Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowIntuit QB Payroll Monthly Per Employee Fee Usage Fee?? What is this for? I paid for the yearly subscription.

Glad to have you here, @cmenard2002.

Allow me to help share some information about the employee usage fee for your payroll service.

On top of your annual payroll subscription fee, we have the employee usage fee. This is a monthly processing fee for your employees' transactions. The $2 dollar usage fee is per employee and it is a fixed amount regardless of how many paychecks you are going to create in a month. For example, you created a paycheck for 5 of your employees for the month of March, therefore you'll be charged for $10 for the employee usage fee.

To learn more about the QuickBooks Payroll Services, please check out this link: QuickBooks Payroll Services and Features for QuickBooks Desktop.

Also, to better discuss this matter with you, I'd suggest getting in touch with our Customer Care Team. They have the tools to check on your account and provide you with more details about this concern.

This should get you moving today.

Feel free to reach back out to me should you need anything else about payroll fees. I want to ensure you're taken care of. Have nice day ahead.

How can I get an invoice for this fee? I would like to have a receipt to go with my credit card statement.

My credit card is charged at least 2.13 per month or more depending on number of employees I pay.

I have look online but can't find anyway to print something off that shows this charge.

Thank you.

Judy Davis

Rob's Refrigeration

Thanks for joining this thread, @RD2018.

You should be able to receive the invoice for usage fee if you're the Master Admin on your company file.

If you're not able to receive an email from Intuit, it might be caused by any of the following:

To find out what to do if you can't receive any emails, you can check this article: Unable to receive Intuit email.

You can also contact our QuickBooks Desktop Support Team they have additional tools to pull up your account in a secure environment and further assists you in printing credit card statements for the usage fee.

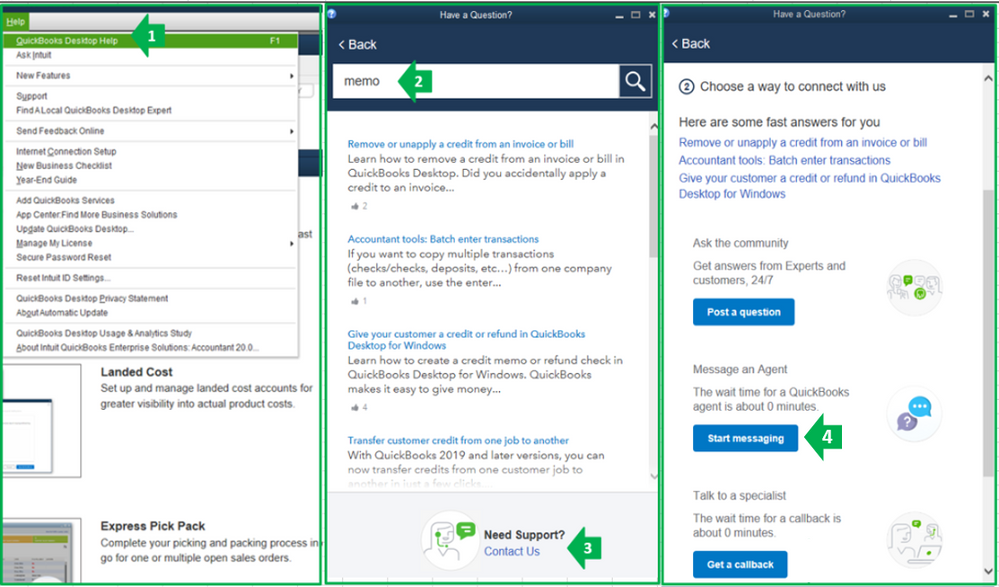

Here's how to contact our customer support:

Please know that I'm just a post away if you have any other questions about the usage fee. Have a good day ahead!

The question was the customer pays a QB Payroll monthly usage fee and an Annual Fee, why? You answered regarding the monthly fee however, not the annual fee. Its my understanding the monthly fee is what we are charged per employee for payroll. And the Annual fee is what we pay to process our payroll taxes or have questions regarding payroll I believe. Correct me if I'm wrong. I feel the annual fee is way to much! Our organization is in search of another program. We have been using QB for decades. However, there annual is almost $500, ridiculous!

