Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowSolved! Go to Solution.

Welcome to the Community, johnfilas.

Thank you for choosing QuickBooks Desktop as your partner accounting and tracking your payroll. I'm here to help set up a SEP IRA.

In a few easy steps, you can set up a SEP IRA. This item is used either for employee contribution to 408(k)(6) SEP or company contribution to an employee's 408(k)(6) retirement plans.

To do this task, please follow these steps:

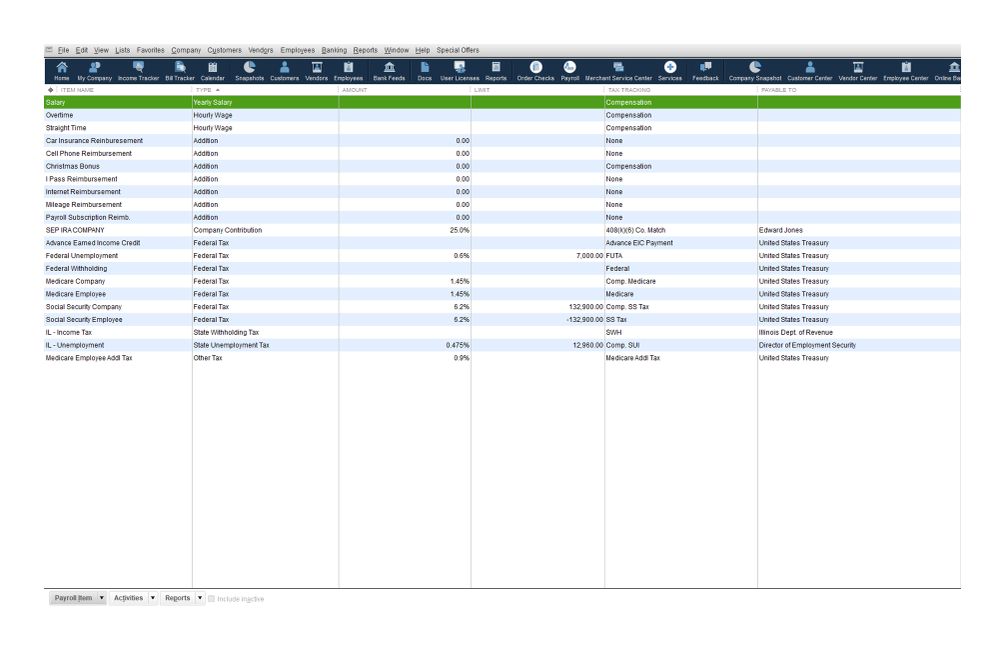

I've attached some screenshots below to help you with the process.

As a reference, you can refer to this article for further guidance: Set up a payroll item for retirement benefits (401(K), Simple IRA, etc.).

This should point you in the right direction. Let me know if you have further questions. I'm always here to help.

Hello, johnfilas.

Thanks for following all the steps provided by my colleagues and for sharing the results you’re getting.

There’s a possibility that there are no transactions recorded in QuickBooks under the payroll item you’ve created. That’s why it’s not showing on the pop up window. To check:

If there are no transactions showing on the report, then you’ll need to record them through Adjusting Payroll Liabilities. Here’s how:

Once done, follow the steps provided by colleague about creating a check to your SEP IRA provider.

Please continue to visit us here if you need anything else.

Thank you! It works now.

Welcome to the Community, johnfilas.

Thank you for choosing QuickBooks Desktop as your partner accounting and tracking your payroll. I'm here to help set up a SEP IRA.

In a few easy steps, you can set up a SEP IRA. This item is used either for employee contribution to 408(k)(6) SEP or company contribution to an employee's 408(k)(6) retirement plans.

To do this task, please follow these steps:

I've attached some screenshots below to help you with the process.

As a reference, you can refer to this article for further guidance: Set up a payroll item for retirement benefits (401(K), Simple IRA, etc.).

This should point you in the right direction. Let me know if you have further questions. I'm always here to help.

How to create a check to provider of SEP i.e. Edward Jons

It's good to see you again, johnfilas.

Let me help create a check to your SEP IRA provider in QuickBooks Desktop.

