Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I issued a refund to a customer who had overpaid an invoice. However, the balance of the overpayment was left open on the customer's account. I cannot figure out how to take this amount off of the account without affecting sales. Can someone give me guidance?

Good day, Lisa-S.

Thanks for posting your concern here in the Community. Let me share a few details about issuing a customer's refund in QuickBooks Desktop.

May I know how did you process the refund? When recording a refund check to a customer, a credit memo should be created first, so you can track the sale and refund correctly.

When the customer has an overpayment, you have the option to leave the credit to be used later or refund the amount at that time.

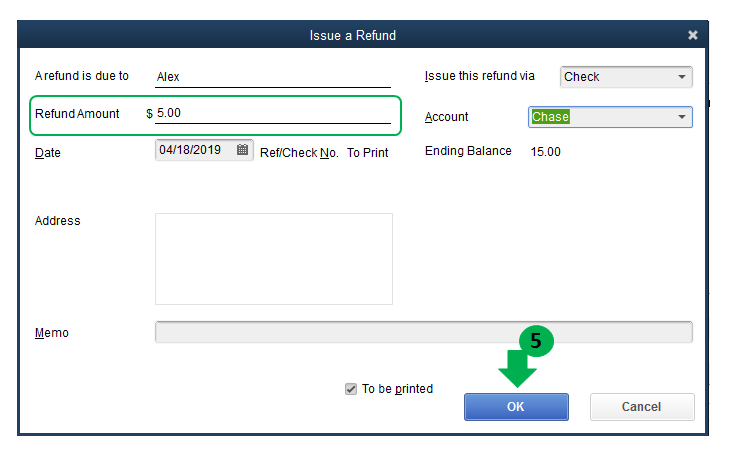

If you chose to leave the credit and need to issue a refund, open the payment transaction and select the Refund the amount to the customer radio button, so QuickBooks will create a check.

I've attached some screenshots below, so you'll know what I'm referring to.

That should do it. Feel free to leave a comment below if you have further questions. I'll get them answered for you.

Hi JaneD,

The check was done in January and I do not remember how it was done. I might not have switched to "refund the amount to the customer" when I issued the refund check. What I need to know what to do without affecting sales, is getting the amount left over off of the customer's account. Can you help?

Thank you

Lisa-S

Welcome back to our forums, @Lisa-S,

Allow me to join the conversation and add a bit more about correcting customer overpayments in QuickBooks.

You're almost there you only need to take more steps. Since you issued a refund check to the client, you'll need to link the transaction to the Accounts Receivables account. Let me walk you through the steps:

This is how it should look like:

Once done, find the invoice then link the refund to offset the overpayment. Follow the steps below:

That should rectify the issue, @Lisa-S. Here's a great article I've added for your reference: Record a credit memo or refund in QuickBooks Desktop

I want to ensure that you're able to enter your refund without any issues, so please feel free to let me know how it goes. I'll be keeping an eye out for your response. Have a good day!

@JaneD wrote:

When recording a refund check to a customer, a credit memo should be created first, so you can track the sale and refund correctly.

Bad advice. If you create a credit memo the customer will have double the credit.

Hi Jen-D,

Thank you for your answer. I followed your instructions but when I go to customer payments the "Discounts & Credits" button is "greyed" out . So this didn't work...any other suggestions?

THanks,

Lisa-S

Thanks for keeping us updated about the steps that you've tried, @Lisa-S.

Allow me to step into this conversation and provide you with some details about recording customer refunds in QuickBooks Desktop.

You'll need to select the correct customer upon receiving payments so the Discounts And Credits option will be clickable.

However, if the issue persists after selecting a customer's name I'd suggest running the verify and rebuild process. Verifying the data self-identifies data issues within a company file while rebuilding the data resolves data integrity issues.

To do that:

Once done, you can proceed with verifying the data:

For detailed instructions on these steps, please refer to this article: Resolve data damage on your company file.

If the problem continues, I'd recommend getting in touch with our Customer Care Team. They have extra tools like screen-sharing that can help verify what's causing the issue.

That should do it.

Please let me know how it goes or if you have any other concerns with QuickBooks. I'll be around to help you out. Have a great day.

Hi,

I am having a glitch with old refund checks to customers that were automatically created by QB as refunds, with "accounts receivables" in the Expense line of the check. They are showing up under my Unbilled Expenses By Project Report. No one at the QB help team could figure it out. How can I get rid of these on this report? I have $34K worth of refunded customer checks that are on this report.

Thanks!

Hi there, @KRose.

I appreciate you joining this thread and reaching out to our Help team.

So that I'm able to provide you with the best information, could you please let me know if you're able to drill down the Unbilled Expenses By Project report? Also, may I know if you've tried deleting them? If yes, did you get an error message? Any additional information or screenshot you can attach is very appreciated.

Once I have the details, I'll be glad to look into it for you. I'll be keeping an eye out for your response. Take care and have a good one.

Thank you so very much. I was able to "fix" my issue. I hope your day is great!

I spent 4 hours with the tech and Payroll teams yesterday and stumped them both...they think it may be an internal error. I ran a rebuild after a verify and got the codes 179 (but we don't download from the bank), and 278 which I couldn't find any web info on.

What is happening is: I run the Professional Services Report>Unbilled Expenses by Project. (I have manually unclicked 4.5 Million dollars worth of billable check boxes that had been checked but were not really billable items from 2004 through 2019). This left me with two categories of items still on this report. None of them have billable check boxes. They are 1) Refund of Client Overpayment checks (processed through the Customer Payments Tab) and 2) Paycheck line items associated with a client (but NOT checked as billable on the time sheets).

Our Edit Preference box is not checked for "make all expenses billable." Which should make the billable check boxes stay blank, unless we manually check them. Yet SOME items are still coming up with the check box automatically clicked as soon as I enter a client name into the Customer field on a check or bill, etc, and we have to manually remove them, so there's a glitch there.

For the paychecks I cannot delete them as they are run through Intuit. I have checked the payroll item setup (nowhere to mark as "billable"), payroll time sheets (there are NO Billable check marks on any payroll item line).

On the refund checks, they were created via the Customer> Receive Payments>there was no invoice to attach to, the box in the bottom right comes up and says "do you want to refund to customer?">yes>QB created the refund check, Accounts Receivable offset as the account, client name, no billable check box checked. We ran several scenarios. We deleted them, and ran e created credit memos first, then refunds. Same issue as creating the checks directly. Tried deleting the credit memos and refund checks and adding a journal entry instead. Same issue as long as I added a client name, regardless of whether there is a billable check box or not.

We ran a verify and rebuild from the source computer. Got the error codes 278 and 179.

Any enlightenment you might have would be appreciated.

Thanks!

Hello, @KRose.

Thank you for sharing detailed information about the items still coming up on your Unbilled Expenses by Project. Allow me to step in and help provide other troubleshooting steps to resolve this issue.

If this is caused by internal error, rebuilding your data should fix the issue. Since you're still having this problem, let me refer you to this article for other solutions: Top data damage errors in QuickBooks Desktop.

I'd also suggest reaching out to our Tech support again and provide your case number since this issue hasn't been resolved yet. I'm sure they are investigating this unusual behavior to get this resolved.

Should you need anything else or have other questions about the error codes, please let me know. I'm here to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here