Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHello, I am obviously no accountant and have very basic skill level in QB Premiere Non Profit 2017. Following a tutorial on YouTube, we receive donations each Sunday on a Sales Receipt. I just received a check returned for NSF. The check was canceled and a new check written to cover both the original amount and the bak charges. How do I process this properly so that the bank statement will reconcile? All answers that I have read on the site deal with Invoices and we do not use them. Thank You!

Solved! Go to Solution.

Hello there, @pastorwinters.

Thank you for choosing QuickBooks as your accounting partner, and I appreciate your efforts in resolving your concern.

I can help you process the NSF check received on a sales receipt. You can create a Journal Entry to record the transaction and NSF fee:

I also advise reaching out to your accountant who can tell you which process would be better for your specific books. After recording the transaction, you can reconcile your account.

Keep me posted if you have follow up questions. I'm still here to help you out. Have a good one!

Hello there, @pastorwinters.

Thank you for choosing QuickBooks as your accounting partner, and I appreciate your efforts in resolving your concern.

I can help you process the NSF check received on a sales receipt. You can create a Journal Entry to record the transaction and NSF fee:

I also advise reaching out to your accountant who can tell you which process would be better for your specific books. After recording the transaction, you can reconcile your account.

Keep me posted if you have follow up questions. I'm still here to help you out. Have a good one!

Thank you so much for this...

It's always my pleasure to help, @pastorwinters.

You are welcome to post back in the Community if you have other concerns. Wishing you and your business continued success!

Please note there is Never a JE for this, because you avoid JE for Names. and you just bypassed the reporting for the Customer, and if that is Donation, a JE does not provide for using Items.

The Banking is addressed like this:

You use Banking Menu > Write Check. You don't need a payee and this is not a real check. List here the Item, such as your Tithing or Donation Item. This is the Offset for the amount that bounced; put NSF in Check #. Now this entry and the Deposit clear against each other to the total Actually deposited, or this matches the Bounded amount the bank took out separately and later. So, the Check Entry is the Financial Placeholder that is the opposite of the original Donated amount and removes the banking, meeting your Two Requirements.

Then, the replacement check is a New donation. The fee is a Fee Income for you, so you need Two Items on the Sales Receipt for that replacement payment.

And in your accounting, for Donation, you see, for example:

$100 in

My $50 Bounce

My $50 replacement

= $100 still, is all that happened for Donation.

How do I charge the "customer" the bank fee and our charges for the NSF check?

How do I charge the customer for the bank's NSF check charge and our NSF check c harge?

Hi, MDTerp66.

You'll need to create an item and income account to track bank's NSF check charge. Afterwards, create a Bad Check Charge item and set the Account Type to Other Charge.

Once done, create a journal entry to reverse the original payment. Here's how:

Now, convert the payment for the invoice to the reversing journal entry. The amount of the NSF charge will reduce your bank account. Here's how:

Please let me know how these steps work. I'll be right here if you have follow-up questions.

Thank you for the QuickBooks answer. Unfortunately, if I use a general journal entry, I lose the ability to tie the transaction back to the customer. I don't think that is a good answer.

Hello MDTerp66,

I appreciate you for getting back to us through this thread. Allow me to chime in and help you record the NSF charges to your customer in QuickBooks Desktop.

Right now, you have two options for recording the bounced check coming from your customers in the QuickBooks system. You can either use the Record Bounced Check feature or manually record them through a Journal Entry, then resend the open invoice again.

For the detailed instructions, I suggest visiting the article I recommend on this:

Handle Non-Sufficient Funds (NSF) or bounced check from customers.

If you're still looking for different ways to tie the transactions to the customer, I recommend seeking expert advice from an accountant. By doing so, you'll be able to record the fees correctly into QuickBooks.

Let me know if you need further recording the NSF fees. I'm always up to lend a hand.

