Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

If you flow both the sale and the refund through Undeposited Funds, you can assign the bank debit also to Undeposited Funds, and create a zero Bank Deposit and check off the 2 negatives against the positive, to clear them out

Appreciate your time reaching out to us, julia8,

I'm here to help share information about matching transactions.

Here's what you'll need to do:

To for more detailed information, I'm attaching some helpful articles that you can check on:

If you need further assistance with the steps, you can always contact our Customer Care Support Team. They have the necessary tools like screen sharing to walk you through.

To contact us, here’s how:

Please don’t hesitate to reach back out if you need further assistance in matching transactions. Have a great day!

If you flow both the sale and the refund through Undeposited Funds, you can assign the bank debit also to Undeposited Funds, and create a zero Bank Deposit and check off the 2 negatives against the positive, to clear them out

Finally!!! I have been messing with this for months. Talked to 2 different Quickbooks help line people and sent 2 messages. I don't know why they don't recognize an ACH debit as a "negative deposit" and let you clear it like the rest of the deposits. Thank you so much. You have been a great help.

Hi there, julia8,

I'm glad to hear that everything is now resolved with the help of Malcolm Ziman.

If there's anything else you need help with concerning your QuickBooks Online account, please feel free to reach back out. More powers to you and to your business! Have a great day ahead.

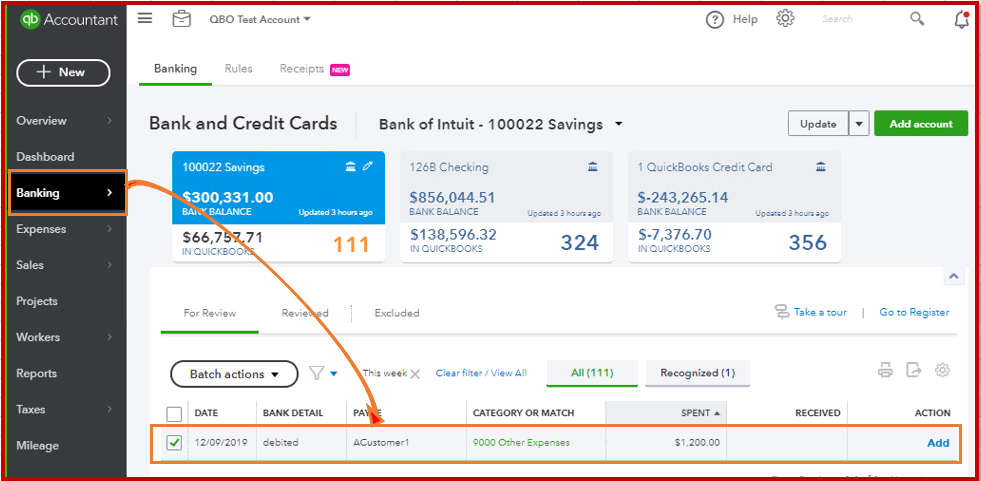

I have been having difficulties trying to figure out how to do this. Our merchant co debited our account for $1,200 for a customer refund of $1,865 and a separate customer sale of $665. I have changed both to undeposited funds but they aren't pulling over when i try to match them to the debit transaction that downloaded in the bank and credit cards. I also changed the category/match to undeposited funds. So i'm not sure if i'm missing something or what the issue is. I would greatly appreciate any help you can offer as support told me it's not possible to have both a refund and sales receipt match to a spent transaction.

Thanks for joining this thread, gngrbrmn.

Let me clarify things out for you.

Yes, you're unable to match both the refund and sales receipt (money in) to a spent transaction (money out).

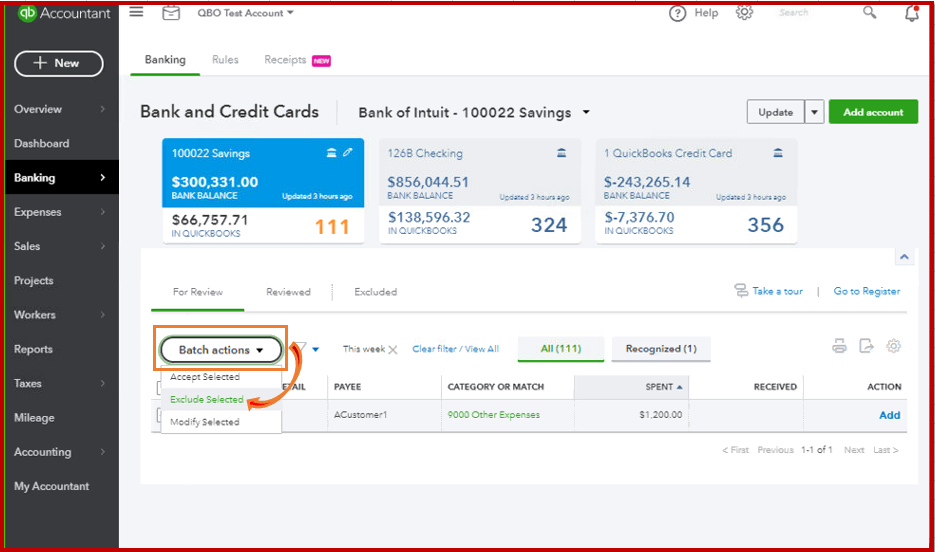

I suggest excluding the spent transaction since you've already created a refund and sales receipt in QuickBooks. This way it won't continue to appear as transaction to be reviewed.

Here's how:

This entry is listed on the Excluded tab for your reference. And, this won't appear in any associated account on your registers.

Upon sharing this solution, I also suggest consulting with an accountant. He/She might have specific instructions on how to handle different sale and refund amounts.

Learn more about categorizing downloaded transactions in QuickBooks Online through this link: Download, match, and categorize your bank transactions . This article includes a quick video tutorial and detailed steps to guide you with the process.

Keep me posted if you have follow-up questions and I'd be glad to help you out.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here