Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThanks for getting back in here, @Andrew93.

Let me provide additional steps on how to delete customer payment in QuickBooks Desktop.

Here's how:

Also, to view the deposit payment for the invoice, you can follow these steps:

If you're still unable to delete the payment, I suggest contacting our support team. They have the tools to check your account in a safe environment. This way, they can also further assist you to delete customer payments.

You'll want to personalize email templates. Feel free to check out this article for more details: Create custom email templates in QuickBooks Desktop.

Let me know if you have other queries aside from deleting customer payments. I'll be happy to help you. Have a wonderful day.

Thank you for your help. I had to call the support center and they are still trying to resolve my issue as it seems like I have a program bug.

there is no transaction tab

there is no transaction tab

The Transactions tab is located in the upper-right hand corner of the Invoice, 222444.

It's possible that the tab is hidden. This can be the reason why you can't see it. To make it visible, click the Expand arrow or icon in the right-hand corner. You can also see this in the screenshot below.

Let me also share this link for additional reference when preparing your year-end tasks: QuickBooks Desktop Year End Prep and Resources.

The Community is always here if you need anything else.

I tried this already and it won't let me delete it.

Hi alisabuckland,

If the payment was already deposited to the bank register, you'll want to delete the deposit before you can delete the payment. However, if you've already done this, please contact our Support team to check your transactions further. They are available on weekdays from 6 AM to 6 PM PST.

If you have other questions in mind, you can always go back to this thread.

Help! I'm stuck.

I'm used to working with Banking, Write Checks. For refunds, we make a 'customer' out of vendor+refund (say ebayrefund) and in Write Checks, that 'customer' gets the refund line. Then we can do Customer, Enter Sales Receipts to convert the refund into a payment to be deposited, then deposit the payment in Banking, Make Deposits. Works great.

Recently, the owner switched to using a credit card from the vendor we buy the most parts from, and Write Checks for other stuff. When I had parts refunds - for example if you buy a battery, you get a core charge, which is refunded when you turn in your old battery-I did the same as I had been doing, and put 'xxxrefund' in the customer field to the right. I got my credit in the credit card register but also I got a cash deposit for the credit, because I accidentally filled in the customer field. the light finally dawned and I now know not to fill in that field.

I need to get rid of those cash deposits. I've tried what is in these suggestions. I can follow MaryJoyD's process and delete the payment from the undeposited funds, but when I go to the register under Banking, Make Deposits, it is still there. Help! I have about 30 of these to get rid of. I didn't notice my mistake until I'd done quite a lot of transactions wrong!

I replied a few minutes ago. I just confirmed that the payment I tried to delete is still in the Make Deposits window. And when I looked in the Undeposited Funds register, it has reappeared, although I deleted it earlier using the process in MaryJoyD's post July 7, 2020. Now what? I delete it from the undeposited funds register, and it isn't completely gone, because it's still in the list of payments to deposit, and then it comes back into the undeposited funds register. Help! PamP

Thanks for adding more details about your concern, pperrott.

