.

I can help you on how to deposit the vendor and make it show on the correct item category. There are certain scenarios we need to determine first before recording the refund.

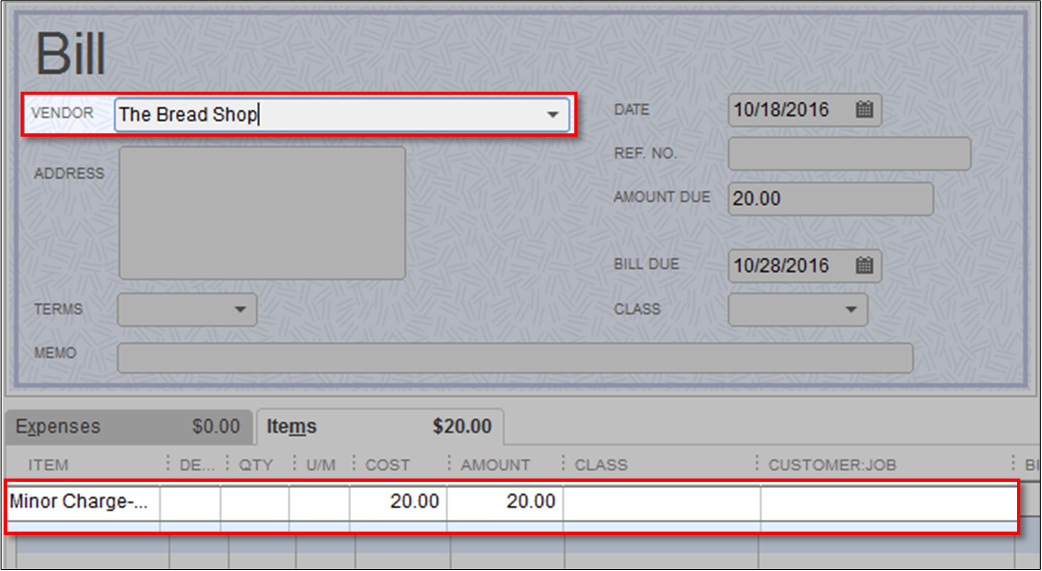

If the vendor sends you a refund check for a bill that is already created, you can follow the steps below:

Next, record a Bill Credit for the refunded amount. From here, you'll need to select billable so you can enter the project name. Later on, you will link this to the created deposit.

Here's how:

That should do it. It will now post to the correct project with the specific item.

For other appropriate scenarios on how to record the refund from a vendor, please check this helpful article: Record a vendor refund in QuickBooks Desktop.

Should you have other questions about the process, don't hesitate to let me know. I'm always here to help. Have a great weekend.

Hi there, @Weber.

I can help you on how to deposit the vendor and make it show on the correct item category. There are certain scenarios we need to determine first before recording the refund.

If the vendor sends you a refund check for a bill that is already created, you can follow the steps below:

Next, record a Bill Credit for the refunded amount. From here, you'll need to select billable so you can enter the project name. Later on, you will link this to the created deposit.

Here's how:

That should do it. It will now post to the correct project with the specific item.

For other appropriate scenarios on how to record the refund from a vendor, please check this helpful article: Record a vendor refund in QuickBooks Desktop.

Should you have other questions about the process, don't hesitate to let me know. I'm always here to help. Have a great weekend.

Just a note: When you are recording a Bill Credit, after entering the Vendor name, Item 4 says to Click the Expense Tab. To get the credit to apply to an "ITEM" you have to click the ITEM tab, not the Expenses Tab. Took me several tries, but finally got this to work. I think part of my problem was not refreshing the report when I went to see if it worked! Thank you for your help.

You're most welcome, @Weber.

I'm glad the steps worked for you.

Entering the expense tab or the item tab may depend on the scenario given in the article. If the vendor sends you a refund check for returned inventory items, then the returned items with the amount should be entered on the bill credit. Either way, it will post to the correct project as long as you marked it as billable.

Just in case you need other references in the future, you can always visit our site: Help articles for QuickBooks Desktop.

