Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI was just hired by a non-profit, which uses the non-profit designation in qbo but hasn't set things up for funds/programs, etc. Been doing a lot of investigation on how to do this and am confused with the different ways people do this. Can someone give me a step by step on what to set up? I know how to do it mechanically (like how to turn on classes/projects, etc).

1. We have 6 programs (ESL, Farm, Food bank, dental etc) that we service. I want track the grants, expenses (paid for by grants and operating accounts) against each program. Do I set up a project for each?

2. We have the normal Restricted/non-restricted grants. I want to track how that money is being spent, two much we have left. Do I do this through classes?

3. What do we set up in Products/Services?

4. Are there other fields I need to set up now to give us reporting by Program and by Grant/Fund for both income and expenses?

Thanks!

It’s great to see you today, alyspiess.

Welcome aboard to the Intuit Community. Let’s set up your non-profit account by turning on the Projects feature, adding accounts to track the grants, and then add the items.

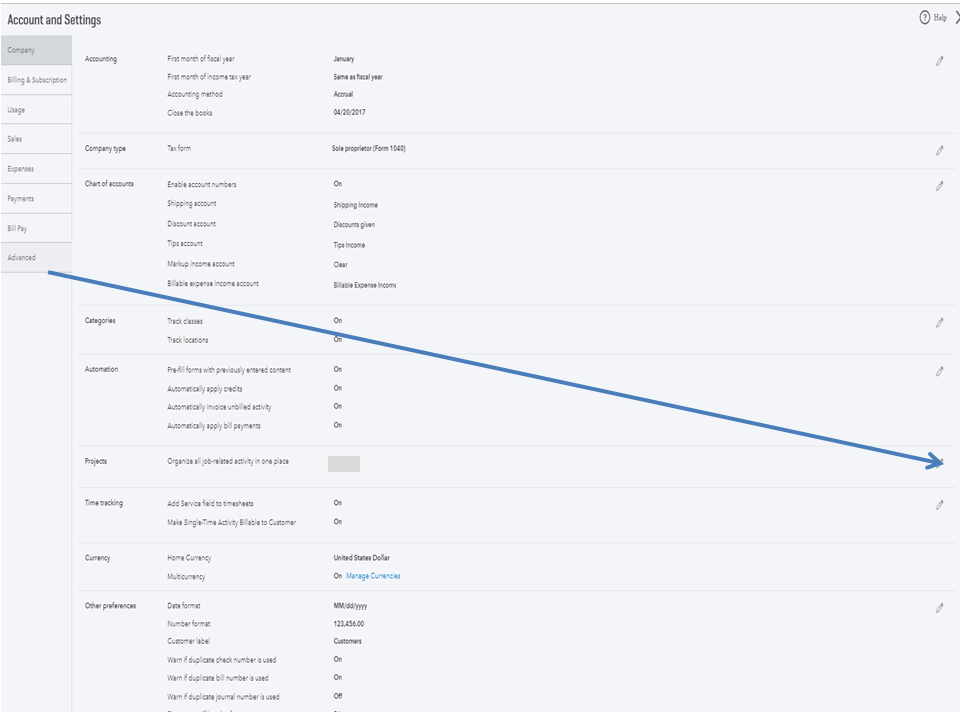

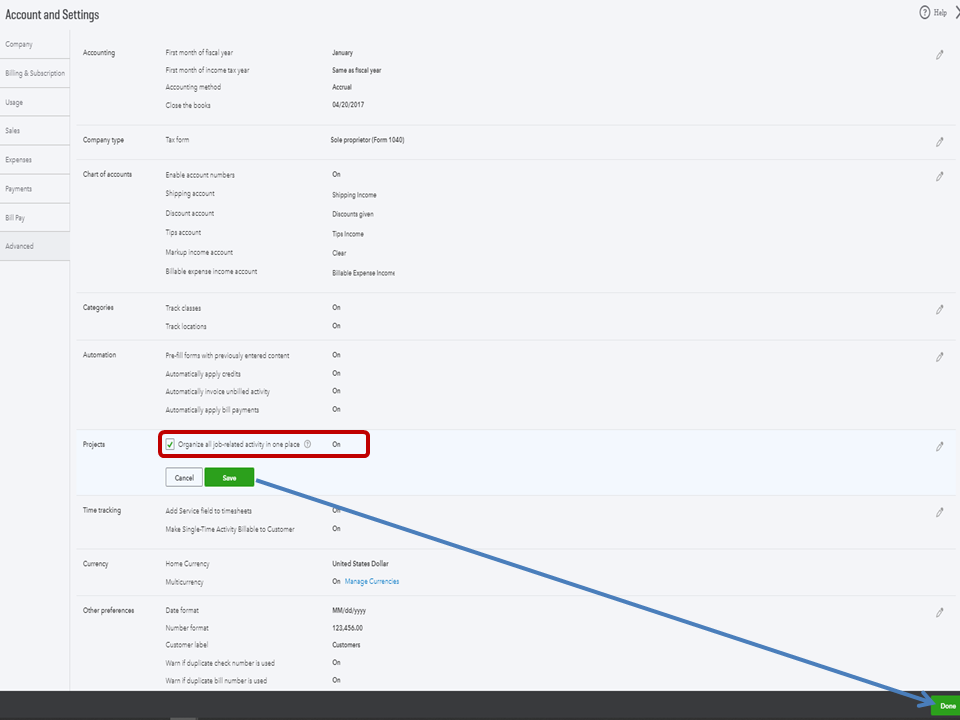

The process can easily be done with just a few clicks. To begin, activate the Projects option by following these steps.