I appreciate your response, but I am not using Online, I am using Desktop. As I stated, the check was recorded through the Sales Receipt method, so there is no bounced check method that there is if I invoice and receive payments.

The steps and article given by my colleague is for the Desktop version, MDTerp66.

You've mentioned above that you want your customers to pay the NSF and bank charges. For this, I suggest reaching out to an accountant. They can also help you handle the rejected payment depending on your business preference.

For the rejected payment of your customer's Sales Receipt, we can delete it and then record an Invoice. That said, your customer will have a pending payable. Once it's already paid you can record a customer payment.

Keep me posted if there's anything else that I can help you with.

Please direct me to the instructions for handling an NSF customer payment using QuickBooks ONLINE. Thank you.

Thanks for joining this thread, @Anonymous.

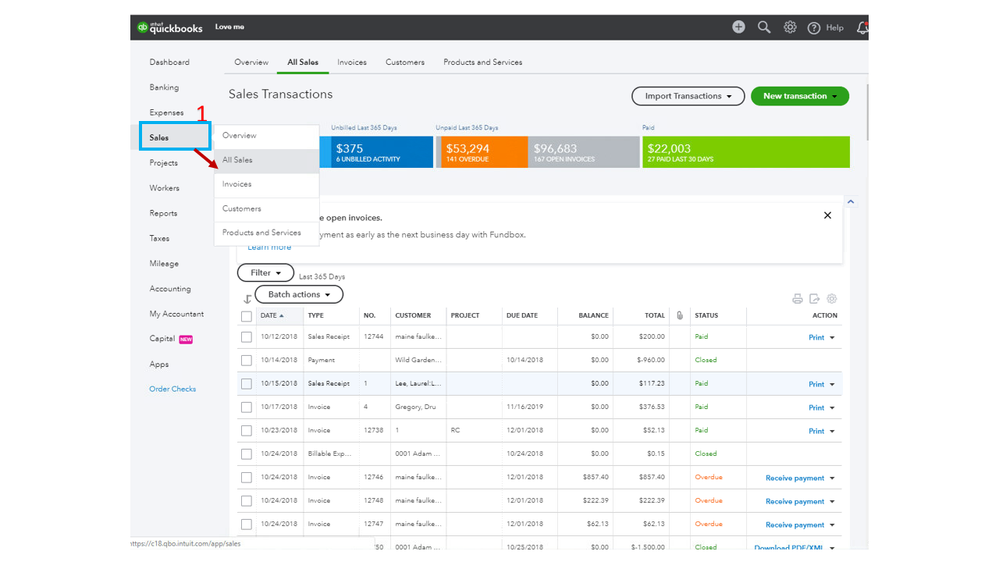

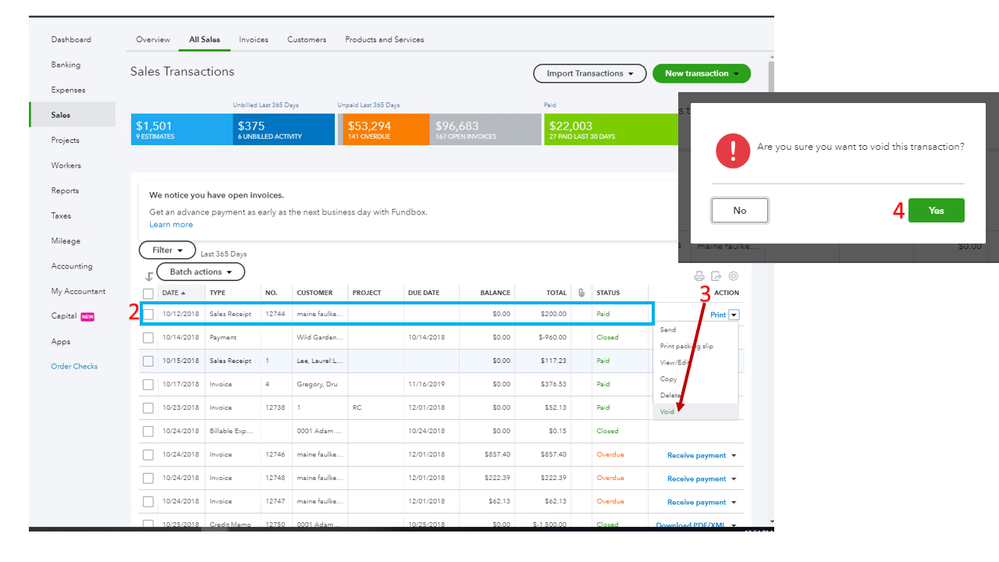

In QBO, you can either void the sales receipt or create an expense and then use the same item entered on the transaction. Let's go open the entry to remove it, follow the steps below.

Here's how to record the transaction:

If the entry is processed in your Merchant Account, I suggest contacting our support team. They have to check the items used for the transaction and make sure the non-sufficient sales receipt is properly recorded.

Let me know if you have any other questions or concerns. I’ll be right here and make sure you’re taken care of. Enjoy the rest of the day.

Thank you very much for the help. I ended up using the "Record a bounced check using an invoice" method described in the online help system. Enjoy your weekend.

Your method makes the most sense to me for processing a bounced check that was received via Donation/Sales Receipt by writing an NSF check in the register.

However, the missing piece in the puzzle for me is that if I go to Reports>Nonprofit>Donor Contribution Summary - the customer's report shows that he has given/donated both the bounced check amount and the makeup check amount. So he bounced a check for $2500. I wrote an NSF check for $2500. This makes my register look fine and reconciliation takes place as it should, but the reporting is wrong. I have spent hours and hours on this, trying different methods, including invoice/pmt, JE, Reversing JE ---all to no avail.

I cannot tell you how much I would appreciate your help.

Hello, rloew2004.

