Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowI have a customer (Boy Scout troop member) that has what are ultimately offsetting journal entries and credits. Is there a way to have them explicitly offset to reduce the Open Balances?

Thank

Hi there, gbonawitz,

Thank you for the screenshot. I'm here to help clear out offsetting journal entries and credits in QuickBooks Desktop.

You'll need to apply those entries to outstanding invoices. By doing so, the balance on the customer profile will be reduced.

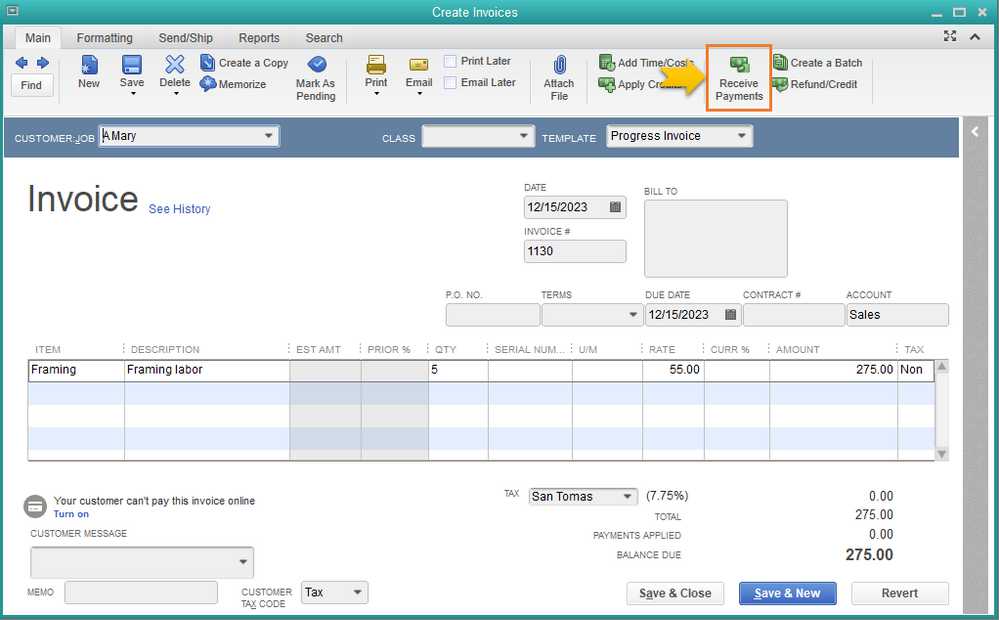

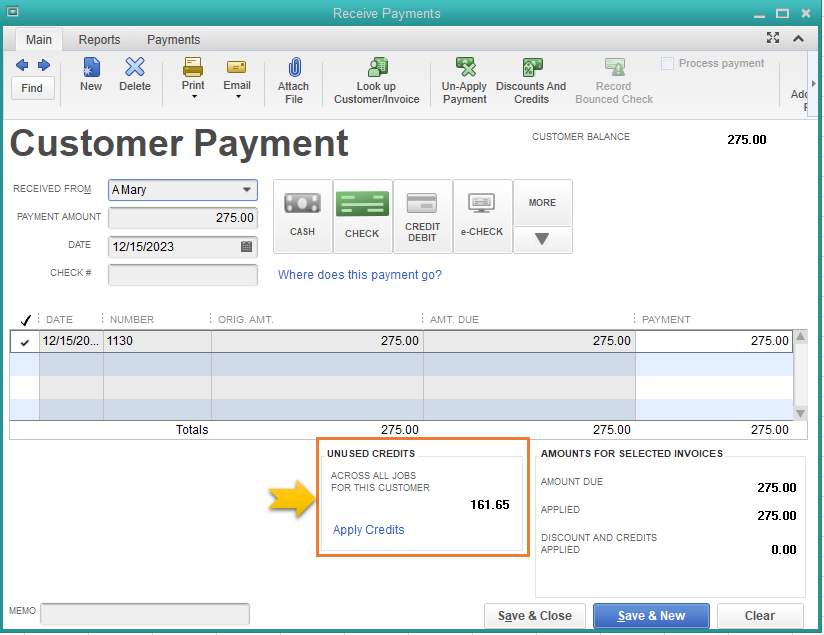

I'm glad to show you how:

Another way of managing customers and accounts receivable is to set up a clearing account. This account is used to move money from one account to another account when you cannot move the money directly.

For more details, feel free to read through this handy article: Set up a clearing account. Upon sharing this, I still suggest consulting your accountant. He/She might have specific instructions on how to handle journal entries and credits. This is to ensure your records on the account is accurate.

Let me know if there's anything else I can help you today. Just mention my name and I'll get back to you.

Thank you and stay safe!

Hi. Thank you for the response!

I'm familiar with clearing accounts - I used them all of the time to move money between the scouts' "jobs"(e.g. move credit from their Troop Activities balance to their Registration balance).