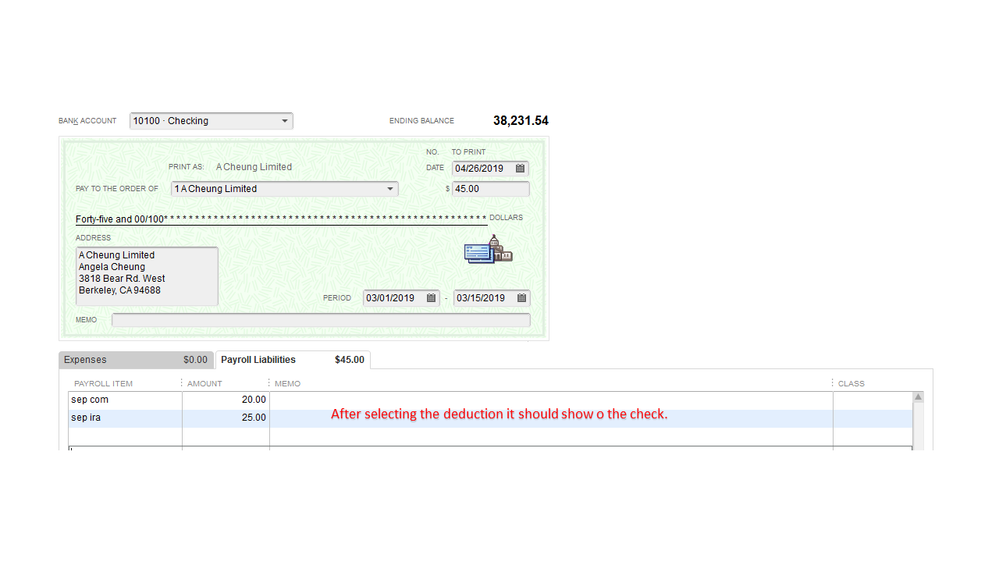

After creating the employee's paycheck, QuickBooks allows you to record a check through the Pay Liabilities window. To do so, you can follow these steps:

For your visual reference, please see attached screenshots.

You can also check this article for more information: Set up and pay scheduled or custom (unscheduled) liabilities.

From there, you'll be able to create a check for the SEP IRA provider.

Please let me know how things go once you've tried these steps. I'll be here to keep helping. Take care.

Thank you for your help! All worked correctly until after hitting ok at step 6. The SEP IRA Employer does not show up in the window that pops up so I am unable to create the check. It does, however, show in the 'payroll items' window. What could be the cause of this and how do I fix it?

Thanks for getting back to us, johnfilas.

I appreciate sharing the result of the solution provided by my colleague. Allow me to step in for a moment and help ensure you can create a liability check for the mentioned liability above.

Just to clarify, did you also select the SEP IRA Employer? While waiting for the details, you’ll have to mark the liabilities that need to be paid when creating custom payments.

To accomplish this, you'll have to open the Create Custom Payments screen again and mark the payroll item. You can follow the steps provided by @JaneD.

This way, the SEP IRA company contribution, and employer portion will show up on the liability check. I'm attaching screenshots for visual reference.

In step 7 i do not have SEP Ira Employer listed.so I can't create a check. I want to do only employer contribution for employee.

Hello again, johnfilas.

