Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHow do I combine payroll liabilities to the same vendor on a single payment ?

Solved! Go to Solution.

It’s great to see in the Community, Mend1995.

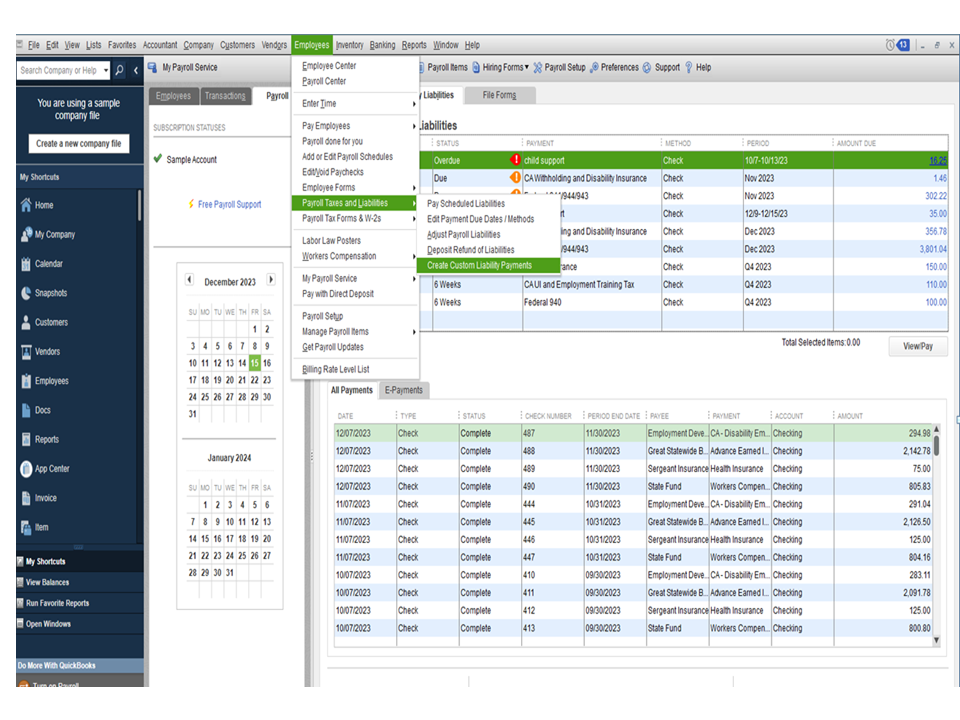

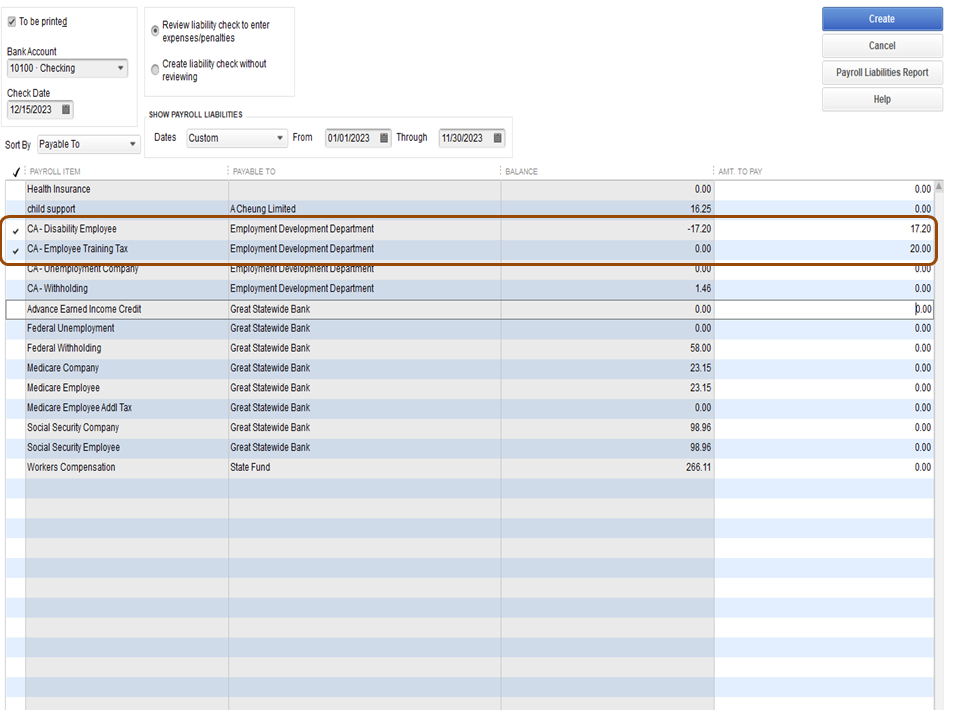

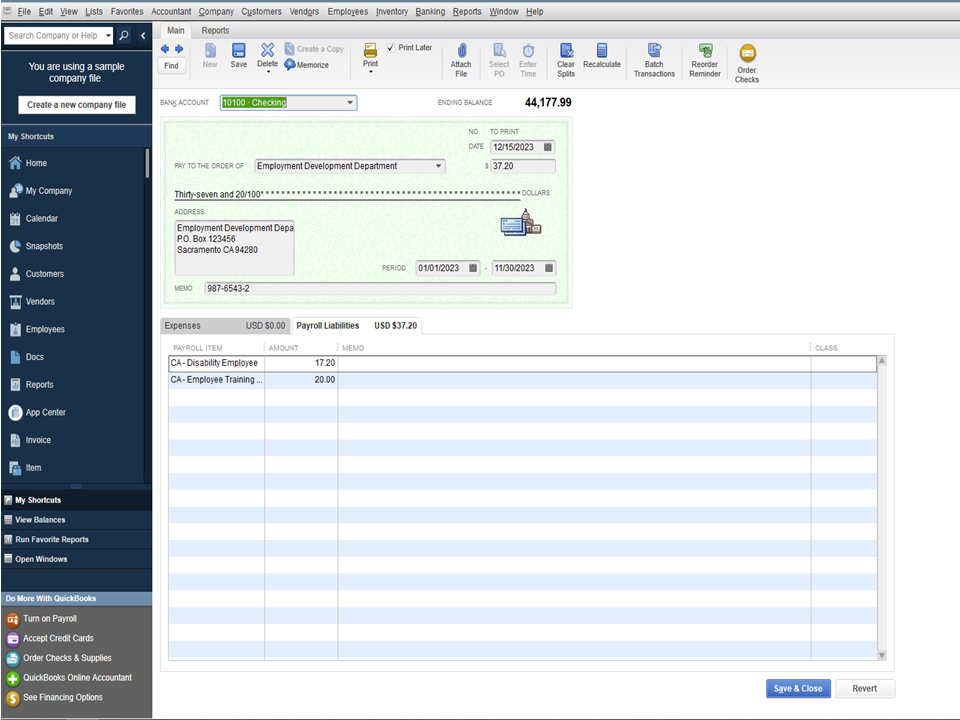

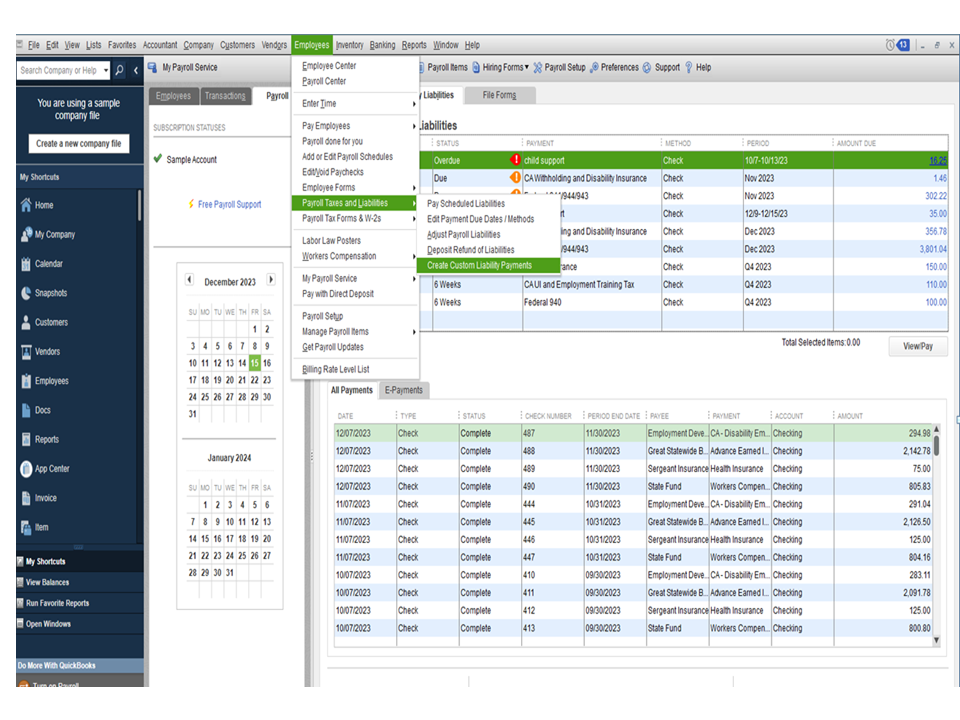

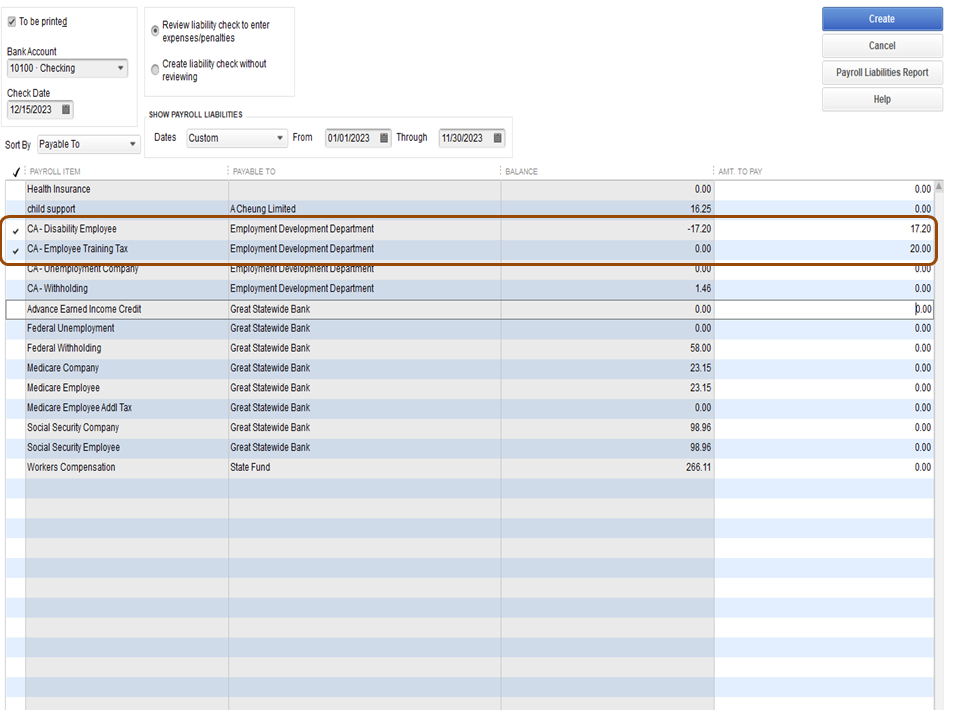

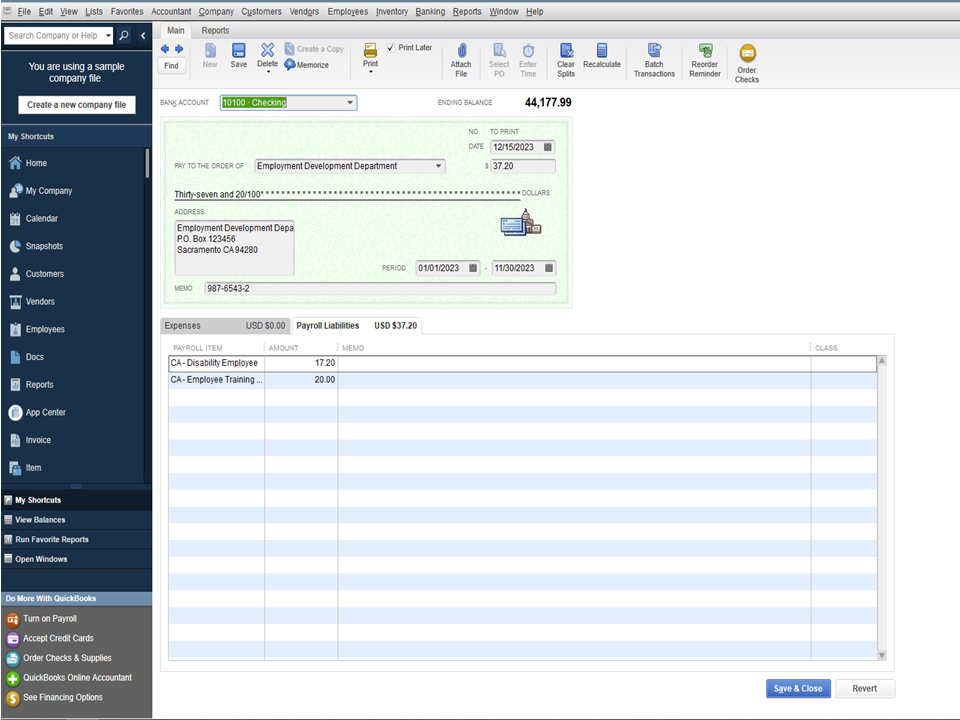

The Create Custom Payments feature allows you to combine payroll liabilities on a single payment. With just a few steps, you can accomplish this task in your company file.

Here’s how:

For more information, the following guide provides an overview of how to set up an unscheduled or custom liability check: Set up and pay scheduled or custom (unscheduled) liabilities.

