Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy nowI know a way on how to handle this in QuickBooks Online, MRPERFORMANCE.

When a payment gets disputed, don't issue a credit to your customer’s card or any other type of refund. I'm here to show you the correct process.

Once a customer disputes a charge, the financial institution notifies QuickBooks Payments. Then, QuickBooks checks for the credits when receiving the disputed payment. I've listed below the cases where we can't match the payment to the credit:

You are given an option to respond if an amount is disputed. To learn how, please see this article: Handle Chargebacks and Retrieval Requests for QuickBooks Payments. Then, go to Step 2: How to respond and select Respond to a Chargeback. I also suggest browsing up to Step 4 to ensure everything is handled properly.

To avoid this in the future, I encourage checking out this article for the detailed steps: Prevent Future Chargebacks.

I'm only a post away if you need more help in managing the disputed amount. It's always my pleasure to help you out again.

Hi MRPERFORMANCE,

Hope you’re doing great. I wanted to see how everything is going about handling the disputed charges you had yesterday. Was it resolved? Do you need any additional help or clarification? If you do, just let me know. I’d be happy to help you at anytime.

Looking forward to your reply. Have a pleasant day ahead!

Hello I just want to talk to some one who can tell me what to do a costumer disputed and the bank return the money I don’t know what to do who to talk there is not option for this in quickbooks i try calling never got a answer just now the text from you. I want to know if I call the bank what I’m suppose to do just let the customer take the money ?

Thanks for following up with the Community, MRPERFORMANCE.

When chargebacks occur on your QuickBooks Payments account, you'll receive notification emails for each case. These communications contain detailed instructions on what to do.

If you need to challenge a customer's dispute, here's some of the documents you can send to Intuit for your rebuttal:

You can also review our article about handling chargebacks in CharleneMae_F's post to learn more about working with them.

In the event your customer's willing to, existing disputes can be cancelled by the cardholder working with their financial institution. If they inform you they've dropped the dispute, request a copy of their letter of retraction. This is provided by the cardholder's bank and will have their letterhead on it, along with an official statement confirming the dispute's been dropped/resolved in your favor. Make sure to send a copy of this letter to Intuit as part of your supporting documentation.

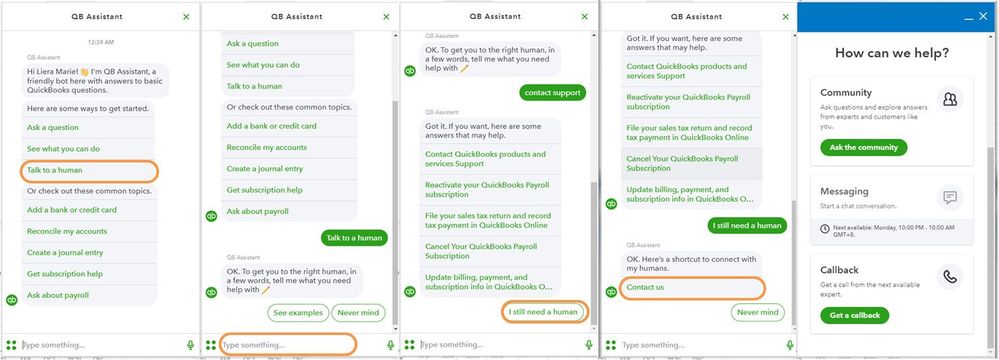

If you need to speak with our Customer Care team about your account, they can be contacted while you're signed in.

Here's how:

Be sure to review their support hours so you'll know when agents are available.

I've additionally included a couple useful resources about working with disputes that may come in handy moving forward:

Please feel welcome to send a reply if there's any questions. Have a wonderful day!

The customer physically came and picked up the goods and I charged his credit card. He lost his card and disputed the charges. I emailed him a receipt after he physically signed on my phone and I emailed it to him through the system and now I cannot find that signed receipt anywhere in my online dash. Quickbooks have the signed receipt and yet they want me to upload what I cant find, what do I do?

Hi there, @sales128. I want to make sure everything is taken care of.

Retaining signed receipts is very important for a business, as it allows them to respond to copy (retrieval) requests and chargebacks. May I know how you emailed the form to the customer? I'd recommend reaching out to our Customer Care Support team to assist your further.

Here's how:

To ensure we address your concern, our representatives are available from 6:00 AM to 6:00 PM on weekdays and 6:00 AM - 3:00 PM on Saturdays, PST. For more information, check out our support hours and types.

I'm also adding this article that talks about chargebacks and what to do to avoid them: Handle chargebacks and retrieval requests for QuickBooks Payments.

Please know that you're always welcome to post if you have any other concerns. Wishing you and your business continued success, @sales128.

