Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI work for a General Contractor who pays the temporary power bills and temporary porta potty bills then bills the customer with a small markup for reimbursement.

I am not sure on how to enter this in QuickBooks Pro so it will reflect properly on the P and L

Pam

Hi there, pam0315.

You've come to the right place. Entering billable expenses is my specialty, so let me lend a helping hand in recording this in QuickBooks.

We'll begin by setting up the preferences that'll allow us to mark expenses as billable and enter a markup percentage. Let me walk you through the steps on how to do it:

After we've set it up, allow me to guide you on how to enter the power and porta potty bills as billable expenses:

We're almost done. Now, we just need to create the invoice for the customer with the marked up amount. Here's how:

That should do it! I'm confident that with these resources you'll be able to enter billable expenses like a pro in no time. You'll also be all set with your Profit & Loss report after you follow these steps.

Keep in touch with me here if there's anything else you need. I always got your back. Thanks for reaching out, wishing you and your business the best.

Thank you for your reply. I have a few more questions.

1. I am thinking I don't want to mark in the customer preferences all expenses are billable because they are not.

I can just check the billable and customer name if that applies when I am entering the bill - correct?

2. The default mark-up account is an Income account - Correct? So that when I print out a P and L statement it will show the income generated for the mark-ups throughout the year.

3. When I enter the bill the account would be Reimbursable Expenses when we want to be reimbursed from the customer? Correct

I believe the way the account is currently set up is Temporary Power or temporary facilities. But I am thinking when it is a billable expense to the customer and we receive payment back that it should not be under temporary power or temporary facilities BUT reimbursable Expense account. Is this correct?

4. So basically I have to set up two additional accounts - Reimbursable Expenses from Customer ( which is an expense account)

AND Markup account which would show up under Income. Is this correct?

Do you have a youtube video you can link to this message?

Am I correct that these particular expenses have nothing to do with Cost of Goods sold as that would be for specific material items - correct?

Hello pam0315,

Thanks for joining us again here in the Community. I can further help and add up to the detailed response given by my colleague, @AldrinS.

QuickBooks Desktop is great for allowing users to manage transactions and accounts based on their preferences. The set up would depend on how you want to track your finances, and I can guide you through it.

You can opt to mark all expenses as billable from the Preferences page. Anyway, you’ll have the option to assign a customer or remove the checkmark in the billable column when you create bills (see screenshot below).

Yes! To easily track the mark-ups of the billable expenses in the Profit and Loss report, it needs to be an income account. It’s money in type of transactions though!

Once you mark a bill as billable, the program automatically recognizes it as reimbursement from client. Therefore, regardless of whether you choose to use the reimbursable or any other expense accounts, your customers would need to pay you back.

The choice is yours; you can continuously use the Temporary Power or Facilities, or a new reimbursable expense account. All you need to do is create an invoice for them, so they can process the payment. I’ve added a screenshot below for visual reference.

In connection to your fourth question, if you want to create an income account specifically for the mark-up amounts for better tracking, you may do so. I’ve added steps below on how to do it:

Then, for the last question, I’d suggest consulting an accountant to verify if there’s a need to link them with the Cost of Goods Sold account. They are the experts with tax and account-related concerns to ensure accuracy of your books come tax time.

You can now proceed and enjoy working with your account. But, if there's anything else you need help with, I'm only a comment away. The Community is always here to help, anytime!

Thank you.

I have one more question. When the customer sends us the reimbursement check is there a way to keep track of that check to where it is reimbursed income and doesn't go directly to income. The reason for this question is because in a recent General Liability audit they wanted the company's income. Technically, the reimbursement check is just that a reimbursement for a bill we already paid for the customer and should be separated from the actually income of the company.

Thanks for coming back to the Community, pam0315.

I can help you track the customer's reimbursement check.

You're correct. You can set the reimbursement account as the default income account on your Reimbursable Expense account. This way, you can easily track the reimbursement check from your customers.

Here's how:

Once an invoice has been paid, the payment will be tracked on the reimbursable expense account.

