Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI run an education consulting company. Recently, we hosted a business retreat to discuss strategy with other entrepreneurs. One of our contractors (who works and teaches lessons for us) who attended the summit helped organize everything, and booked AirBnBs, meals, etc. with her own personal credit card. We then reimbursed her for her expenses in Gusto. But now, I'm trying to figure out how to represent that in Quickbooks.

Currently, we have all of the expenses tracked under a separate Credit Card account representing her personal credit card. We also have all the receipts. However, after doing more research in this forum, this seems to be the incorrect approach. Instead, I've read through threads giving conflicting advice: some say to create an Expense Account and then log reimbursements through there; others say to create a clearing account; others say to log it as an expense through Payroll; others say to write it as a billable expense income... what is the correct thing to do in our situation?

Solved! Go to Solution.

I'll help you understand better and give more information about how QuickBooks deals with reimbursing a contractor, JeffreyYu18.

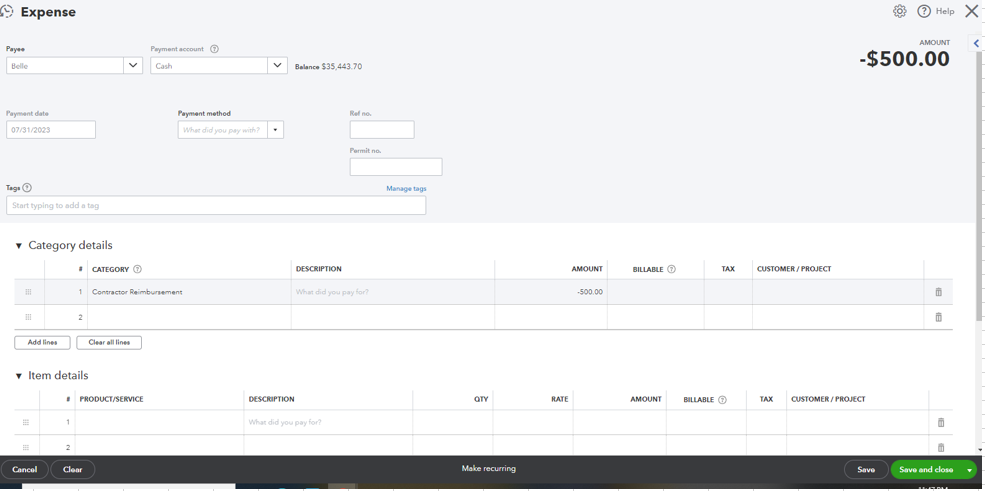

Your accountant is correct in stating that the contractor's credit card (CC) is no longer necessary for reimbursement. Instead, you can use your checking account under the Payment account. By simplifying the process, you can eliminate the need for the contractor's credit card information and streamline the payment process.

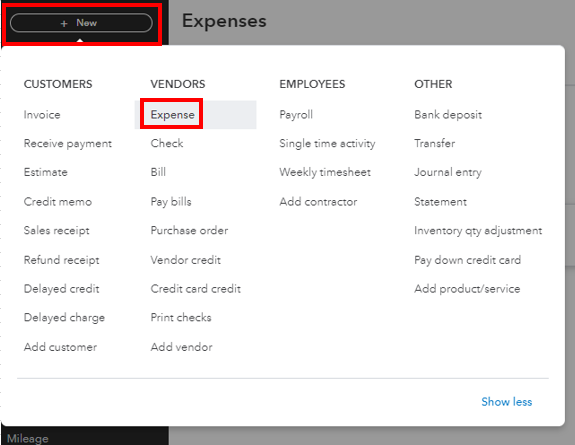

For the reimbursement, you have two options as an alternative. You can record it as a Check or as an Expense. Before proceeding, it's best to consult with your accountant to guide you in choosing the right account to ensure your books are up-to-date.

To record as a check:

To record as an expense:

With these steps, you can reimburse contractors in QBO and keep track of their expenses for accurate financial reporting.

Furthermore, I would like to provide you with a resource to assist you in accurately closing out the current period: Learn the reconcile workflow in QuickBooks.

If you need further assistance with managing your contractors or any other tasks, please don't hesitate to let me know. I'll be ready to assist you in this thread promptly.

I understand the importance of accurately recording reimbursement transactions in QuickBooks Online (QBO), JeffreyYu18. Let me guide you through the process.

