Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am taking over the bookkeeping for a new client and they invoice all their clients via estimate. They create and estimate and then create an invoice from the estimate each month based on the % complete.

1 - They enter the vendor invoice and show it as billable to the client

2 - They create an invoice from the estimate based on % complete.

3 - How do I show or know a vendor invoice has been billed if the client invoice is based on % complete?

Solved! Go to Solution.

"I'm just confused on how to make sure we bill all costs to the project when not using the Add Item option."

Run your Reports. That is how you manage projects.

"Sometimes there are more costs than the estimate"

Run the report Estimates vs Actuals Detail for that one job. This is how you manage if there are overruns = you see that different in this report.

"and we want to make sure they are all included"

They don't get included in Progress Billing. Let's review:

If you sign a Quote, and that is All I am charging you, then I need to manage that there is no Overrun. Or, I give you a Quote, but we will charge from Actual Time & Costs, and you agreed to that Scope as Not a fixed bid, but as a sort of Plan or budget.

Or, Both: We progress invoice from the estimate. As we work, we discover there is a need for an expanded scope = change order, and you agree we sill simply charge Direct Time and Costs for the amount outside of the original estimate's Scope. That is a Separate Invoice. I progress invoice from the Estimate. I separately invoice using Add Time & Costs, for the "Additional Scope."

"and there seems no easy way to make sure you cover all your costs by billing by percent complete."

Because agreeing to a Progress Invoice from an Estimate or scope is sometimes referred to as "not to Exceed/ Not to Succeed." The point of using Progress Invoicing is to be good enough to project your Costs and manage the project and build in the Price to cover your own contingency factor.

This is why some business only use Direct Time at Hourly Rates & Costs, or Time & Costs plus Markup. Not everyone can Bid a job and then stay to the Bid or Estimate. That is part of Project management, not QB.

You can finish a job and come in more profitable than expected under Progress Invoicing. You can finish a job and see less profit than planned due to errors in the Estimate, do-overs, improper supervision of labor, and errors in contracts with suppliers of goods or services.

I had one architect ask me, "How much can I work on this job?" The answer was, up to what you Estimated it will take. If you do Twice the work, we just lost money.

Hello there, @Kitkat2.

I'd be happy to help get you to the right track to get this resolved.

I have an answer to a post with a question similar to this. Let me direct you there: https://quickbooks.intuit.com/community/Reports-and-accounting/Estimate-Adjustment/m-p/232495#M13745.

That should take care of it.

Feel free to drop a comment below if you have any other questions about QuickBooks. Please know that the Community has your back if you need assistance. Wishing you and your business continued success.

I guess I'm not being clear. These are the steps we take in QuickBooks:

1 - Create Estimate

2 - Receive invoice from vendor

3 - Enter invoice from vendor - it shows billable to customer

4 - Create invoice to customer based on % complete

How do I know that the invoice from vendor is being billed, if it still shows as billable to customer since I bill customer from the estimate for % complete? I'm not selecting the vendor invoice to bill to custom invoice so I'm not understanding how to remove that 'billable to customer'

It's great to here again from you, @Kitkat2.

Allow me to join the conversation and provide additional details on how to determined whether a recorded invoice is billable.

If I may ask, are you perhaps referring to the invoice your vendor gave to you? If yes, when you received an invoice from a vendor it will be recorded as a bill in the system. You can verify whether an invoice is billed if there's a check mark on the column that says Billable.

On the other hand, to ensure the estimates and invoices you created are tracked accurately, here's the correct workflow:

That should do it! If you need further help with the workflow above, I'd recommend contacting our Customer Care Team. An agent will be able to further assist you via secured remote access session.

Here’s how to contact us:

Let me know if you have other questions on how QuickBooks Desktop handles your accounts receivables. I'm always here to lend a hand.

Yes, I'm referring to the Vendor Bill. I enter the Vendor Bill, mark it billable and note the customer. BUT, when I go to Customer Invoice, I bill by % complete of an Estimate and not by selecting Add Items. You need to use Add Items in order to get the Vendor bill applied to the Customer Invoice.

If I'm not using the Add Item of the Vendor Bill, how do I know I invoiced the Custom with the Vendor Bill? How do I make the BILLABLE of the Vendor Bill noted as billed?

