Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI would like to seek advice on how to adjust stock qty and value:

I made a mistake when creating Purchase Order and receiving the Order (bill paid and inventory qty / value updated) : I input the purchase qty to a wrong Product and would like to adjust.

Basically the total qty and total value of inventory is correct, I only need to re-match the qty & value to the correct products.

Both products have zero qty before this PO, what is the best way to handle?

I tried to use "inventory qty adjustment" but since I could not enter value, therefore not sure how to proceed.

Can I just update the qty and value in the Product Sheet?

Thanks for the advice.

Regards,

SY Chan

Solved! Go to Solution.

Hi SY Chan,

Thank you for the additional details. Let me continue to help you out.

As for the quantity correction, you can follow the steps for adjusting the quantity. However, for the price correction, you'll want to do it on the receipt transaction itself. Actually, it would be better if you can correct both the quantity and the price of the items on the Item Receipt transaction. That way, you'll have a correct Cost of Goods Sold value when you sell these items.

Let me know if you have more questions about your transactions.

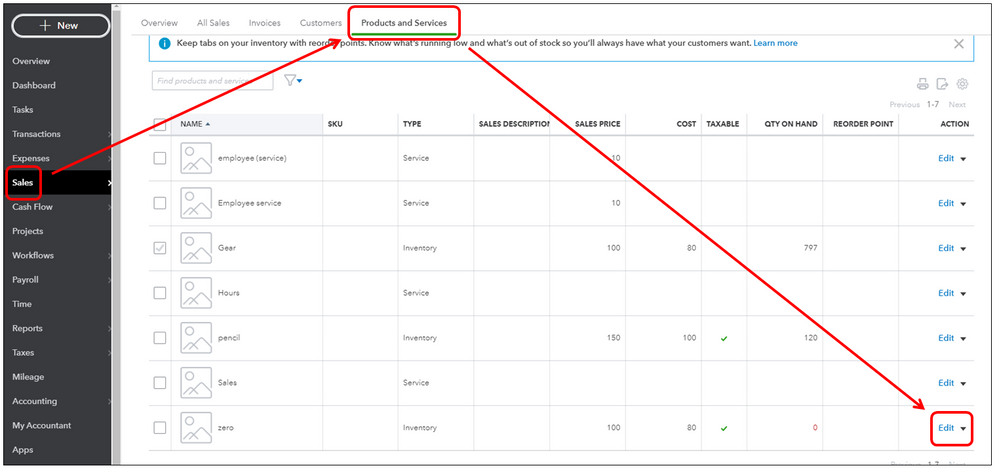

Yes, you can update the quantity and value of the product in the Product/Service information window, @sychan.

Let me show you how:

In addition, you can run the Physical Inventory Worksheet report in QuickBooks. This will show you the list of inventory items, with space to enter your physical count so you can compare to the quantity on hand in QBO. Just go to Reports and open the Physical Inventory Worksheet report.

Please know that our doors are always open to help you with any QuickBooks-related concern. Take care, and enjoy the day!

Thanks @ReymondO

My issue is mixing up the Inventory Receipt of 2 Products, I need to adjust both qty and inventory value. May I recap my problem:

I should have ordered:

Product A x 10 pcs x $2 each

Product B x 20 pcs x $2 each

However I made a mistake of creating PO and receipt as follows:

Product A x 30 pcs x $2 each = total $60 value

Product B x 0 Pce

Now I need to deduct 20 pcs (value $40) Product A and increase 20 Pcs of Product B.

What can I do?

Thanks for your advice.

Best regards,

SY Chan

Hi SY Chan,

Thank you for the additional details. Let me continue to help you out.

As for the quantity correction, you can follow the steps for adjusting the quantity. However, for the price correction, you'll want to do it on the receipt transaction itself. Actually, it would be better if you can correct both the quantity and the price of the items on the Item Receipt transaction. That way, you'll have a correct Cost of Goods Sold value when you sell these items.

Let me know if you have more questions about your transactions.

Thank you @JessT

I will revise the Paid Bill (Goods Receipt) as per your suggestion. Would like to verify the following point before I proceed:

- We sold some other items on this PO after receipt, if we revise the Bill now, will the current stock on hand be updated to precious receipt qty?

Thank you for your advice.

Regards,

SY Chan

Thanks for getting back to us, SY Chan.

Once you revise the Bill, you'll have to manually adjust as well the previous quantity on hand of the previous receipt.

Once done, you'll have to adjust the quantity on hand recorded on the system. This way, you'll have the correct tracking of the items on your QuickBooks Online account.

You can take a look at this article as a guide when adjusting the quantity: Adjust Inventory Quantity On Hand in QuickBooks Online.

Feel free to get back to this thread if there's anything that I can help with. Keep safe.

thank you Adrian.

Your always welcome, SY Chan.

Don't hesitate to mention my name if there's anything that I can help you with. We are here 24/7 to help resolve any issues you have.

Have a great day ahead!

After the inventory QTY adjustment entry is saved, why there are two line items created in inventory GL transaction details; one with $ amount, and one with zero amount? Is there a way to delete the line item with zero amount? Thank you.

Eva

Hi Eva,

Welcome and thank you for joining the thread.

The lines with zero values are for adjusting inventory items that originally have no qty. We're unable to remove them from the ledger from the transaction journal.

If you have other questions, please don't hesitate to go back to this thread. Have a good one!

hi,your reply is very useful to me.but I still have a question. if I follow the steps to drcrease my stock, does it impact my balance sheet and income statement? some of my stocks are missing not knowin why.

hi,your reply is very useful to me.but I still have a question. some of my stocks are missing not knowin why.

i find that there are some items to choose in the "inventory adjustment account" ,including "change in inventory", "cost of sales", "inventory shrinage", Other", etc. which one should I choose? "inventory shrinage"?is there any other field or memos to record the real reasons?

if I choose "inventory shrinage", how does it affect my balance sheet and income statement?

It looks like this is a duplicate post, @golden2010.

My colleague GlinetteC already shared her answer to your concern regarding inventory adjustment. You can check her response through this link: https://quickbooks.intuit.com/learn-support/en-us/other-questions/re-stock-adjustment-qty/01/1068046....

The QuickBooks Community team is always here to help if you have any other concerns or follow-up questions. Have a good one, @golden2010.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here