That's it. Should you have more questions, feel free to let me know. I’ll be here if you need me. Have a great week.

I have another question on this.

When I select reimbursable Invoices it seems that there are two different Invoice number rather than Invoice numbers in sequential order.

Reimbursable Invoices seem to have one set of Invoice numbers and service Invoices not reimbursable seem to have another set of Invoice numbers

None of this is correct, for QB and Job cost tracking and reporting.

You want to use Two Sided items, not that Expenses tab. Examples:

Other Charge Items for Waste Removal, Building Permits, and Equipment Rental. Two Sided = checkmark the box on the left, link the Left to Expense and the right to Income. Two Sided Service item, such as Electrician Sub and Plumber Sub. Two Sided Noninventory item for Doors, Windows, Roofing, etc that you custom order for the job. Use the Items on the Items tab, use Qty, use them on Purchases and job track them. Optionally, this is Billable or not, depending on the terms for the job, such as Fixed Bid (direct costs not billable) or Time & Materials (is billable).

That way, you don't Micro-manage the Expenses tab as one expense account mapped to one income account. And now, when you use Items on estimates, and on Purchases, credit card charge, and sales, you see the info in Job reporting. Run Job Profitability Detail and see if yours reads as nicely as my attachment. And Est vs Actuals, these rely on the use of Items. Not that Expenses tab.

And the Reimbursement is Gross Income. Yes, it is All Income. Do not wash away expense with negative expense (income) or income with negative income (expense).

This is Wrong: "it should not be under temporary power or temporary facilities BUT reimbursable Expense account. Is this correct?"

This is more Items, not more Accounts: "I believe the way the account is currently set up is Temporary Power or temporary facilities."

That way, you see Gross Cost and Gross Revenue, and the job reporting and the P&L reporting will show the Net. Even the Item Profit reporting will show the net.

This also is wrong for your accounting: "

So basically I have to set up two additional accounts - Reimbursable Expenses from Customer ( which is an expense account)"

For instance, as you see in my side-by-side of the P&L related to the Job details (follow the matching Color), I have one expense account for Jobs, one for Subs labor. The Details are Items.

"When the customer sends us the reimbursement check is there a way to keep track of that check to where it is reimbursed income and doesn't go directly to income."

It is your Payment to process against their Charges. The check is just part of Banking.

"The reason for this question is because in a recent General Liability audit they wanted the company's income."

And your data has been "netting in the accounts" all this time, which is Wrong. Everything is Under-reported.

"Technically, the reimbursement check is just that a reimbursement for a bill we already paid for the customer and should be separated from the actually income of the company."

No, that is not what you are doing, for a Business. You track Gross Revenue and Gross Expense and you let Reporting show these differences. Otherwise, you completely under-report the scale of this business.

Please see my attachment.

Please use the Handout I just attached to learn from. You are all giving out bad info for using QB desktop for Job Tracking and for managing the accounting data flow properly.

huh?

Welcome to the Community, thedeedee54.

I'm here to help you. I'd like to know more about your concern so I can assist and provide an accurate answer. It would be best if you can provide a screenshot or site an example.

You can reply to this thread with more details of your concern. I'm looking forward to your reply. Have a great one!

Hi,

If possible, can we talk? My number is [removed]. I need a QuickBooks expert thay I can hire.

Best,

Diana

Hi there, thedeedee54.

Thanks for visiting the Community today. I'd be glad to help point you in the right direction to contact support via telephone.

This can be done directly through your QuickBooks account. If you're using the Online version, here's how:

1. Click the Help button in the top right corner.

2. Choose Contact Us at the bottom of the panel.

3. Enter Support in the field, and click Continue.

4. From here you can choose to schedule a callback for a time that is convenient to you.

If you have a Desktop account, this link provides the steps to reach the Support Team: https://quickbooks.intuit.com/community/Getting-Started/Contact-the-QuickBooks-Desktop-Customer-Supp....

You're always welcome to ask any questions you have here. I'll do my best to help in any way that I can. Take care.