Glad to hear again from you, @Kitkat2.

I appreciate you for clarifying your concern. Let me share additional information on how to set up progress invoicing.

For starters, if you create an invoice out of the estimate that you have created in the system, all the information on the estimate will be carry over to the invoice.

On the other hand, since you're creating an invoice based on the percentage of the completed task or supplied materials, you can create send your vendor a progress invoice.

Let's make sure that this feature is enabled on your end. Here's How:

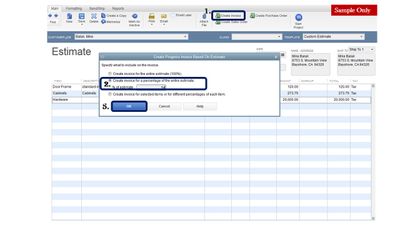

Once progress invoicing, you can now create an invoice for a specific item on your Estimate. Here's how:

Also, you can pull up your Job Progress Invoices vs Estimates report to verify how much of the estimated amount has been billed.

That should do it! Feel free to click the Reply button if you have other questions about creating a progress invoice. I'm here to help.

You would report for that job and the same Item.

The Bill or purchase entry is Job Tracked as Not Billable, because you are using Progress Invoicing from the Estimate. That means the Direct Purchase is Job Tracked for the reporting to work, but Not Billable.

You won't mark the purchase details billable unless you intend to use Add Time & Costs. You won't use Add Time & Costs, if you Invoice from the Estimate or from an SO as Fulfillment tracking.

Now you run reports. Example: Job Profitability Detail will show all Items Purchased and all Items Sold. You also run Estimates vs Actuals Detail for that one job, to see this.

I have an attachment, it is side-by-side for Job Profitability Detail and P&L for that same job. Look at the Building Permit entry at the bottom. This shows we Wrote the check wrong, not using the item, so the Cost = No Item. But the Customer shows Twice the Value. Either this company marks up the cost 100% or they Double-charged the customer.

Yes, I do this already but that's not my question.

I invoice my customer by progress from the estimate. I go to Customer, create invoice, and it shows available estimates. I click the estimate I am using to create an invoice, then click the 3rd option crate invoice for selected items or for difference percentage for each item. I use the percentage. When I click enter, it also opens a box that asked if I want to include BILLABLE TIME/COSTS. I am using PERCENTAGE. The issue is, Percentage does not change the VENDOR BILL to being billed. When you enter a VENDOR BILL, you click the Billable box. If you don't enter the VENDOR BILL on the CUSTOMER INVOICE using the BILLABLE/TIME COSTS, how do you know it has been billed? I don't know how else to explain this. I bill client by % but that does not change the vendor bill to being billed.

Thank you. I understand that. We won't mark the vendor bill as billable. I'm just confused on how to make sure we bill all costs to the project when not using the Add Item option. Sometimes there are more costs than the estimate and we want to make sure they are all included and there seems no easy way to make sure you cover all your costs by billing by percent complete.

"I'm just confused on how to make sure we bill all costs to the project when not using the Add Item option."

Run your Reports. That is how you manage projects.

"Sometimes there are more costs than the estimate"

Run the report Estimates vs Actuals Detail for that one job. This is how you manage if there are overruns = you see that different in this report.

"and we want to make sure they are all included"

They don't get included in Progress Billing. Let's review:

If you sign a Quote, and that is All I am charging you, then I need to manage that there is no Overrun. Or, I give you a Quote, but we will charge from Actual Time & Costs, and you agreed to that Scope as Not a fixed bid, but as a sort of Plan or budget.

Or, Both: We progress invoice from the estimate. As we work, we discover there is a need for an expanded scope = change order, and you agree we sill simply charge Direct Time and Costs for the amount outside of the original estimate's Scope. That is a Separate Invoice. I progress invoice from the Estimate. I separately invoice using Add Time & Costs, for the "Additional Scope."

"and there seems no easy way to make sure you cover all your costs by billing by percent complete."

Because agreeing to a Progress Invoice from an Estimate or scope is sometimes referred to as "not to Exceed/ Not to Succeed." The point of using Progress Invoicing is to be good enough to project your Costs and manage the project and build in the Price to cover your own contingency factor.