We’re glad to have you here in the Community, @L4100.

To ensure you get the support you need in regard to the annual payroll fee, I’m happy to provide you further information. It’s easy to make sure the employees get paid on time. You’ll just enter the hours and we’ll do the rest for you. You’ll get reminders from us so your taxes and forms are on time. You may file your forms and pay taxes electronically.

For annual subscribers, Intuit sends notices 45 days prior to the renewal date. The increasing of the pricing is to reflect the value of the offering which includes features like the after the fact payroll, full QuickBooks integration, fast client-ready reports, automatic tax calculations, and easy tax forms processing.

For more information about QuickBooks payroll pricing, you can visit this article:

Let me know if you have other questions. I’m here to lend a helping hand. I hope you have a great evening.

I have not been able to reach a person. Called several times and only refers me to "help". Ridiculous!! I am looking for credit for the month of May and June credits ($80). There was no payroll due to c19. Please credit my account or call me since I cannot call you. (REMOVED). Thank you!

Debbra Malchow

Emily's Cookies and Cakes, Inc.

Hello, @Emma123.

You can chat or set a callback with our Payroll Support team.

Here are the steps to contact support:

Our dedicated Phone Support team will contact you to help check your billing information and verify the charge on your debit card. They can also assist you in submitting a Refund Request Form to our billing department once confirmed it's unauthorized.

Also, you can chat with a specialist through here:

Just a heads-up, the operating hours for chat support depends on the version of QuickBooks that you're using. Please see this article for more details: Support hours and types.

Feel free to comment below if you have further questions. I would appreciate the opportunity to help you with your concerns.

I see your response to payroll fees. We've been using QB Enhanced Desktop with Payroll for years! Never did we have fees beyond the subscription. We did, however, get a $2 charge for this month that appears will be ongoing monthly. We just purchased and installed QB 2021 with 1 year payroll subscription and it registered and working What's up with the new fees?

I can share some information regarding the $2 fee in QuickBooks Desktop payroll, Jubes.

Most of our payroll services have a base fee per active employee. Every time you process payroll, there's a $2 usage fee per employee every month. Regardless of whether or not you use direct deposit and how many times you process payroll.

You can get more details about the following resources. You'll find lists of payroll pricing and a chart to compare their features as well as steps to check your statements:

QuickBooks Payroll Services and Features for QuickBooks Desktop.

Understand Intuit charges on your credit card or bank statement.

Don't hesitate to drop me a reply below. I'll be more than willing to provide additional assistance. Have a wonderful day!

I just got an email about the $2.00 charge per month per employee for payroll. When I purchased Desktop Pro with Enhanced Payroll I believe the first four employees were supposed to be free. We only have four employees. Will I be charged? I've looked back and I cannot find anything regarding the first few employees being free.

Hi there, @Riti32.

Thanks for following the thread and sharing your concerns.

I recommend contacting our Payroll Support Team to see if this was a promotion offered to you when you first signed up. If so, it could be possible that the promotion has timed out and that's why you're seeing the $2 fee per employee. You can use the link I've included below to connect with an agent directly.

Please let me know if you have any other questions or concerns. I'm always around to lend a hand. Take care!

I got email that the fees is gonna be $ 5 from October? This is very high considering I pay 550 annual fees also? Purpose of getting intuit desktop payroll was to save money now might have to move to another vendor like ADP or surepayroll or Gusto to save cost as I have multiple EINS and one payroll I pay 100+ employees so this price hike will very expensive for me plus on your website it is still showing 2 dollars per employee can you please explain and is there anyway I can keep the 2 dollars per employee fees continued ?

Thanks

Ed1

I see where you're coming from, @Ed 1. As a customer myself, I also like to save on the cost of the services I use to pay and manage my employees.

I've got some insights about the new QuickBooks Desktop (QBDT) Payroll pricing so you can manage your subscriptions and services.

Yes, the email you've received is correct that starting October of 2022, we have raised the price on the per employee fee for QBDT Basic and Enhanced Payroll services. This is to simplify our payroll offerings, align with industry standards for pricing on Direct Deposit, QuickBooks Workforce, eFiling, etc., and retain affordable pricing by raising the per-employee fee instead of the base subscription fee.

