Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe want to use Journal Entries to label bank transfers that occur between our multiple Quickbooks Online accounts.

EX: $1,000 transferred from Business Checking Account A to Business Checking Account B.

To clarify these are real separate bank accounts that are sister companies to each other. We often do transfers between the multiple checking and savings accounts.

Welcome, @SE_Accounting47.

It's always great to have someone new in the Community. I can provide you with some information about creating a journal entry for a bank transfer.

You can create a Journal Entry within two Chart of Accounts inside of one QuickBooks, but you're not able to within two QuickBooks companies. Your accountant will know the best way to make journal entries or bank transfers for your unique business. If you currently don't have an accountant, I suggest looking into our QuickBooks Live opportunity.

This is a link that can give you some information on Journal Entries.

Please know I’m only a post away if you need me.

I use journal entries for moving expenses and income between subaccounts of savings and from checking to and from savings depending on the transactions during any given month after I reconcile the bank accounts. I determine the aggregate amount to make the actual transfers at the bank. I cannot seem to add the journal entry as a matched transaction to the transfer to reconcile it. How should I handle this?

Hi there, @office1011.

Let me help you add the journal entry, so you can match the transfer and reconcile it.

Before proceeding, here are a few reasons the match may not have been recognized:

You may want to double-check again the date, amount, category, and check numbers of the entries are aligned. This is to make sure those checks will match.

Once checked, you can now match the transactions again. Let me show you how:

For more in-depth information about finding a match in QuickBooks, refer to these articles:

However, if you have multiple bank feed transactions but a single journal entry, then you'll want to skip the matching part. Instead, exclude those transactions and manually clear the journal entries in the register.

To exclude the transactions:

Do all the steps until all of the transactions and records are accounted for in all bank accounts.

Once everything is recorded, you can now reconcile the transactions. Check out this guide on how to do it in QuickBooks Online:

Also, browse our articles if you need help navigating around the program or if you're simply looking for a guide: QuickBooks Online general support page.

Please get in touch with me if you have further questions. I’m always available for all of your QuickBooks needs. Cheers to a safe and productive day!

What is the process if the accounts are already reconciled?

Does it make sense to instead post each line item as a transfer instead of a journal entry?

I have a few information to share with you, @office1011.

Any related to journal entries, we would recommend consulting an accountant for depth information. This is to make sure books are accurate.

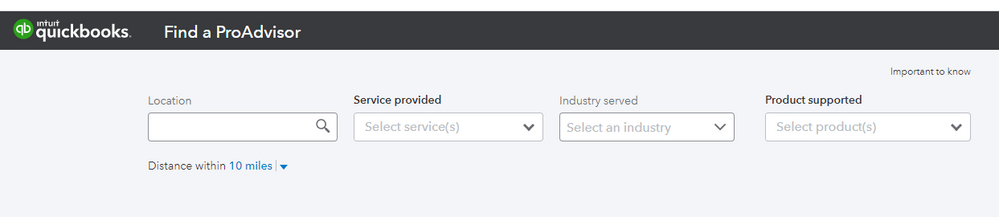

If you don't have an accountant, I can guide you in finding one. Just follow the outlined instructions below:

If you need tips and resources to manage your QuickBooks Online account and your finances, feel free to visit our Support page. This gives you information to handle your business efficiently and improve your navigational experience.

Get back in this thread if there's anything you need assistance with. We’re more than happy to help. Have a good day!

In order to accommodate transfers between my various companies I set up contra accounts to allow reconciliation, i.e. in the Farm Company books:

Date Account Memo Debit Credit

07/15/2023 Checking Record transfer in from Properties Company 1000.00 0.00

07/15/2023 External Record transfer out of Properties Company 0.00 1000.00

Then in the Properties Company books:

07/15/2023 Checking Record transfer out to Farm Company 0.00 1000.00

07/15/2023 External Record transfer in to Farm Company 1000.00 0.00

"Checking" is, of course, an Asset account. What type of account is "External"? If I classify it as an Asset, the balance sheet is incorrect for both companies. It's not income, expense, liability or equity. How do you recommend handling this?

Thank you

After digging out my old accounting textbooks, possible journal entries to transfer $1000 from Company A to Company B could be:

Company A buying something from B

Company B books Debit Credit

Company B checking $1000 0.00

Company B Income 0.0 $1000

Company A books Debit Credit

Company A checking 0.0 $1000

Company A Expense, Inventory, or Capital Asset

$1000 0.0

Loan from A to B

Company B books Debit Credit

Company B checking $1000 0.00

Company B Liability 0.0 $1000

Company A books Debit Credit

Company A checking 0.0 $1000

Company A Notes Held Asset $1000 0.0

Equity Transfer

Company B books Debit Credit

Company B checking $1000 0.0

Company B Contributed capital 0.0 $1000 (an Equity account)

Company A books Debit Credit

Company A checking 0.0 $1000

Company A Equity Draw $1000 0.0

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here