As you can see in the screenshot I have the offsetting amounts [for the same scout] in the same "job"(Troop Activities)...and the balance shown by QB does reflect that they offset. Is the only way to make the balances go away is to apply them to future invoices? There's no way to cancel each other out as-is given that the balance already takes the offsets into consideration?

Thank you for clarifying your concern, @gbonawitz.

You can write a check to apply the credit as a refund. Let me guide you how to do it.

Lastly, to avoid getting open credit memos and unapplied refund checks, let's link the credit memo to the check. Here's how:

Once completed, you can run the Sales by Item Detail report. By doing so you'd see whether the credit memo is properly applied.

I'm always here to help if you have other questions about creating a credit memo in QuickBooks Desktop. Feel free to leave your comments below.

This solved part of my problem, but I still have open items that are General Journal Entries and Payments. I inherited these items from my predecessor. Is there a way to clear G/Js against one another, or against payments? These are zero balance, inactive customer records, but they show if I run an open A/R report.

Thank you for joining the thread @Lisa_at_STCS,

It might be, you have an open invoice in your QuickBooks Desktop account that affects the open balance. You can check your open invoices and review the transaction if it is still collectible. If not, you can record it as a bad debt. Here's how to run an open invoice report:

Also, you can customize the report if you're looking for a specific transaction statement.

Once done reviewing the open invoices, you can record it as bad debt and write them off. Visit this link for the steps: Write off bad debt in QuickBooks Desktop.

If you need further assistance, just drop a message in the comment section. I'll be happier to help. Have a nice day!

This response did not answer her question. And I have the same problem.

I inherited an accounts receivable ledger "customer" that was set up through a series of journal entries. The balance is net zero but shows as a hundred lines in my open a/r report.

I have cleared all the debits against matching credits (this only worked if an exact match). When I try to clear the remaining debits and credits (again they net to zero), I get "must enter a transaction amount". I did not get this error message when clearing the exact matches (even though my transaction amount was also zero).

Screen shot of the error message:

This response missed the key point of the question. The net balance is zero so the response doesn't fit.

I have the same issue. I inherited an accounts receivable "customer" with a net zero balance. This customer appears to be from the initial set up in QB and the open account consists of a long series of journal entries that net to zero. This long list appears on all my a/r reports. Yes, I can filter it out but I'd rather clean it up properly.

I was able to clean out all exact match debits and credits through receiving a payment. The remaining

I have the same problem in both AR and AP. There are journal entries in each one that net to zero. The boss wants them off the detail aging reports. Did anyone find out how to handle this?

Hello there, Kim B & sandrews552003.

I'm here to make sure these journal entries o longer appear on the report.

You can edit the customer payment transaction and select the journal to pay as if it was an invoice. Let me show you how:

Also, please check these links. These will show you how to fix customer and vendor balances as well as AR and AP balance issues:

Don't hesitate to reply to let me know if you need anything else when working in QuickBooks. I'll respond as soon as I can.

Thanks for responding, but I still am not getting it. ALL of the entries I am trying to clear are journal entries. They all net to zero. How do I remove these journal entries off the AP Aging and the same need off the AR Aging so they no longer appear in the detail. See attached.

I'm here to share additional information about applying available credits, @sandrews552003.

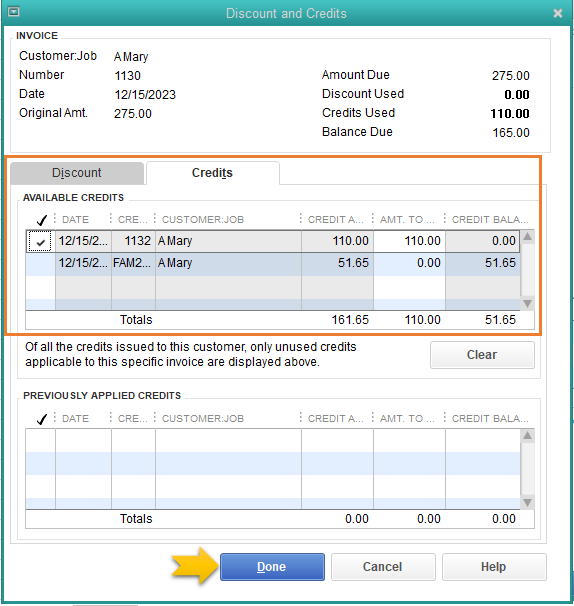

When we enter a journal entry (JE) for our receivables and payables, QuickBooks will recognize them as an open invoice and bill, respectively. Receiving their payments using a JE will show as an available credit to the customer/vendor. Hence, there are entries in each one that net to zero in their respective Aging Detail reports.

To get the amounts off the Accounts Receivable Aging Detail report, we'll have to link them by receiving a zero payment.

To straighten out your Accounts Receivable Aging Detail report, link the bill to the vendor's credit with a "zero dollar" payment.