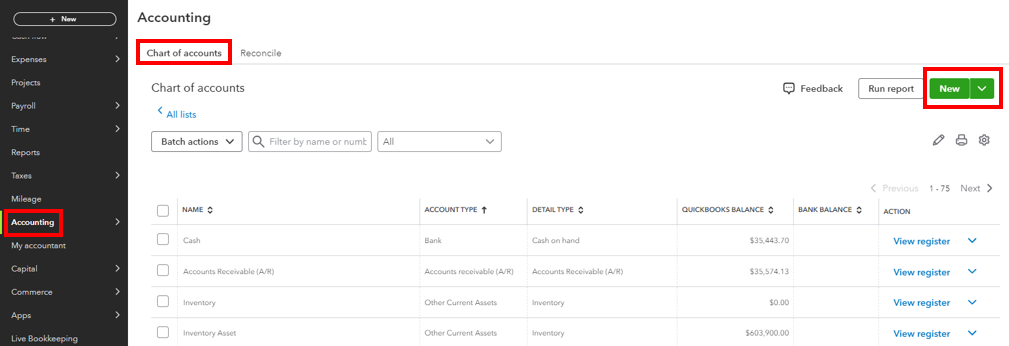

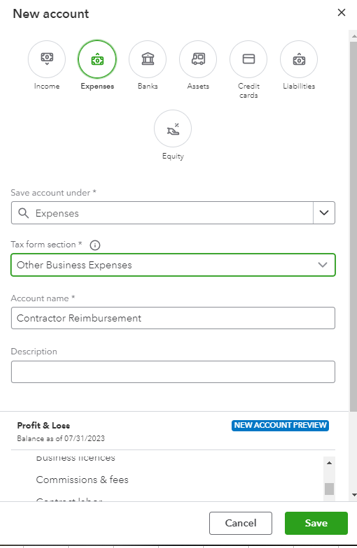

In QBO, we can create an expense account specifically for contractor reimbursement. This will help you track the transactions separately from other expenses.

Here's how:

Once done, let's record the reimbursement transaction in QuickBooks. I'll guide you on how to do it.

I also suggest seeking guidance from your accountant to help you choose the right account. It's to ensure that your books are accurate.

We hope this guidance helps you accurately represent the contractor reimbursement in QuickBooks. If you have any further questions or need additional assistance, please don't hesitate to drop a comment below. We are here to support you in managing your finances effectively.

Got it! Thank you!

Thanks for getting back here in the Community space.

We're happy you've got through your current situation with the help of my colleague. It's always our pleasure to assist customers like you using QuickBooks Online (QBO).

If you have any additional QuickBooks-related concerns, we'll help you resolve them on time. Please don't hesitate to visit us anytime. Take care, and have a good one!

Hello, I'm a little confused. The guide says,

"Under the Payment account drop-down arrow, choose the credit card account representing her credit card."

For Payment account, are we putting a credit card account for the contractor (e.g. CONTRACTOR Credit Card") OR are we supposed to put the checking account which we used to reimburse them?

I'll help you understand better and give more information about how QuickBooks deals with reimbursing a contractor, JeffreyYu18.

Your accountant is correct in stating that the contractor's credit card (CC) is no longer necessary for reimbursement. Instead, you can use your checking account under the Payment account. By simplifying the process, you can eliminate the need for the contractor's credit card information and streamline the payment process.

For the reimbursement, you have two options as an alternative. You can record it as a Check or as an Expense. Before proceeding, it's best to consult with your accountant to guide you in choosing the right account to ensure your books are up-to-date.

To record as a check:

To record as an expense:

With these steps, you can reimburse contractors in QBO and keep track of their expenses for accurate financial reporting.

Furthermore, I would like to provide you with a resource to assist you in accurately closing out the current period: Learn the reconcile workflow in QuickBooks.

If you need further assistance with managing your contractors or any other tasks, please don't hesitate to let me know. I'll be ready to assist you in this thread promptly.

Hello,

I tried to follow your instructions, but I got the following error:

Enter a transaction amount that is 0 or greater.

It's not letting me upload a negative expense to the Payment Account, Contractor Reimbursement. Thus, how am I supposed to show that it was a reimbursement?

Hi Jeff,

I'm here to explain the error message you received, and I'll guide you through the steps to fix it.

You'll receive that error when you've entered a reimbursement amount with a negative or zero amount. QuickBooks Online requires reimbursement amounts to be positive values.

To resolve this issue, you need to enter a reimbursement amount greater than zero. Ensure you do not enter a negative value or leave the amount field blank.

If you need to enter a negative amount, I suggest reaching out to your accountant so they can guide you on the best alternative to record the transaction.

I'll also share this article as your guide in ensuring the amounts in your QuickBooks match your real-life bank and credit card statements: Reconcile an account in QuickBooks Online.

You can always mention my name whenever you have concerns about your QuickBooks account.

Hi, I’m a little confused. The original instructions stated to post the reimbursement as a negative amount to ensure it wasn’t viewed as a traditional expense. But now I’m hearing I’m supposed to put in a positive value. Which one is correct? Will putting a positive value cause it to be regarded as a traditional expense?

Thanks for getting back with the Community, JeffreyYu18.

If you've received a refund for a business expense, how it's entered depends on how you record your purchases.

In the event you enter expenses or write checks:

If you enter bills you plan to pay later:

Next, you'll need to apply vendor credits to a bill.

You can also deposit vendor credits or record refunds on credit cards if necessary.

Please don't hesitate to send a reply if there's any additional questions. Have a wonderful day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here