Let me know if you need further assistance while working in QuickBooks. I’m more than happy to help you. Have a great weekend.

It’s great to see in the Community, Mend1995.

The Create Custom Payments feature allows you to combine payroll liabilities on a single payment. With just a few steps, you can accomplish this task in your company file.

Here’s how:

For more information, the following guide provides an overview of how to set up an unscheduled or custom liability check: Set up and pay scheduled or custom (unscheduled) liabilities.

Let me know if you need further assistance while working in QuickBooks. I’m more than happy to help you. Have a great weekend.

How do you do this on Quickbooks online?

Thanks for getting involved with this thread, retail1971.

You can combine liabilities for a payment to a vendor while creating liability checks.

Here's how:

I've also included a detailed resource about working with payroll liabilities which may come in handy moving forward: Create a payroll liability check

If there's any additional questions, I'm just a post away. Have a lovely day!

Is there a way to combine these from the payroll liability tab? I have the payroll items set up to pull the amounts in correctly and they are all paid to the same payee but from different payroll liability subaccounts. I would like to make all of my payroll liability payments from the same screen and not have to make custom payments. Quickbooks combines payables that way. There should also be a way to do this from the payroll liability screen.

Our goal is to consistently find ways to enhance your QuickBooks experience and make it more convenient for you, M-D-R.

I understand the benefits of consolidating payments to the same payee from different accounts on the payroll liabilities tab for your business. However, this functionality is unavailable within the software.

We know that this limitation may cause inconvenience for you. I encourage submitting a feature request for this option directly to our development team. They actively consider customer suggestions when planning future updates and enhancements to QuickBooks.

