Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

My employees are having a fit - not enough federal tax is being withheld from their checks with the new form.

How can I go back to the "2019 and Prior"?

Once the new w-4 is used you can never go back to the old w-4

Hi there, jam12414.

I'll provide information about federal tax calculations for W-4 2020. Before selecting the federal W-4 and later form, you have to consider these factors:

Furthermore, FIT amount calculations are also determined by the following:

To verify the accuracy of the FIT calculation, you can refer to Publication 15, Circular E, Employer's Tax Guide.

Please let me know if you have follow up questions or any other additional concerns. I'm just a post away. Thanks!

No way to go back, either in QB or legally, but they can always fill out a new W-4 and enter an amount on line 4(c) "Extra Withholding", just as on the prior form:

Thanks for the screenshots, @tchow.

You'll want to edit the W-4 of your employee and add the deduction to step 4 box b (Deductions). That way, you don't have to manually add taxes before each pay period. Here's how.

Before doing so, ensure you have the latest payroll tax table. Once done, in your QuickBooks Desktop (QBDT):

Here's an article you can read for more details (check QuickBooks Desktop Payroll section): What’s changing with the Federal W-4?

You can also check this great resources for additional reference: FAQs on the 2020 Form W-4

I'm always around to help anytime you have other concerns or questions.

I'm using QB Online. I tried adding the 4500.00 to the Deduction field, but it still is not withholding any taxes.

Hi @tchow,

Since you applied the standard deduction when entering the deduction for W-4 form and you have previous paychecks. QuickBooks automatically calculates or adjust the deductions.

Then, if you reach the deductions through your paychecks, it won’t calculate in the form. You can check this link for the instruction with IRS: https://www.irs.gov/pub/irs-pdf/fw4.pdf.

Also, I'd still recommend contacting your accountant for additional guidance and how you can enter your employee's W4 information.

Please let me know by leaving a comment below if you need more help with this. Have a good one.

I updated an employee to 2020 W4 but haven't processed the payroll yet, I still can not return to 2019 and prior W4?

Hey there, Migio.

Thanks for following up on this thread. I'd be glad to provide some additional information about the 2020 W-4.

The new layout reduces the form's complexity and increases the transparency and accuracy of the withholding system. This specific form applies to newer employees. All new employees first paid after 2019 must use the redesigned form. Similarly, any other employee who wishes to adjust their withholding must use the redesigned form. I recommend checking out this link from the IRS that offers answers to FAQs on the 2020 Form W-4.

Additionally, you may want to reach out to a member of the Payroll Support Team to make sure you're using the correct form. An agent can be contacted by visiting this link https://help.quickbooks.intuit.com/en_US/contact.

Don't hesitate to reach back out if you have any other questions.

I had claimed married and 9 dependents for Dec. 2019. So for my 2020 checks, there was only 30.00 taken out and isnormally 80.00 forlast year. have talked with numerous people with quickbooks and no one has been able to help explain. Please help me to change this. Sherri Rene Sweatt [removed]

@sweatt Thank you for joining this thread. I can understand your concern over the recent changes to the W-4 form. I am including a link that provides information on the changes you see with the implementation.

What’s changing with the Federal W-4?

If you need additional assistance on making adjustments to your tax setup you may want to reach out to a tax professional.

I'm very frustrated over the inability to get a direct answer to my question. The system is still not taking out any taxes. This is March and the only taxes taken out have been the ones that I have manually deducted.

Hello there, tchow.

We can look into your employee set up and investigate this further why taxes are not calculated and withheld properly. I suggest getting in touch with us so we can sort things out with you.

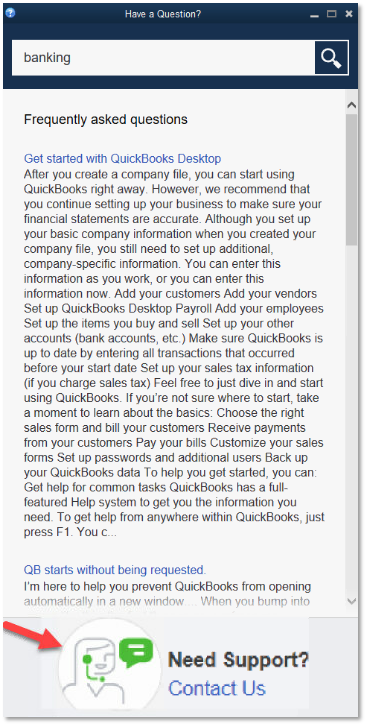

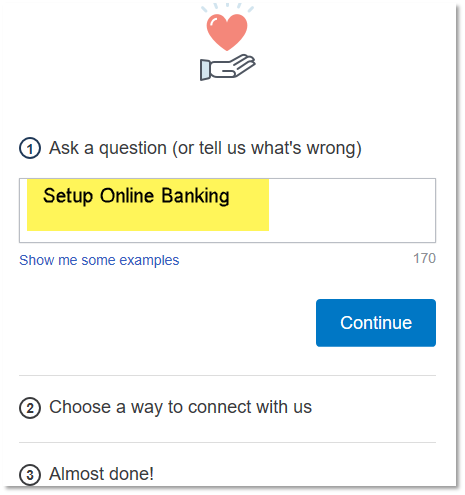

Here's how:

You might want to check out the articles shared by my colleagues above on our basis in calculating taxes.

Thanks for your time in getting this fixed. Mention me if you need anything else.

Honestly, don't waste your time contacting them.

I spent over 2 hours in chat this morning with QuickBooks, only to be told that their system is behaving accordingly to IRS updates, and that I will need to contact them.

Alright, so QuickBooks is no longer providing a service that I pay monthly for, and I have to go fight with the IRS to figure out what I need to do to correct it? Nah.

This is not the experience we want you to have, @bdockery79.

Let me share additional information about how the new 2020 W-4 form impacts your income tax withholding.

In the 2020 W-4, withholding allowances are removed. Instead of claiming withholding allowances to reduce federal income tax withholding, your employees can now claim dependents or other deductions on the form. Also, there are New Tax Withholding Tables that were released to complement the new W-4 form. You can refer to the IRS website for more detailed information: FAQs on the 2020 Form W-4.

In line with this, let's make sure that your QuickBooks software and payroll tax table is updated to the latest version. This is to ensure that the 2020 W4 updates are applied to your account. You can read through these articles for more detailed information:

Also, you can let your employees use the Tax Withholding Estimator to help verify the accuracy of the amount of tax withheld from their paycheck.

Swing by here if you have other questions. I'm always here to help.

what does it mean "complete a payroll run for the employee for the year"?

what does it mean when it is "suggested you complete payroll run for the employee for the year"? Is this a report or what does this refer to?

Hi Kristypackoutz.

Thanks for stopping by the Community, when it says "Complete a payroll run for the employee for this year" that is referring to running payroll for your employee/employees. Without being able to see your specific account, I'd recommend reaching out to our support team as they have the tools at their disposal to dive into your account and see why you're getting this message, all while in a screen share with you, that way you can see the same thing together. To reach them follow these steps.

Check our support hours and contact us. If you have any other questions, feel free to post them here. Thank you for your time and have a nice evening.

Like others here, I am not an accountant. I purchased QBs so it could calculate taxes for my payroll employees so I don't have to. So why isn't it taking anything from my new employee's checks? I selected the 2020 and Later W4, but thinking that was a mistake now. Is there a way to change that? Or click something so it deducts the appropriate amount of taxes from her paycheck? Thank you in advance.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here