Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

We have a tenant who bounced a check. Every discussion I find on here will not work for our situation because our accountant who set this up when we started using QuickBooks Enterprise, had me enter tenant payments under "Sales Receipts."

I can create a journal entry as required for accounts receivable and the bank but it leaves it hanging out there on the AR detail report.

I don't know how to clear this out and add the bank charge.

Help?

I can help you handle the bounced check in QuickBooks Desktop, @SheilaB965.

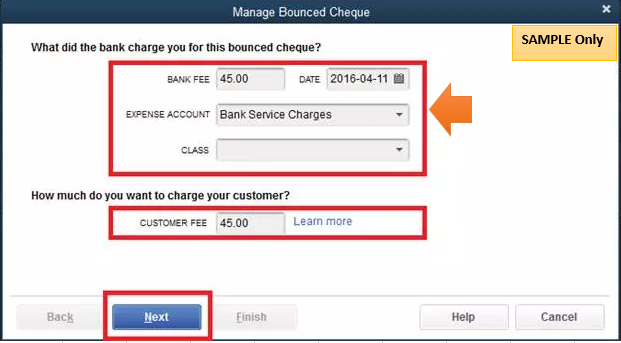

You've got two ways on how to record your bounced check for tenant payments made through sales receipts. You can either use the Record Bounced Check feature or perform the manual process.

For the Record Bounced Check feature:

If the payment method is grayed out or you’re unable to follow the steps, please proceed to Option 2 in this article: Handle bounced checks or Non-Sufficient Funds (NSF) from customers.

To keep track of this payment or bounced check, you can run the Customer Balance Detail report. To achieve this, click the Reports menu, and then select it from the Customers & Receivables section.

You can lean on me if you need more tips about managing transactions in QuickBooks. I'd be glad to help you some more. Take care!

Thank you! I did end up chatting with support. Had to totally re-do the way we were entering checks on those tenants in order to do the bounced check feature but did employ that once we fixed those transactions.

Thanks so much for responding!!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here