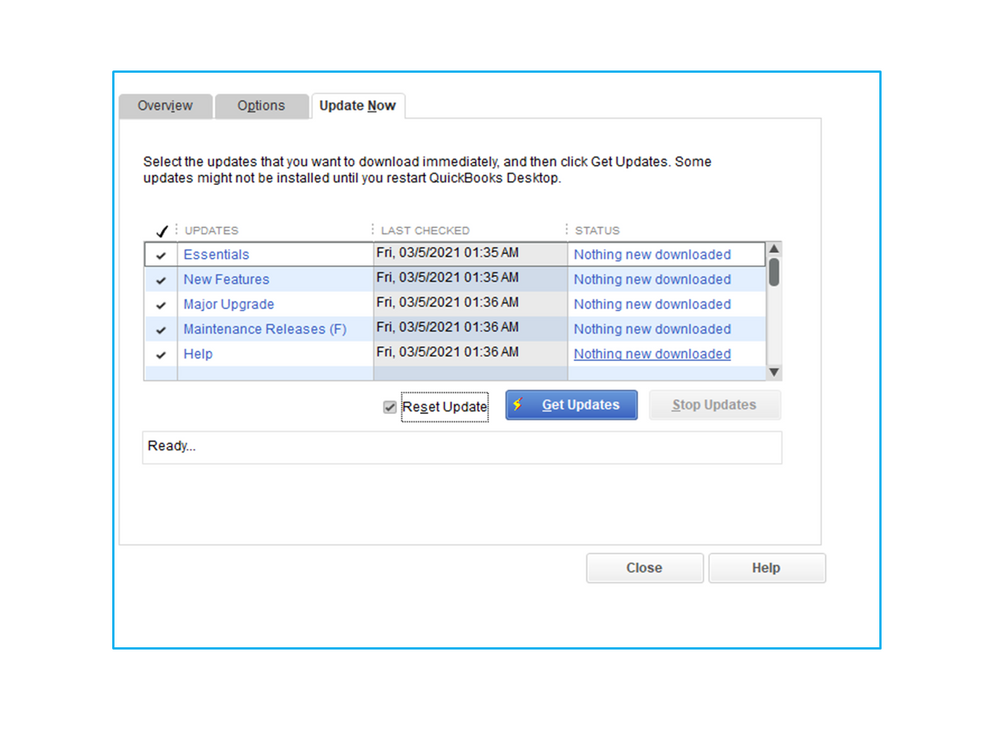

I appreciate you for letting us know the result of the steps you’ve performed. QuickBooks provides maintenance release and product updates to fix known issues, add features and enhancements. Downloading it can help resolve the issue you’re currently experiencing.

Here’s how:

In your company file, go to the Transactions List and look for the payments. Then, open each one and delete it.

Here’s a great resource to help with your future tasks. It contains resources that will guide you on how to perform any QuickBooks processes. Click on the topic to view the complete details of the article: QuickBooks Desktop.

Click the Reply button if you have other concerns or questions. I’ll jump right back in to answer them for you. Have a good one.

I've made a mistake and I need to clear all payments, how do I do that in one go.

Hello, Jin Suarez.

I have some details about clearing or deleting your invoice payments in QuickBooks.

QuickBooks Desktop can only let you delete those payments one at a time. We're unable to do it in batch at this time.

You'll want to open one of the invoice payment, then Delete it. To make it easier, you can use the arrow buttons to move to the next invoice payment after deleting the previous one.

Our developers might add a new option to batch delete invoice payments in the future. So I'd recommend sending feedback within the program:

Do you use the Accountant versions of QuickBooks Desktop? There's a tool where you can batch delete or void certain transactions. Check out this article if you want to learn more: Batch delete or void transactions in QuickBooks Desktop Accountant Edition.

If you're looking forward to connect your bank with QuickBooks Desktop, feel free to check this article for a guide: Get started with Bank Feeds for QuickBooks Desktop.

If you have other questions about your invoices and their payments, please let me know. I'm happy to share a thing or two again. Do you have any other concerns? Let's hear them out.

I am using desktop pro plus 2019 I have deleted deposit but then it goes right back to record deposit box. I am not able to adjust the payment amount. I have deleted it under chart of accounts, under check register I even have tried to delete just one line but it shoots it right back to record deposit. Please Help!!

I appreciate you joining in this thread, lsandersoio.

Updating the QuickBooks Desktop release version is a good start when it comes to fixing program-related issues, and make sure to create a backup copy of your company file. After that, you can follow the steps below to verify and rebuild your data.

To Verify Data:

To Rebuild Data:

Once done, go back to your check register and delete the deposit from there. To know more about how deposit works in QuickBooks, feel free to scan through this article: Record and make bank deposits in QuickBooks Desktop. On the same link, you'll find steps on how to record deposits into two separate bank accounts as well as setting up recurring deposit transactions.

Anytime you have questions about QuickBooks, you can post them here and I'd be happy to answer. Have a good one.

Your answer actually DELETES the existence that a deposit was ever made or money even received into the company?? For my purpose, I simply want to UNAPPLY payment(s) to an invoice, not eliminate the fact that a payment was received? Sometimes payments are received and should simply show as "credits" until which time an invoice can be generated to apply the payments......your method eliminates the deposit/credit completely - am I missing something?

