Get 50% OFF QuickBooks for 3 months*

Buy now- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Other questions

- :

- Re: Printing 1099-NEC; QB Online version is printing the SS# in EIN format in the PAYER"S TIN box.

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Printing 1099-NEC; QB Online version is printing the SS# in EIN format in the PAYER"S TIN box.

Printing 1099-NEC; QB Online version is printing the SS# in EIN format in the PAYER"S TIN box, how do I fix this?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Printing 1099-NEC; QB Online version is printing the SS# in EIN format in the PAYER"S TIN box.

It's good to see you here in the Community, @mjo379.

I'm here to help make sure you can print 1099-NEC with the Social Security number format.

Please know that the information showing in the Payer's TIN box depends on the data entered in the Business ID No. / Social Security No. field on the vendor's profile. It's possible that the information entered isn't Social Security number format. To verify, let's go to the vendor's profile. Here's how:

- Sign in to your QuickBooks Online (QBO) account.

- Click Expenses from the left menu, then select Vendors.

- Select the vendor that shows the EIN format. Then, click the Edit button.

- Review the information entered in the Business ID No. / Social Security No. field. Make sure you entered the correct format for Social Security numbers which is XXX-XX-XXXX.

- Make a necessary change if needed.

- Then, click Save and print the 1099-NEC again.

You might want to learn more about 1099 forms. This article will provide you the detailed information: Get answers to your 1099 questions.

If you need further assistance printing 1099 forms, just comment below or post again. I'm always around if you need any help, @mjo379.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Printing 1099-NEC; QB Online version is printing the SS# in EIN format in the PAYER"S TIN box.

Mark R,

The problem is with the Company ID (sole proprietor) printing in the Payer's TIN box on the 1099-NEC.

The SS# was set up year's ago, and we've had no problem with printing the 1099's in prior years as a SS#.

But this year the SS# is printing in EIN format, (with only one dash) in the Payer's TIN box.

The 1096 form is printing the SS# correctly (with two dashes).

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Printing 1099-NEC; QB Online version is printing the SS# in EIN format in the PAYER"S TIN box.

Mark_R,

The problem is with the Company ID (sole proprietor) printing in the Payer's TIN box on the 1099-NEC.

The SS# was set up year's ago, and we've had no problem with printing the 1099's in prior years as a SS#.

But this year the SS# is printing in EIN format, (with only one dash) in the Payer's TIN box.

The 1096 form is printing the SS# correctly (with two dashes).

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Printing 1099-NEC; QB Online version is printing the SS# in EIN format in the PAYER"S TIN box.

I appreciate you getting back to us, mjo379.

An outdated Adobe version can lead to a problem when printing in QuickBooks Online. You may need to update the Adobe Reader. Here's how:

- Launch Adobe Reader or Acrobat.

- Choose Help, and then Check for Updates.

- Follow the steps in the Update window to download and install the latest updates.

However, if the same thing happens, let's proceed with repairing your Adobe Reader: How to update, repair, or re-install Adobe Reader/Acrobat.