I have reviewed the information in regard to chargebacks or disputes and it is indicated that an email is to be sent through QB's in regard to a payment retrieval or to respond to a chargeback. I never received a notice in regard to this. Now what?

I appreciate your patience. I'm here to make sure that proper action will be done with your chargeback, debbie2120.

Normally, once you have already disputed the charge to your bank or credit card company, and notified us with regards to this, you'll surely receive an email where it gives you a clear instruction on what to do next. Since, you haven't received one, I recommend reaching out to our support team so they can double check on the status. They also have the tools to pull up your account in a secure environment and what to do next. Here's how to reach them:

Furthermore, to make sure you'll be able determine if the email you're receiving is from us, check out this article for your guide. This contains different email address that we use to communicate with our customers: Official Email Communication From Intuit Payments.

Feel free to let me know if you need further assistance with chargebacks. The Community is always right here 24/7 to help you as always.

Hello: Please help. I got an email from QBooks Intuit stating one of our customers disputed a charged. I called the customer and he said the card had been compromised and gave me a new card for the monthly auto charge. When I went into my Qbooks to reverse that charge it wont accept the reversal because the customer cancel that credit card. Please make me clear this up. I followed the link on the email they sent and it did help.

Case# [Removed]

Merchant Acct [Removed]

Business name Cost Management Solutions

Address QBooks sent the email to: [email address removed]

Thank you

Cindy

Hello there, @cjjdelay.

I'll help share details about how you're able to reverse a charge taken out from a customer's card in QuickBooks Payments.

With QuickBooks Payments, the option to reverse a charge from a customer card must take place using the card it was taken out of. Use this article to read and learn more about how to reverse a charge: Void or Refund Transactions in QuickBooks Payments.

Additionally, I still recommend contacting our QuickBooks Payments Team. Even if you've already reached out to our Customer Care Support, I still recommend contacting them so that one of our specialists can discuss how you update the customer's card on file. Use this link for the contact information: Contact Payments Support.

Lastly, the following references below may also help you understand what are the common questions asked and the corresponding answers while processing other types of payments in QuickBooks:

I'm just a post away if you have any other questions about credit card payment processing in QuickBooks. I'll be around to help you out.

I am in the same situation than you, after the customer request their money back QB withdraw the money of my account and reimburse them, the job was done in the right and the perfect way ( we always take Pictures Before and After ) so i send all the require documents and proof of the job we have done , also a letter of explanation, at the beginning they told me it will take one week to be resolve , so i call back and they said they have received the documents and the customer's bank is the one is not responding and i have to wait one month, so i have been calling at least 6 times, every agent is telling me a different story, its been more than 2 months and i still waiting to see of someone call me or what's going on, the customer does not have any proof that the job was not done properly, but we do have many.

Now i am really worry and mad more than losing that money is what's gonna happen every time that a customer call to complain or ask for reimbustemt, QB will just give their money easily and not fight for me ??

even if they not have any way to win a dispute and i have a lot of proofs.

My question is :

Why do i have to stay with QB since they don't fight for me since i know i have the reason this time, why they are such a bad company that charges lots of FEES but they don't even care to call the customer bank and ask then what proof they have in order for them to don't reimburse my money ?

I don't know what else to do.

Can someone help me please !

Quickbooks is sorely mismanaged by morons. They are not protecting small businesses. They awarded charges to the customer on rendered services with signed authorization they agreed to pay yet cited that there was no authorization. They outsource their work to a bunch of morons.

We have worked the dispute out with our customer & would like to know who she needs to contact to resolve this matter

Thanks for joining the Community and getting involved with this thread, STEPH 72. I appreciate your detailed information.

If your customer's interested in dropping a dispute they previously initiated, they'll want to get in touch with their card issuer who issues them that card. The card issuer will be able to help guide their cardholder through the process.

In the event their dispute is dropped, the case will be closed in your favor, a letter will be provided by the card issuer confirming this (this letter will need to be delivered to Intuit for your chargeback case), and funds will at some point be sent back to Intuit since the cardholder has cancelled their dispute.

Even when a customer is informing you they're interested in dropping a chargeback, it's still recommended that you send a detailed rebuttal with relevant documents to support your side of the transaction. If sending a rebuttal response is an available option for the scenario, you'll see it mentioned in our emails to you about your customer's dispute.

I've also included a detailed resource about working with chargebacks which may come in handy moving forward: Handle chargebacks & retrieval requests

If there's any additional questions, I'm just a post away. Have a great Monday!

The total invoice for the customer is $2,526.20. Since the job was completed in full, Customer chose to split the payment—$1,200 via e-transfer and $1,326.20 by credit card, which he has now disputed.

It is not fair to the service provider to dispute payment after services have been rendered in good faith and as agreed.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here