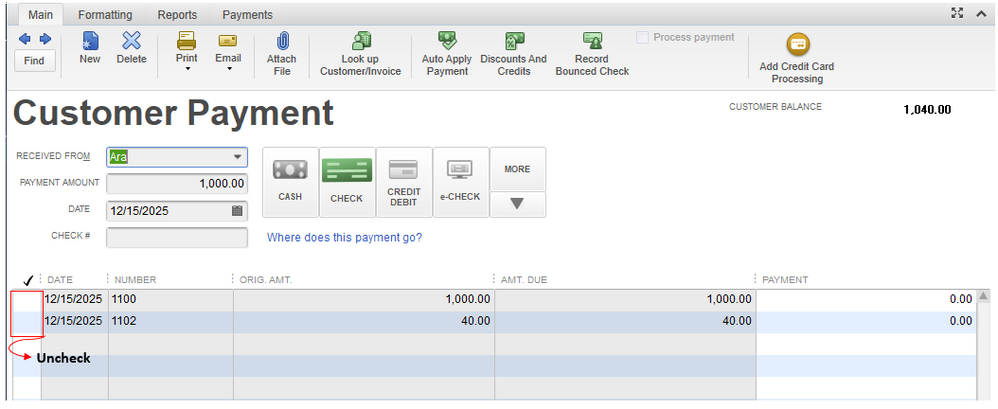

I've got some information for you about unapplying payments in QuickBooks, @Plinkr.

If you’re referring to jamespaul recommendation above, yes, all invoice payments you’ve recorded in QuickBooks Desktop will be deleted.

Here’s how:

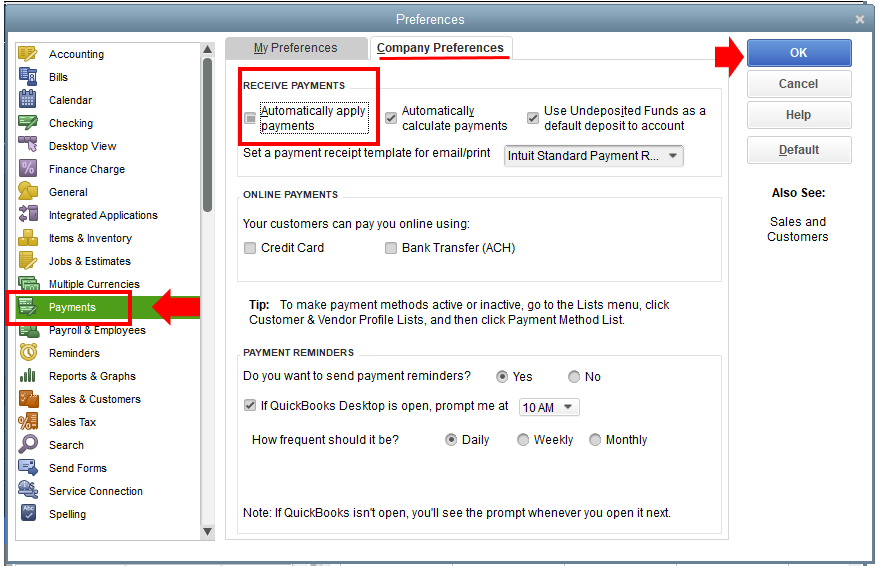

You can turn off the Automatic apply payments feature in the Preference so any credits won’t be directly allocated to the next invoice issued to the customers' account. I'm glad to show you the steps.

You might want to read this article that contains steps to remove the customer or vendor credit: Remove or unapply a credit from an invoice or bill.

I've also included this helpful reference to help manage your customer transactions: Learn the different ways you can track customer transactions in QuickBooks Desktop.

If you have any other questions or concerns besides unapplying payments, just let me know. I'll do my best to help you out. Take care!

HI Madelyn!

Thank you for responding - truly appreciate that! :) I consider myself pretty versed on Desktop but I ran into an issue with some payment applications and had to make some changes, I never needed to "unapply" payments before so I was in a pickle. I read his response to another discussion, was following it, then realized the process was eliminating the money even received....ugh. Ergo, what I ended up having to do was re-open/unlock November, (as I had already reconciled), undo my reconciliations for 2 accounts and re-enter the deposits that were deleted via his instruction....all I wanted to do was unapply the payments to said invoice, not eliminate them entirely. No harm no foul, took longer for me to accomplish my task to re-enter & re-reconcile. All is good now.....thank you for again for the response, enjoy your day!

