By following these steps, you can effectively change the status of the invoice from "Paid" to "Unpaid" without creating a credit, allowing you to reapply the payment using the new credit card information provided by the customer, @karen1951.

If you've issued a refund to your customer using the built-in feature, then you don't need to modify the original invoice or change its status from Paid to Unpaid. Instead, you’ll want to create another invoice transaction with the same information.

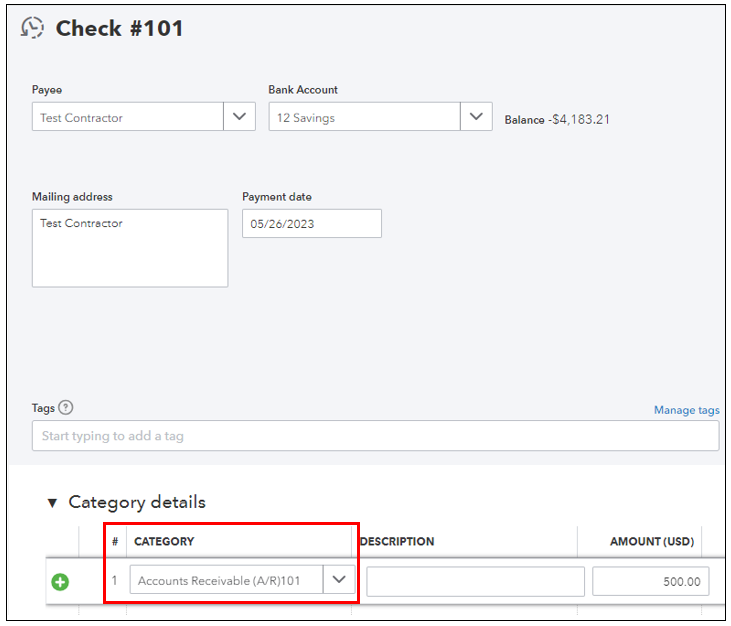

On the other hand, if you've written a check to refund your client's payment, you need to edit it and update the category to Account Receivable (A/R).

Here’s how:

- Go to your Expenses menu, then choose Expenses.

- Locate the check and open it.

- Change the category to A/R and Save.

Once done, go to your invoice and remove the applied payment to show it unpaid in the system. Then, resend the transaction to your customer. When done, link the check and the unapplied amount via Receive payment. This way, the program won’t generate credits for the customer.

I’m adding this article to ensure everything is accurate and accounts are balanced: Reconcile an account in QuickBooks Online.

If you need further assistance with the process or have other concerns managing your sales transactions, please don’t hesitate to let me know. I’ll be here to assist you, @karen1951.