Here's how:

Your input will help us prioritize and implement features that align with our users' needs. You can visit our website to vote on future ideas. To access the page, click the link: Customer Feedback for QuickBooks.

In addition, you can use the payroll reporting capabilities within QuickBooks. These reports enable you to manage payroll taxes and conveniently monitor employee expenditures.

If you have any additional inquiries regarding payroll liabilities or related matters, feel free to add them in the comment section. I'm available to help you.

Replying to ZackE Moderator. You provided an inaccurate reply. Please do not reply if you really do not know what you are talking about. You should not post payroll liability payments using regular Checks as you described. It must be done from the Payroll Liabilities screen to do it properly. The correct answer is to create a custom liability payment if it is not combining in the Payroll Liabilities screen.

Lorien Prince CPA CGMA

Advanced Certified Quickbooks ProAdvisor

In QBDT, this is the correct answer, thank you!

Lorien Prince CPA CGMA

Advanced Certified QuickBooks ProAdvisor

So does anyone have an idea as to why QBDT would suddenly stop combining liability payments to the same vendor? Our 401k plan has 5 payroll items that, up until now, would combine to one payment/check when using the pay liabilities function. Now for some reason it wants to do only 1 payroll item at a time regardless of the fact that all go to the same vendor. Again, for years it has always combined liabilities per vendor to one payment. I've checked preferences and payroll setup but cannot find any setup that might affect this process. Curious to see how QB support explains this one.

Let me share some insights on why your liability payments stop combining in QuickBooks Desktop, @IPTacctg.

One of the reasons why this thing has happened is because your 401k has five payroll items. While all these items are from the same vendor, they represent different liabilities. As a result, it is necessary for you to add each payroll item to your account manually. Doing so ensures that each liability is accounted for correctly and your 401k account remains accurate and up-to-date.

Moreover, it may be possible that you're able to combine liabilities per vendor into one because you're using the Create Custome Payment functionality in QBDT. As my colleague mentioned, you can also use these features to merge these liabilities. Here are the steps you can follow:

If you want to know more about report information about your payroll items assigned to liability, you can check this article: Fix a discrepancy on Payroll Liability Balances report in QuickBooks Desktop Payroll.

Please let us know if you have further concerns regarding combining your liability payments for the same vendor, don't hesitate to get back to us by replying to this thread.

It doesn't make sense why this has changed. It used to be as long as the two (or more) payroll items were to the same vendor and had the same memo, it would combine them from the pay liabilities option. No need to do custom option. Why did this change and how do we make it go back?

Hello there, @hanescpa.

Let me help and provide insight about the Pay Liabilities option in QuickBooks Desktop (QBDT).

Upon checking here on my end, It's possible to combine the payroll items for the same vendor and memo. To use this feature, ensure that the vendor, and account number of the item are the same.

To check if the account ID is the same, here's how:

You can't use this option if the liability has a different period. You can check it in the Pay Liabilities section.

In addition, to combine the liability payments, select each items, and then select click View/Pay.

For future reference, you can check this article to guide you on fixing a discrepancy or inaccurate information when you run a report: Fix a discrepancy on the Payroll Liability Balances report.

Please leave a reply if you have other concerns regarding payroll liability. The Community is always available to back you up.

Thank you for your reply. Any info on why that went away? Is there any place to request it be brought back?

I appreciate your quick reply, @hanescpa.

Allow me to join and clarify some information about the issue of combining liability payments in QuickBooks Desktop (QBDT).

Please know that my colleague updated his answer to clear things up. The option to combine payments didn't go away. You'll need to make sure that the setup of the two payroll items has the same vendor and number that identifies you to the agency. Also, once you're in the Pay liabilities section, check the Period and make sure they're the same.

Then, once you're ready to pay the liabilities, you'll need to put a checkmark on all the liabilities you want to combine.

I'm leaving you this article in case you want to run payroll reports to view information about your business and employees: Run payroll reports.

Tag me in the comment section if you have clarification or additional information about your concern. I'm always around to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here