Let me know if you need anything else. I'm always here to help if you have additional questions about recording refund in QuickBooks. :)

I am having a similar problem: We are a small construction company and have a credit open from 2016. We finally got it squared with the vendor and they issued a check in 2019.

How do I record this to remove the credit from the Vendor without deleting it? I thought about creating a bill, but wouldn't creating a bill throw off the P&L?

It's nice to have you as part of the conversation, @LeahC,

I can share some insights on how to correct your vendor balance from a previous period.

You're correct. You can offset the credit by creating a bill. A bill Debits the account then increases A/P balance. Here's how:

Once done, apply the available credit to the bill.

That should get your work done, @LeahC. You may want to check this article to learn more about correcting customer and vendor balances: Write off customer and vendor balances

I want to ensure your vendor balance is correct, please let me know how it goes by leaving a comment below. I'll be keeping an eye out for your response. Have a great weekend!

This does not seem like the correct solution. The credit is from 2016. Entering a bill and applying a credit will cause the P&L to be overstated by the amount of the refund. This would be alright if the amount was small, but in larger amounts, this is the wrong way to do this.

For the amount of money QB charges, you'd think you'd be able to record the deposit and have a place to mark it as a credit refund.

Thanks for getting back to us, @LeahC.

I appreciate you trying the solution provided by my colleague. Allow me to join the conversation and add steps for recording the transaction.

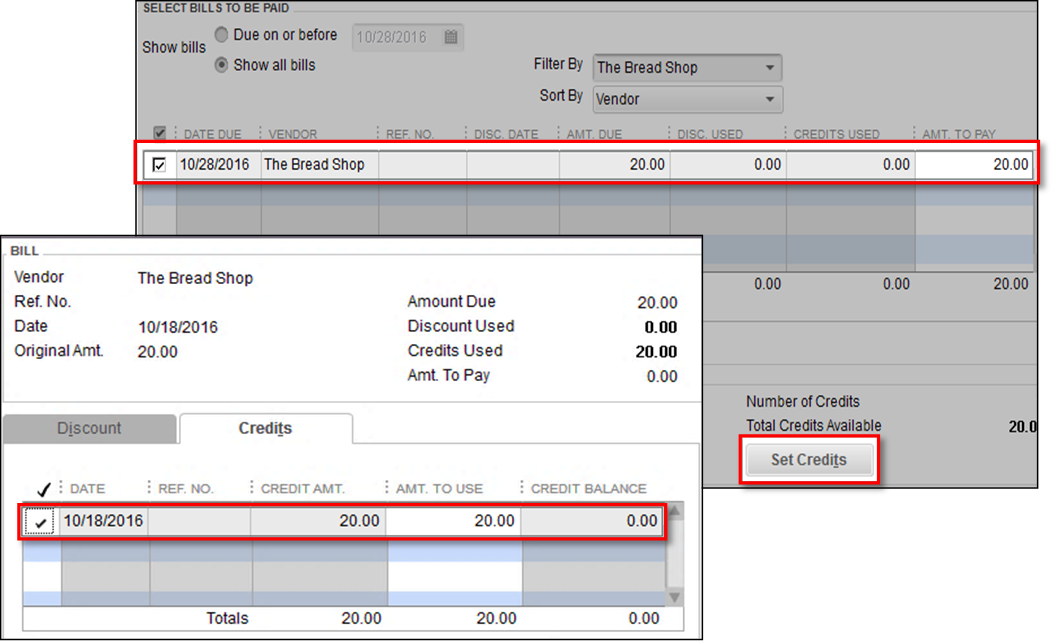

If the vendor’s profile shows a negative balance, create a bank deposit and link the credit to offset the amount. Here’s how:

Right after, you can link the deposit to the credit. Follow the steps below:

These steps should record the transaction correctly. For more information, check out this article: Record a vendor refund in QuickBooks Desktop.

Hit the Reply button below should you need further assistance working with QuickBooks. I’m more than happy to help. Have a great day!

Thank you! This worked and it will not screw with the P&L. :)

You’re welcome, @LeahC.

I’m glad the steps work perfectly for your situation. Should you need tips and related articles in the future, visit our Community website for reference: QBDT Self-help.

Reach out to me if you have questions, I’m always here to keep helping. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here