Here's how:

Refer to these articles to learn more about running an A/R Aging report and how to write off uncollectable balances:

I've also included these links that will guide you on how to handle customer and vendor credits:

Get back to me if you have other concerns about applying credits. I'll be around to answer them all for you. Keep safe and have a good one.

I have an allowance for bad debt that was made in 2014, which should have been applied to outstanding 2013 invoices.

The journal entry below shows up in the customer’s Unbilled Time and Expense: $2,800.

The problem is when I go to one of the 2013 past due invoices.

From the past due invoice

1) I click APPLY CREDITS, there’s no available credit of $2,800.

I then tried: (Photo 3)

I appreciate the screenshot you've provided, Medexhco.

To get this sorted out, you'll want to ensure your journal entry is correct (debit & credit). I'd suggest working with your accountant to help guide you in applying this transaction to your open invoice.

Additionally, you might want to visit this article: Give your customer a credit or refund in QuickBooks Desktop for Windows. This will provide you with steps on how to enter and handle credits in QuickBooks Desktop.

Kindly update me on how things go by adding another comment here. I want to make sure you're all set, and I'm here if you need further guidance. Have a great day!

They don't answer the question...they don't know.

I guess we just have to have all that mess on our reports.

The people answering the question do not understand what all of us are asking and don't have a clue how to fix the credits and debits from a journal entry to remove it from our receivable report. Useless

I was able to get my condensed customer account cleared off of my a/r report by going to "new" then receive payment of zero from "condensed customer" and it listed all of my general journal entries equaling zero. But, I am not seeing any advice how to do this for my a/p report and clearing off the condensed vendor general journal entries (HELP!)... I did not inherit this; I've been on Quickbooks desktop for over 20 years and just switched to online last week. So many of my easy reports are not so easy yet. I really hope this gets better. I was chatting with a rep for 1.5 hours before I made my decision for my forced upgrade since I was on 2019 version. It seemed like they really, really pushed for online. Been beyond frustrated!

Thank you for sharing detailed information, @G-IWI.

I'm happy to know that you're able to clear off your A/R balance by receiving the customer's payments. And I'm also here to help resolve your other issue (clear off the A/P balance) to ease your frustration.

The most common cause of a balance in accounts payable is unapplied bill payments. To clear this off, let's find the unapplied payments by running the Vendor Balance Detail report. Here's how:

After identifying them, you can apply the unapplied payments in Accounts Payable (A/P). Let me guide you how.

I'm adding this article for more guidance: Resolve accounts receivable or accounts payable balances on a cash basis balance sheet in QuickBooks.... This will also give you another option on how to clear of A/P balance.

You may also need to run other reports to review your transactions. You can check out this article: Run reports in QuickBooks Online.

Let me know if the steps above clear off your A/P balance. I want to make sure this issue is taken care of, @G-IWI.

Hi I have the same exact problem. I tried to export the customer list change the balances to zero and import it but it gave me an error that the balance can only be altered for new accounts. I have a call in to quickbooks waiting for a response. Did you get anywhere ?

i have the same issue, and completely feel your frustration,

all the replies are making me laugh and the solution is not even close, as it can not be done when you have journals

I wish advisors would actually read the questions and look at the screenshot

i am so disappointed in QB

did you get anywhere with this

why don't you read the original question, this reply is a joke, and not even answering the question

why is QB so useless

The solution posted by Admin GlinetteC dated August 11, 2021 should work.

However, you will need to ensure the customer names are populated in each JE entry under the name field. Also, it is best to use the reverse option when reversing a JE.

Again you will not be able to offset JE's using the customer receive payment option if there are no names listed under the name field in the JE's (original and Offset JE's) and/or the customer names are not matching in JE's.

Hope this helps.

I think I've figured this out - mostly (for anyone still searching). If you follow the initial process suggested; Customer, Receive Payments (select customer you are clearing out). Then select the icon at the top that says "look up Customer/Invoice" and you will then need to "Search By" the invoice AMOUNT (or rather the JE amount). < That's the unfortunate part - I've only found a way to 'write off' the offsetting amounts that are exact equals. So, if you have a JE for 1,000 and another, offsetting, JE for (1,000), you can clear those out against each other. However if you have a JE of 500 and another JE for 500, and then an offsetting (1,000), I can't seem to figure out how to clear those against each other.

Anyway, once you have found the "amount", you'll select "Use selected customer or transactions". For me, it then pulled in ALL JE's for that customer, and that's when you go into "Discounts And Credits". Selecting that icon will automatically pull up the JE offsetting amounts (and it actually selects the exact offsetting amount), and you just hit Done. From there, you can select the next line item listed (which for me is another JE), and use the "Discounts and Credits" option again.

I tried attaching screenshots, but it won't let me - sorry y'all! Hope this is at least kind of helpful!!

Please advise. I have super old journal entries in both AP and AR - detail aging and I would like them cleared up. The balance of each vendor/customer is 0, so they just need to be matched up but can't do it in the payments or cash receipt as they don't come up as available. All General journals. Where/how can this be done? Method shown from @LieraMarie_A does not work.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.