Where do you delete the payment from the deposit?

There is no deposit transaction under related transactions. Where else can I delete the payment from the deposit?

Welcome to this thread, DDCabinets.

I appreciate you for following the solution shared by my peer and sharing the result. This information will guide us on how to resolve your concern.

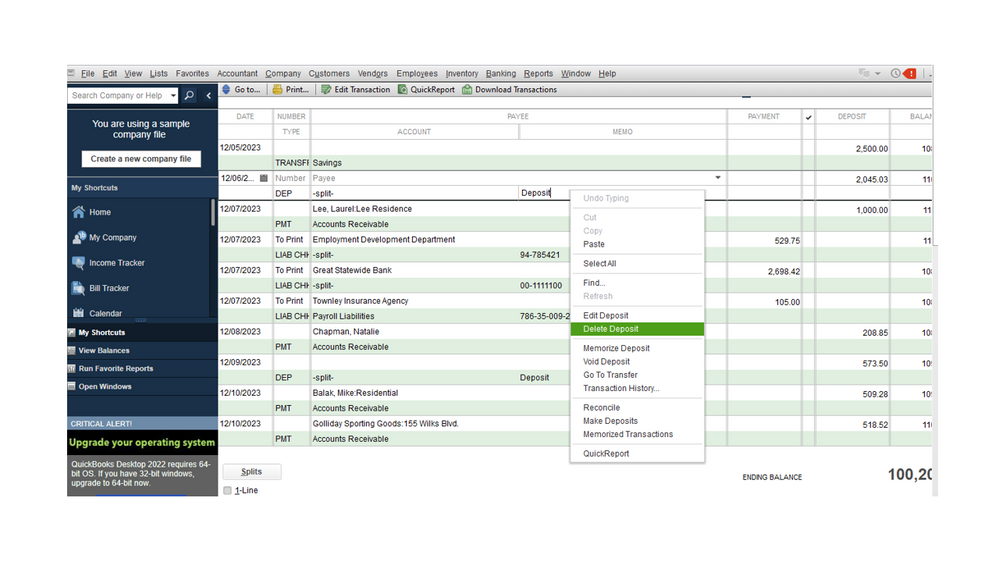

Since the deposit is recorded after receiving the payment, that’s why you’re unable to see it in the Related Transactions section. Let’s delete the deposit first in your register and then the payment. I’m here to help ensure you can do these tasks smoothly.

Next, open the customer’s Transactions List to delete the payment. Here’s how:

For future reference, this article will help you easily handle your customer payments: Void or refund customer payments in QuickBooks Desktop. From there, you’ll learn about processing a refund and voiding payments.

Additionally, the links below will guide you on how to manage your deposits as well as your customer transactions. The topics include creating an invoice, processing payments, making deposits, etc.

Keep in touch if you still need assistance with deleting your deposit or other customer-related transactions. I’m more than happy to help. Have a great day ahead.

i get weekly budget money from my related party because the company has just started so i get it from them every week so i would to know how to expense it in the system when enter the expense and i try to save it would tell me to chose a vendor while using accounts payable account as a line item . help me please where do i go wrong

no i dont but i have not understood your question

Thanks for sharing your concern on this thread, carol710-2022.

I wanted to verify some additional details with you if you do not mind. Is this a reimbursement between related parties? Do you have to associate the expense to a customer?

As for the expense you are trying to record, please make sure to create a vendor so you can save the transaction.

Here's how:

Once done, add the other details for the expense and click Save & Close.

I'm also adding this article for more information: Create, modify, and print checks.

Please feel free to add more details in your reply if you have any additional questions or other concerns. We'll be around to assist you further. Take care and stay safe.

Hi!

I am not able to delete the payment, even after deleting the deposit made in the Undeposited Funds account.

I go to lists, undeposited funds account, i find the deposit and delete instead of void. The deposit, then goes back into Record Deposits. I try deleting the payment from the customer's job and it says i need to delete the payment first before editing or deleting.

please help :(

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here