I'm here to help you open reports on QuickBooks Desktop.

Since the register is working fine, you can open those transactions by customizing a report. Ensure to select the correct date and amount to view it.

Here's how:

Here's an article that will guide you in personalizing and adding the information that matters the most to your business in your reports: Customize company and financial reports.

Additionally, I've added this article that'll help you transfer data on a worksheet: Export reports as Excel workbooks in QuickBooks Desktop.

You can find me here if you have any other concerns or questions about how reports work in QuickBooks Online. Assistance is just a comment away.

There 5 NSF charges on statement and 5 NSF credits to account just wash it out. Do I need to put the charges and credits of the NSF fees. If I do, how do I post them to show both debt and credits.

Good afternoon, @Virgie0730.

Thanks for reaching out on this thread. I can share some additional information.

We have a guide that can help answer questions and show you how to post NSF. Here it is:

Desktop payroll NSF bank returns

I hope this helps. Feel free to ask any other questions if you have any more. I'm only a post away. Wishing you and your business continued success!

I figured out how to process a NSF returned check for non-profits on QBO when dealing with donors. I entered the NSF charge as a "Refund" to the donor from the bank account charged. I used the "this will show up on statements" area of the refund to input the details of the NSF charge. Then I simply recorded a separate expense for the fee charged. This made the bank good and the donor statements reflect accurately.

That sales receipt would have to be deleted from the bank deposit prior to making the invoice, correct?

It's great to have you join here in this thread, @CSM-T. Let me share information about processing non-sufficient funds checks received on a sales receipt in QuickBooks Desktop (QBDT).

Yes, you're right. For the declined payment of your customer's sales receipt, you can delete it and create an invoice. Doing so will cause your client to have an outstanding payable. Once paid, record it in QBDT.

Here's how:

Moreover, design unique templates for your sales forms, like invoices and sales receipts, so you may decide how they'll look and what details to include when delivering them to your clients.

Stay in touch whenever you have additional questions concerning sales receipts in QBDT. I'm always a few clicks away from answering your queries. Be safe and have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.