Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI RECEIVED A U. S. GOVERNMENT GRANT FOR MY MEDICAL PRACTICE FROM HEALTH AND HUMAN SERVICES TO HELP PAY FOR COVID-19 TESTING BUT ALSO FOR LOST REVENUE THE DUE TO THE EPIDEMIC. HOW DUE I RECORD THE DEPOSIT OF THE GRANT MONEY IN MY QUICKBOOKS ACCT AND HOW DO I CHARGE EXPENSES AND LOST REVENUE AGAINST IT?

Hi wfgodot!

First of all, we want to thank you for your services. May you stay in good health to help others survive through this tough time.

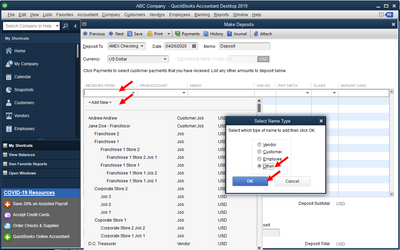

You can record the grant as a deposit to your business account. At the same time, you can create the profile of the agency where the funds came from and the account to categorize the grant. I'll show you how.

3.b) Enter the name of the organization that gave you the grant and hit OK.

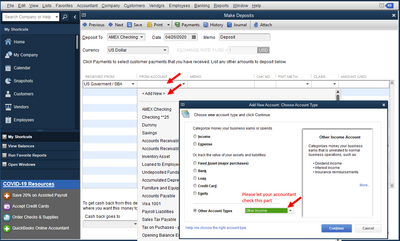

3.b) Enter the name of the organization that gave you the grant and hit OK. 4.b) Select Continue and name it something like COVID-19 Grant Income.

4.b) Select Continue and name it something like COVID-19 Grant Income.Since this deposit is categorized as other income, it will reflect in the Income section of your Profit and Loss report and will offset your total expenses. You may stop there.

If you really want to reduce/offset the total amount of a particular expense account using this grant, you can do that via journal entry. However, I highly suggest you speak with your accountant about the accounts to be used.

If you have additional questions, you can always go back to this thread. Stay safe!

Yes as @JessT Says, grants are income. Income is all money received that is not a loan even though some might be free of taxes, which is your situation.

Two methods to track the dispersed funds from the grant.

Class tracking. Add a class for the grant and add the class to all grant related expense (also tagging the grant income to that class)

Job costing. Instead of adding the SBA as an Other Name, add them as a Customer:Job and post expenses as billable to the grant job.

how do I record a grent thats not paided?

Thanks for joining us here, cacci.

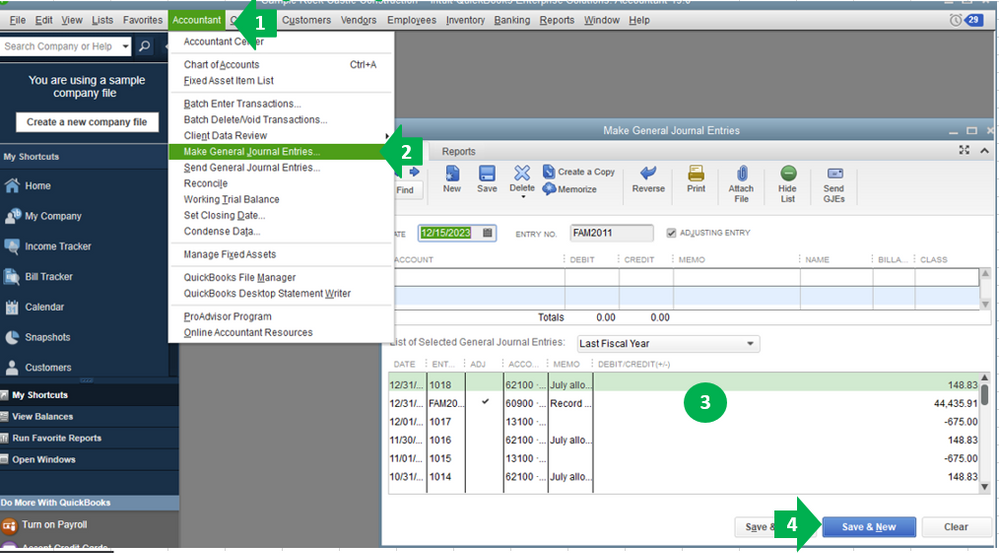

You'll want to create a journal entry to record the unpaid grant in QuickBookd Desktop. Before doing so, I would recommend consulting with an accountant or bookkeeper on this, especially when it comes to recording the grant correctly.

Our Find-a-Pro-Advisor page will be able to assist in connecting you with a certified accountant or bookkeeper that also specialises in QuickBooks: Find an accountant.

I'll show you how to create a Journal Entry:

Here are some articles to become more familiar with managing Journal Entries in QuickBooks:

If you wish to review the entries, you can do so by going to the bottom pane of the Make General Journal Entries window.

By default, only entries from the last month are displayed. To change or expand the list of entries, click from the List of Selected General Journal Entries drop-down list and select which period.

You can also check out this article about Transaction Journal report in QuickBooks Desktop for additional information.

Feel free to comment below if you have any other questions or concerns. I'm always here to help.

I have the Quickbooks Online and Other is not an option I can only choose Vendor or Customer. Would it be fine to but it under vendor? I got a CA relief grant and we do not have to pay it back not sure if it should just be under other Income or not since I have read so many different things on here about how to enter it.

Is the California relief program grant the same thing? I thought it would be categorized as a new Equity account in the chart of accounts?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here