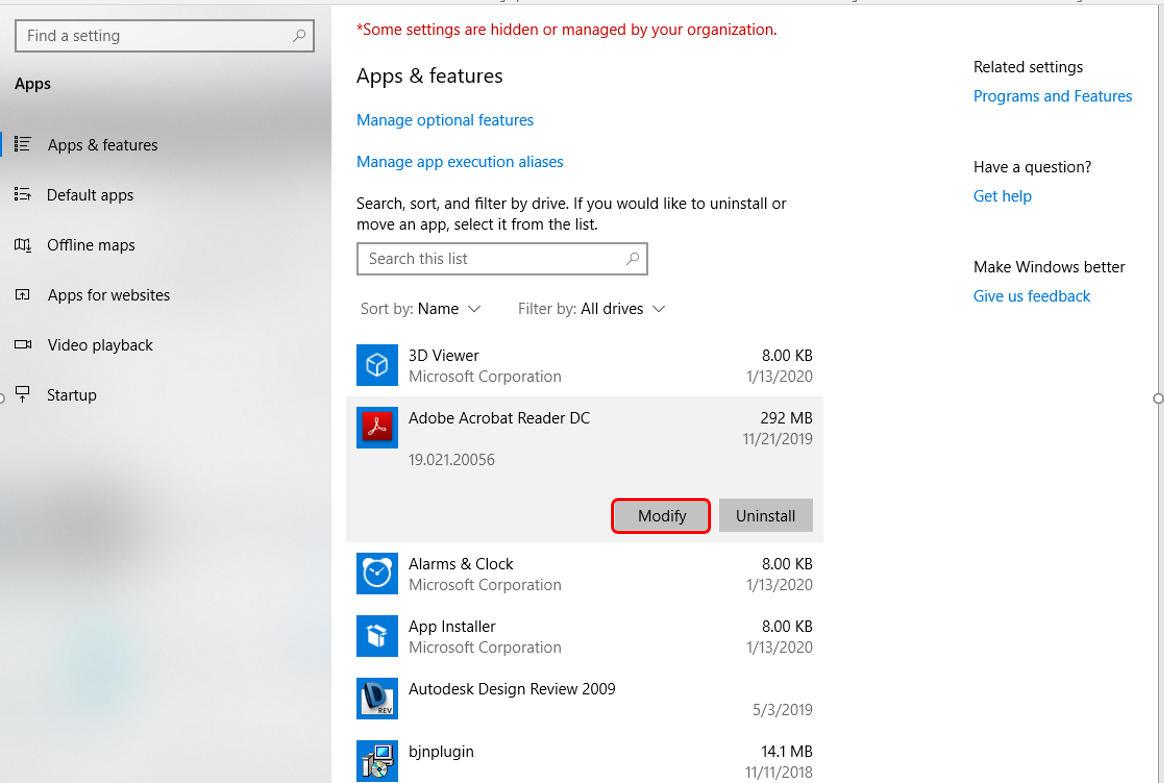

- Close Acrobat/Reader and all open web browser windows.

- Select the Start button at the bottom left of your screen.

- Type Control Panel, then press Enter.

- Select Programs and Features.

- Select Acrobat or Adobe Reader, then click Uninstall/Change or Modify.

- In the Setup dialog box, select Next.

- Select Repair, then Next. Select Install.

- When the process is complete, select Finish.

- Restart your computer and log back into QuickBooks Online, then do a print test.

You can visit this write-up to know more about the new 1099-NEC form as well as a link on how to file them in QuickBooks: Understanding payment categories for the 1099-MISC and 1099-NEC.

If you have additional questions about 1099-NEC or need help with printing other forms in QuickBooks, please let me know. I'll be here to lend a hand. Have a good one.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Printing 1099-NEC; QB Online version is printing the SS# in EIN format in the PAYER"S TIN box.

Thank You Rose-A.

I did the repair to Adobe and restart, that didn't fix the issue.

I also went incognito and logged in, that did change anything either.

I also went to the account settings and reinput the Company name and SS# and restarted, and the SS# still comes in on the 1099-NEC's as an EIN number. I'm at a loss.

Luckly, it's only two recipients, I can hand write the 1099's and use the printed 1096 to the IRS. The only thing is I'll have to hand write the Copy A... and that might look strange to the IRS. Any other suggestions?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Printing 1099-NEC; QB Online version is printing the SS# in EIN format in the PAYER"S TIN box.

Rose-A,

Another thing I've tried is, logging in from another browser, no luck.

But, I have noticed, when I click on the 1096-NEC form to print, it shows the full SS# and automatically defaults to the option of EIN, I change it to SS# and it prints the SS# correctly (two dashes) on the 1096-NEC.

There is no option to choose when printing the 1099-NEC. It makes me wonder if that is defaulting to the EIN format with the new EIN (somehow only on my computer... lol).

I'm going to try on another computer... for kicks.