Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

My boss asked me to set up a separate company to pay commissions to one sales person who is a 1099 vendor. He wanted me to only pay 75% of what is due to that sales person and hold 25% to pay their taxes at the end of the year. I need to show 100% of what was earned on their 1099 though. Can anyone tell me how to do this?

I'll help you record the prepayments for your 1099 vendor, @JanetMM.

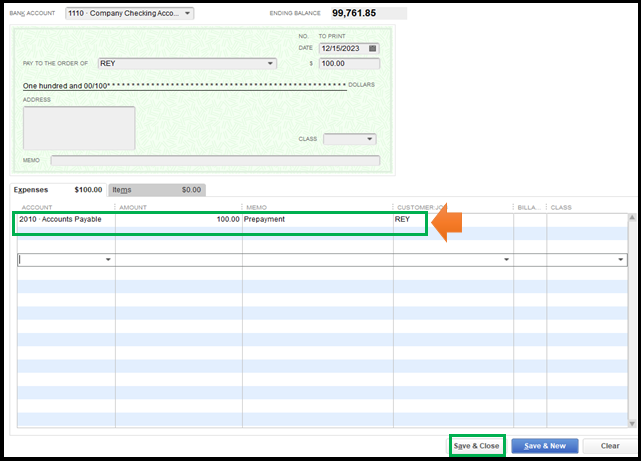

You've got two options on how to record vendor prepayments in QuickBooks Desktop (QBDT). First, you can write a check and record it to your Accounts Payable (A/P) account. This will decrease the balance until you're ready to create the final bill.

To create a check:

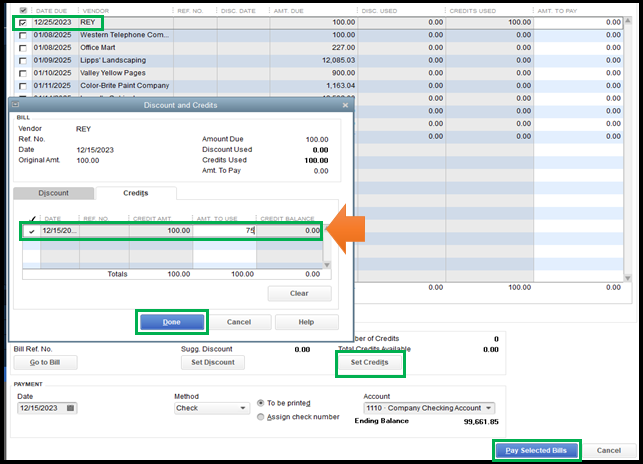

After that, you can now enter a bill as you usually do. Please make sure to select your 1099 vendor. When you're ready, it's time to apply the prepayment to a bill.

Here's how:

Second, you can use the asset account to track the prepayments. Please refer to Option 2 in this link for more details: Record vendor prepayments in QBDT.

To review your vendor's prepayments, you can run the Vendor Balance Detail report under the Vendors & Payables section. Then, customize it to get the information you need.

Also, you'll want to memorize the said report to save a copy on hand.

Count me in if you need more tips about handling your vendors in QuickBooks. I'm here to extend a helping hand anytime.

Thank you. I'll give this a try. It sounds kind of confusing but hopefully as I go to do this, it'll make more sense.

John,

If my boss wants us to pay the taxing authorities directly (I believe that is what he is leaning toward). How would I record it then and still have the full 100% show as payments to the employee as that is what they'd be taxed on?

Thanks,

Jan

You're welcome, Jan!

I can share more tips on how to handle your vendor prepayments.

You can pay the remaining 25% bill amount using the same steps above. Just indicate in the Memo field that it's intended for the vendor's taxes.

This task can be tricky. Thus, I suggest consulting your accountant for further guidance. If you don't have one, we can help you find an expert through our Find-an-Accountant tool.

To keep track of your vendor's prepayments, you can pull up the Vendor Balance Detail report. Then, customize it to get the information you need. Just go to the Reports menu, and then select it from the Vendors & Payables section.

Fill me in if you have more questions regarding vendor prepayments. I'd be glad to help you always. Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here