QBDT Basic and Enhanced Payroll will receive a price increase on the “Per Employee” fee portion of the subscription from $2 to $5 per an employee a month.

Please feel free to visit this page for more details: Announcing changes to QuickBooks products and pricing + QuickBooks Desktop FAQs.

On the other hand, for fees, discounts, and billing inquiries, you can always reach out to our QuickBooks Payroll Care team. They can securely pull up your account details and provide you with all the information you need.

Also, you may want to check out this article as your reference to guide you in managing your QBDT account and services with the Customer Account Maintenance Portal (CAMPs): Manage your QuickBooks Desktop subscription and services.

Let me know if there anything else you need or payroll concerns in QBDT. I'm always ready to help. Take care, and I wish you continued success, @Ed 1.

But I have a business with more than 100+ employees I need some discounted rates, or I am moving to some other vendor who shall I talk to about this? I do all payroll myself, so it does not make sense why pay so much more per employee as I use Enhanced payroll 5 dollars will cost me heavily really

Ed 1

I appreciate your immediate response, @Ed 1.

Let me route you to the best support who can check for available discount rates and help you in managing your QuickBooks Desktop (QBDT) subscription and services.

Since the Community is a public forum, and we'll need to collect some personal information to pull up your account, I encourage you to reach out to our QuickBooks Support team. They can check for any available discount rates and provide you with options for managing your account. Here's how:

Also, you may want to check out one of our Help pages as your reference to guide you in managing your payroll account and employee transactions using QBDT Payroll: QuickBooks Learn and Support. It includes QuickBooks Help articles, Community discussions with other users, and video tutorials, to name a few.

Keep me posted if you have other payroll concerns or questions about managing your QBDT account. I'll gladly help. Take care, @Ed 1.

They are off today I think problem is Enhanced payroll support is outsourced someplace aboard, its, hard to explain then sometimes so I think better I move my large payroll to another vendor if I will be paying same now in Intuit does not make sense 2 dollars was a good deal now its a lot

Ed1

If I were in your situation, I'd feel the same about paying much more per employee, Ed 1.

The availability of our Payroll Enhanced support is M-F 6 AM to 6 PM PT. You may contact them at these times to ensure we address your concerns specifically if you can avail of discounted rates for your employees.

Also, you can visit our QuickBooks Help Page. You can find articles, and video tutorials that help you with other tasks in QuickBooks Desktop payroll concerns.

You can always get back to us if you have other payroll concerns. We're here to help.

Actually, there is another company offering much lower cost might move to them if Intuit does not give me discounted rates will call them Tuesday morning

Thanks

Ed1

Why online still showing 2 dollars? so new clients they still offer same price while old 5 dollars now?

Ed 1

What is the other company? I probably need to move, too. Budgets only stretch so far!!

I pay hundreds of dollars every year for using Quickbooks. I have 1...only1 employee. WHY do I have to pay another $5.35 per month to write him a check???? your computer does not even know I used Quick books to write that check. It does not take any time for any of your employees when I write the check.

We have three employees. The first employee is included in our QB payroll package. However they keep charging me $10.73 per month for two employees. Who do I need to contact to fix this error?

We have three employees. The first employee usage fee is included in our subscription. We have two remaining employees, but the last couple of months they are charging me $10.73? Can you give me a direct phone number or email address to address this situation?

Thanks for joining this thread, @Bonnie1981. Let me direct you to the appropriate support channel to assist you with your payroll concern.

The process of reviewing the fees or charges on your payroll requires the gathering of personal data to open your account. Due to security concerns, I'm unable to complete this task since the Community is a public forum.

That said, I suggest reaching out to our Payroll Support Team so they can look further into your concern and determine why your employees have been charged for the last few months. Here's how:

I'm also this resource that contains the time when the support is available, depending on your type of subscription. Just go to this article's QuickBooks Online Payroll section for more info: Contact Payroll Support.

You can also visit this article to help you view useful information about your business and employees and ensures you're able to get a closer look at your business's finances: Run Payroll Reports.

Let me know if you have other payroll-related issues or any other questions. I'll be glad to help you out. Keep safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here