This will display the Projects menu on the left panel of the company.

Now that’s it turned on, create the first project and then add the income and expenses. Let me share this guide that will walk you through the process.

To view the instructions, perform Steps 2-6: Set up and use the Projects feature.

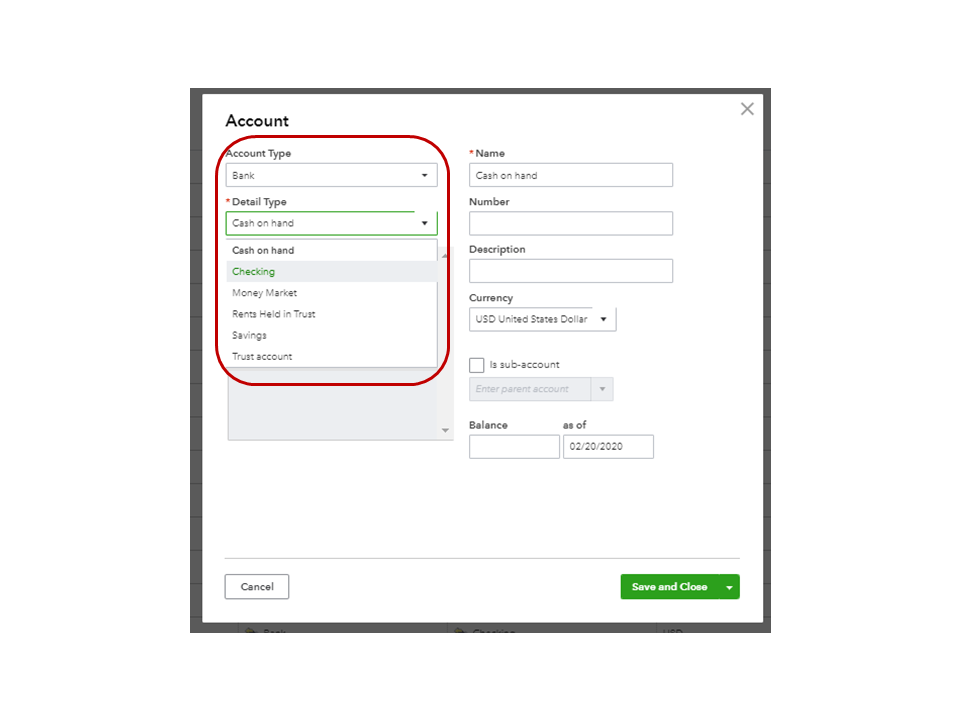

Next, set up a sub-account for each grant (Restricted/non-restricted) and associate it with the parent account. This is to ensure your records are organized.

If you haven’t added the main account, I have a few easy steps to do this.

The following link provides an overview of creating sub-accounts and ways to organize the register: Chart of accounts in QuickBooks Online.

When setting up products and services, the item type depends on how you use them. For an overview which category to use, see the Change Product and Service types article and proceed directly to the Four Product and Service types section.

Additionally, the following articles provide detailed instructions about tracking inventory, services, or non-inventory items.

Lastly, you don’t have to set up another field to display the Program and by Grant/Fund for both income and expenses. Simply use the Filter feature on the report to achieve it.

By following these steps, ensure your grants and expenses are properly tracked in QBO.

Keep in touch if you have any other concerns or questions. I’m more than happy to assist further. Enjoy the rest of the day.

Thank you for all this information. I'm still not following though. Many articles say to use the classes for grants and many say to use it for the programs. It is vastly different tracking.

1. For my PROGRAMS (what we offer at the non profit), is this set up under PROJECTS?

2. For my GRANTS - is this set up under CLASSES?

3. For sub-bank accounts, when I go to set up, it asks me when I want to start tracking it and how much is in there. The money is already part of the parent bank account. How do I "transfer" the money into the sub-account in qbo?

4. In the project instructions, what does it mean when it says "You’ll automatically tag new items to projects when you select the Add to projects button." There are articles about setting up items but I can't find items anywhere.

5. What do you mean about setting up products? What what I put in there?

6. I will have rent and payroll for each of my 7 PROGRAMS. I was going to set up the programs (ESL, food bank, etc) as a class and use that drop down when I record rent, payroll, expenses. Are you suggesting a different way?

Also - when I set up my restricted/unrestricted grants under net assets - I don't see the drop down for net assets in qbo. Do I select "equity"? If so, what is the DETAIL TYPE under equity to select?

Also - When I try to set up project, it asks for a donor. I don't have one specific donor for each project.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here