Does this work in quickbook essentials

Allow me to join the thread and help share some insights about making expenses as billable in QuickBooks Online (QBO), @Trekqualmie.

As of now, there isn't an option to mark expenses as billable in QBO Essentials. Recording billable expense is only available in QBO Plus and Advanced.

If you wish to track expenses as billable, you may consider upgrading to the versions stated above.

To upgrade QBO subscription, you can check this article: Upgrade your QuickBooks Online subscription.

I'm also adding this article to learn more about the QBO plans and features: Compare QuickBooks Plans.

You can also check this article for your future reference about entering billable expenses in QBO: Enter billable expenses.

Keep posted if you have any other questions about billable expenses, I'm always here to help. Wishing you continued success!

I am on a MAC QB 2019 and the steps you list in "pam0315 below thread" can not be found. How do I create billable markup expenses on a MAC version?

Basically, I have a few vendors and only a few clients that I need to charge a % of goods sold.

Hello, SD677.

Users who record billable expenses will have an option to include markups when invoicing the cost. This process is detailed in the Invoicing for actual costs (page 114) section in this PDF: QuickBooks Desktop for Mac 2019 User’s Guide.

This also contains topics that are very helpful while working with your QuickBooks.

Stay around the Community space if you need anything else.

It's NOT an expense, IT'S AN ITEM... AKA COST OF GOODS SOLD!!!! THE PERSON WANTS TO KNOW HOW TO MARK UP AN I.T.E.M!!!!!!! NOT AN EXPENSE. It is different in construction.

Thanks for joining this conversation, Teamteplow2016.

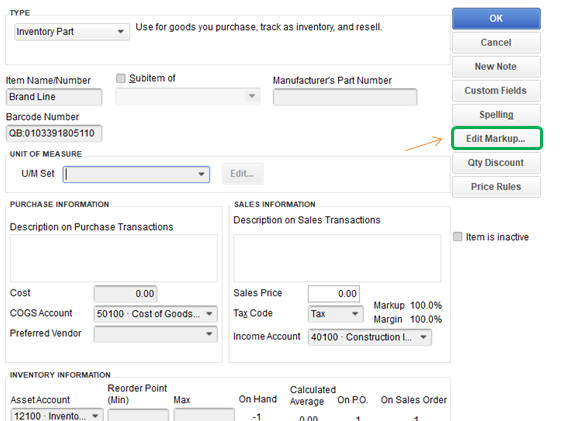

To make sure that I'm on the same page, you're referring to the original post in this thread, correct? If so, adding a markup on an item is pretty easy, and I'm happy to show you the steps on how:

Please note that this option is only available in the QBDT Enterprise version. If you're using Pro or Premier, you can only set up a default markup percentage by going to the Preferences. Here's how:

Just in case, I'll be adding this article for future reference: Add, edit, and delete items.

Please let me know if you have any other issues or concerns, and I'll get back to you as soon as possible. Have a great rest of the day!

small business owner and i am beginning to seriously hate this program. why can i not enter billable time and materials and have both marked up by the percentage i use? i regret the money spent on this program every time i have to try and use it

We appreciate your feedback about the markup feature in Quickooks Desktop, blueridge.

For now, using a markup percentage is only applicable to billable expenses. It does not apply to billable time entered through the QuickBooks Timesheet.

Although, you can add a specific amount for Service Items associate to the billable time if they're used by sub-contractors. Check out the screenshot below on how you can set it up.

We'll also be sending feedback along with a feature request about having the same option for billable time entries. Our engineers are always on a lookout for customers' suggestions and request. They collect and review them for future updates.

Let me know if you need anything else.

so i have to add my own business as a sub contractor in order to do a mark up. that is alot of extra steps and 1 more item to anger me at this program.very useless and not at all helpful

I am using QB 2021 Destktop for Mac. After marking things as billable when I go to create a customer invoice nothing appears or pops up to add the billable expenses. I also do not now where to go to view all the expenses marked billable.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here