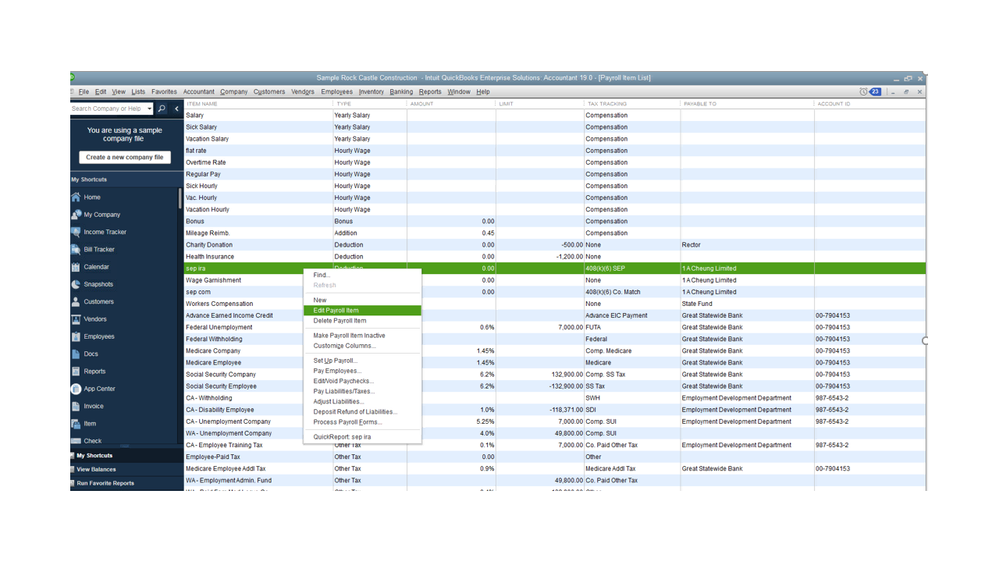

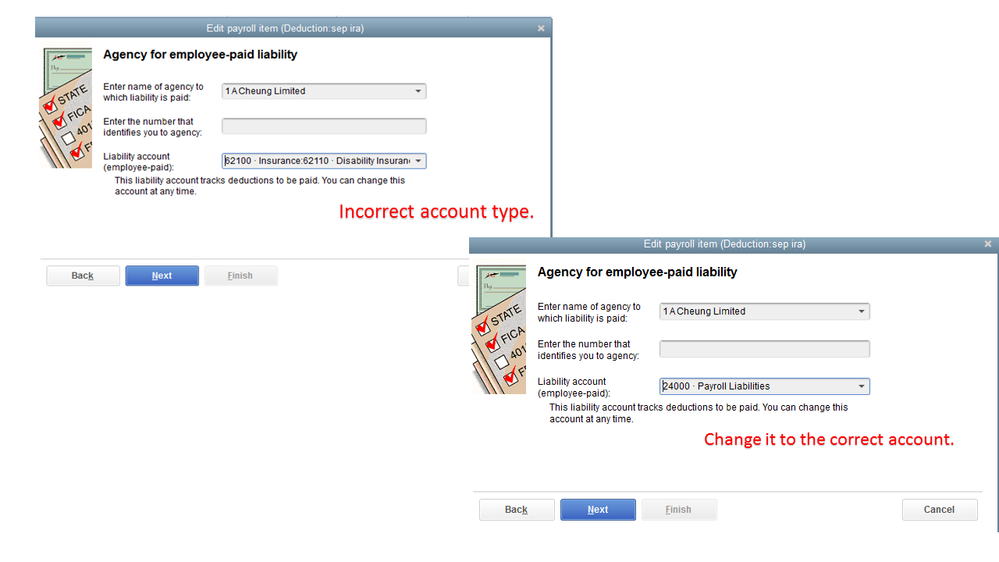

I can help clarify why you’re unable to see the SEP IRA Employer in the Custom Payments screen.

This can happen when the account used to track the payroll item is not a Payroll liability. You’ll have to review the setup and update the information to resolve this issue.

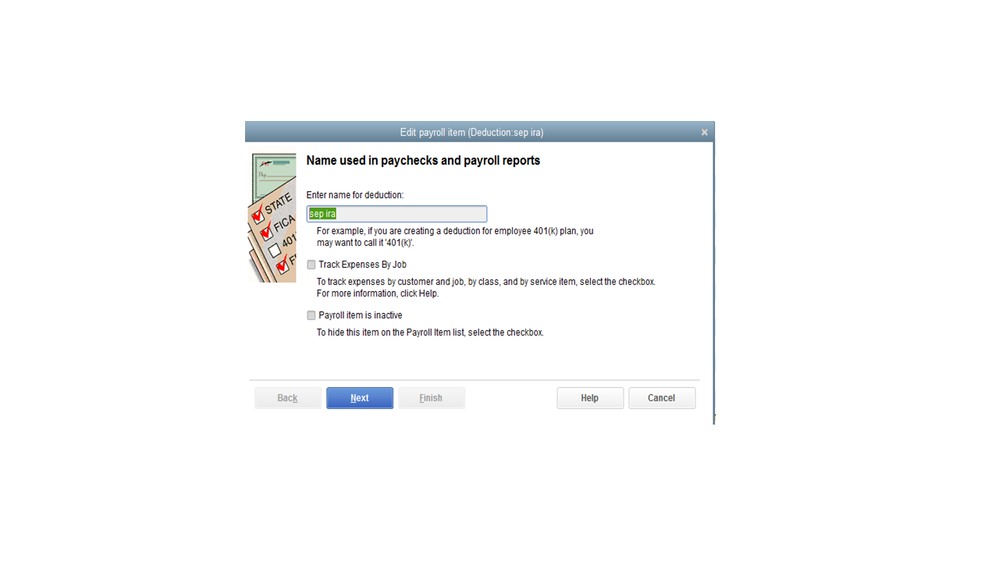

Here’s how:

After completing the process, you’ll see another window asking how you want QuickBooks to update the transactions. Make sure to read the options and select the correct one.

With these steps, you should now see the deduction item and will be able to create a liability check.

Keep me posted on how these troubleshooting steps work for you. I want to make sure everything is taken care of and you're all set with this concern.

Hi,

Thanks again for the reply. I've followed all steps listed and I'm still having the same problem. I've described/illustrated the steps I went through below.

1. I set up the SEP IRA in the payroll items.

3. When I try to create a check from payroll liabilities, the SEP IRA does not show up so the check can't be created.

Is there a misstep on my part? Is there anything else I can do to fix this?

Thanks!

Hello, johnfilas.

Thanks for following all the steps provided by my colleagues and for sharing the results you’re getting.

There’s a possibility that there are no transactions recorded in QuickBooks under the payroll item you’ve created. That’s why it’s not showing on the pop up window. To check:

If there are no transactions showing on the report, then you’ll need to record them through Adjusting Payroll Liabilities. Here’s how:

Once done, follow the steps provided by colleague about creating a check to your SEP IRA provider.

Please continue to visit us here if you need anything else.

Thank you! It works now.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here