This is why some business only use Direct Time at Hourly Rates & Costs, or Time & Costs plus Markup. Not everyone can Bid a job and then stay to the Bid or Estimate. That is part of Project management, not QB.

You can finish a job and come in more profitable than expected under Progress Invoicing. You can finish a job and see less profit than planned due to errors in the Estimate, do-overs, improper supervision of labor, and errors in contracts with suppliers of goods or services.

I had one architect ask me, "How much can I work on this job?" The answer was, up to what you Estimated it will take. If you do Twice the work, we just lost money.

Hello Kitkat2. I found this feed searching for a similar question. I'm not sure if you found a better solution for finding the costs included for a percentage of completion timeframe? If I may I'd suggest using the Job Costs by Job and Vendor Detail report found under Contractor Reports. Change the dates on the top of the report using the calendar icons. If you invoice on Mondays, use a billing start date of Monday and end on Sunday (yesterday). Just don't overlap starting or ending dates or you may charge your customer twice. All your entered costs will be listed whether they were marked billable or not. Hope that helps.

I also have a similar issue. We track furniture purchases for client projects (interior design firm) via Estimates so we can get better reporting Est vs. Actual at the end of a Job, per order. It appears that to get the good report, I have to Invoice my client via the Estimate, instead of the "Add Time/Costs" item list, which is how I previously got to those billables to an invoice (that have shown up from a default setting in QBD when I entered the Bill. My process is as follows.

- First, I enter an estimate for the product (Our customer NEVER sees this estimate, we only use if for reporting).

- Then, I create a Purchase Order for from the Estimate, to send to our vendor

- Then I receive the invoice from the vendor, and pay the Purchase Order with a Bill.

- The bill automatically checks the Bill line items with billable to that same client

- Then I pay the Bill with a payment

- Then I invoice the client

* Upon invoicing the client (we don't do progress billing). Always 100%, I have two options that I see:

1. There is the pop-up window that shows the list of Estimates I have created for that customer. If I produce the Invoice from there, it may not include other charges that belong with that invoice that came up later, i.e. a delivery fee, or perhaps a fee from a vendor that was additional that wasn't on the original estimate and was a separate vendor, many different reasons there could be extra fees. These items never made it to a PO or an Estimate, just a Bill or sometimes just a Payment.

2. The Add Time/Costs tabs - where these other charges show up from the Bill (with the check marked billable).

Under Add Time/Costs - The problem is I see both the new charges in there and the items I just imported from the Estimate to the Invoice (and there are 100s of charges, by the way, for these customers for one project, we could have up to 100 Purchase Orders, with multiple line items, and so this "Add Time/Costs list has hundreds of lines). The issue is the just billed charges don't go away when I bill via Estimate, and now I am having to scroll down these 100s of charges to pick out the other fees that may go with this order.

Why doesn't it close both out (the Estimate and the lines under Add Time/Costs from the Bill)?

My second question is, if I don't use Estimates to create the Invoices, and go ahead and use the Add Time/Costs area, will my Estimate vs. Actual reports show $0 under "Actual Revenue"? Or will it show the amount that was actually invoiced? For instance the "Item Estimates vs. Actual" Report. I don't think it does, and so I have to use an Estimate or Proposal to make that happen for the owner.

It sounds to me from the above back and forth, that the product Invoices created from an Estimate or Proposal, upon creating the "Bill" in QBD from the PO, that I should uncheck all of those, except probably the shipping and any additional charges that may have come in after the Estimate and PO were created. Can someone confirm this?

Thank you!

Thanks for updating this thread and sharing your concern with us, @cbsmith.

It's great to have you here, and I want to help you further.

The only time those charges in the Add Time/Costs is cleared is if it was assigned to a posting transaction. If you want to use progress invoicing and assign the other charges, create the invoice within the estimate itself at 100%. Then, once all the items are assigned to the sale, click the Add Time/Costs icon to add any additional charges for that customer.

Since you also need to create bills out of the estimate, the process of creating PO's from it is the correct process before bills. For now, can you please send some screenshots to show the duplicates you're referring to? This will help us make sure you're on the right track.

See this related link about the topic: Set up and send progress invoices in QuickBooks Desktop

If you have any questions or need further help with QuickBooks progress invoicing and billing, visit us anytime. You can also mention my name on your posts, and I'll be more than happy to help. Have a nice day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here