Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI invoiced a customer and they paid via QB CC payments. The payment just posted to my bank minus the transaction fees. The customer invoice still show's as paid but not deposited. The deposit transaction shows up in For Review. When I click on the deposit to select find match it doesn't find the invoice... How do I match the deposit to the invoice when the transaction fee has changed the amount received? Can this be done automatically since it was all done via QB Payments?

(Title has been edited by moderator for clarity)

Solved! Go to Solution.

Hi Mattmcla,

I'd love to lend a hand with getting these payments matched.

First, I'd like to reiterate what you said, just to ensure my interpretation of the issue is correct.

1. You invoiced a customer, and they paid you via the Intuit Payments Service.

2. The invoice has been marked as paid in full but the payment does not show as deposited in QuickBooks.

3. In reality, this payment was deposited into your bank account, minus external transaction fees.

4. You have the bank account (from number 3) connected to QuickBooks Online, and you see the deposit on the banking page in the "For Review" tab.

5. You would now like to match the imported deposit to the received payment that was entered by Intuit Payments Services.

If this is the case, can you please confirm and then let me know if you're using QuickBooks Online or QuickBooks Desktop?

Thanks so much for your time.

I did some research and found the solution to making sure that fee is accounted for. You can follow these steps when depositing the payment from the Intuit Payments Services.

Please let me know how this goes for you.

Hi Mattmcla,

I'd love to lend a hand with getting these payments matched.

First, I'd like to reiterate what you said, just to ensure my interpretation of the issue is correct.

1. You invoiced a customer, and they paid you via the Intuit Payments Service.

2. The invoice has been marked as paid in full but the payment does not show as deposited in QuickBooks.

3. In reality, this payment was deposited into your bank account, minus external transaction fees.

4. You have the bank account (from number 3) connected to QuickBooks Online, and you see the deposit on the banking page in the "For Review" tab.

5. You would now like to match the imported deposit to the received payment that was entered by Intuit Payments Services.

If this is the case, can you please confirm and then let me know if you're using QuickBooks Online or QuickBooks Desktop?

Thanks so much for your time.

You have it exactly right. I'm using QuickBooks Online. Thank you so much for your time.

It's my pleasure.

First, I'd like to ensure the attached payment is shown as deposited. You can do this by going to the + icon and selecting Bank Deposit. This is where you'll be able to locate the existing payment, select it using the box to its left, and then Save.

Now that it's deposited, please go back to the Banking screen and see if you're able to match the payments. It's likely that QuickBooks will not find it for your because the amounts are different. If this is still the case, you have the ability to exclude the imported transaction. This can be done on the banking page by checking the box to the left of the transaction, clicking Batch Actions, and then choose Exclude Selected.

I look forward to hearing how this goes for you.

So, I can see how that marks my invoice as Paid, but there is no way to associate a deposit with an invoice? How is the transaction fee being accounted for?

I did some research and found the solution to making sure that fee is accounted for. You can follow these steps when depositing the payment from the Intuit Payments Services.

Please let me know how this goes for you.

I am having this problem, but this solution is not working for me. When I go to add a new bank deposit as you instructed, the deposit is not showing up there for me to select. Please help, I would have thought getting paid through quickbooks the system would be smart enough to recognize and catagorize these transactions itself...

I am having this problem.

Additionally, it would be a waste of time to have to manually create the bank deposit when the transaction itself represents the bank deposit.

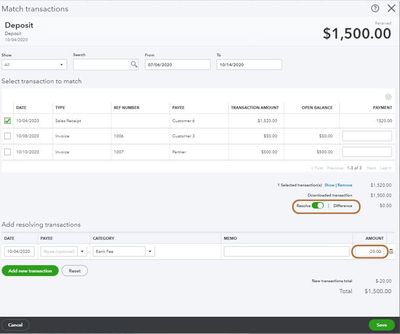

Why not just show the invoice or payment received in the matching list and then we can use the resolve difference tool to add the bank fee expense as a negative amount?

This is so frustrating!

Hi there, @Kerley425,

I'm here to help match the deposits coming from QuickBooks Payments.

There aren't any issues with the automatic matching features in QuickBooks Online. If the transactions are still not automatically matching and deducting the fees up until now, you can try manually doing it.

Here's how:

1. Click Banking on the left panel.

2. Make sure to select the correct bank from the Bank and Credit Cards drop-down menu.

3. Locate the bank transaction, then click it to expand.

4. Click Find match.

5. Select All from the Show drop-down menu.

6. Set the From and To dates.

7. Select the invoices/payments to match.

8. Click Save.

Here's an article in case you need a reference: https://community.intuit.com/articles/1164872

Please let me know how this goes. I'll be here to help however I can.

Hi there, @seanmasonmusic,

Let's check why you're not seeing the deposits.

If you're not seeing the payments in the Select Existing Payments section, the payments may been deposited directly to the bank instead of going to the Undeposited Funds account. Here's what you'll need to do so you can add the fees to the deposits:

After that, you can follow the same steps provided by @AliciaRoy on how to deposit the payment from the Intuit Payments Services.

If you need further assistance, don't hesitate to let me know and I'll be glad to help.

Hi there, @cordoor,

The Resolve the difference option when matching transactions in the Banking page is also another way to add the processing fees. If you choose to go through to this process, you can do and I've added this article to guide you through the complete steps:

Resolve the difference in a matched transaction

If you have additional questions about matching transactions, let me know and I'll help however I can.

We have multiple invoices which all contain the same ammount. I am worried that finding match is incorrect as it only matches the latest transaction to the name. Can anyone confirm that when it finds a match there is a deeper algorithym that matches the correct payment to the correct customer?

Thank you all for your time.

Warmly,

Kai

1. Receive payment for customer invoice to "undeposited funds"

2. Go to "Bank Deposit" and add to the deposit the merchant processing fee to the expense account you have setup for this expense as a credit amount to reduce the deposit total

3. Make the deposit on the date it went into the bank account

4. Match the deposit in your bank feed

Thanks ^ @Regina_Lend_A_Hand_Accounting!

@KaiBates, essentially, when you "make a deposit" with the transactions sitting in your Undeposited Funds, you can offset deposit and processing fees by adding individual transactions as lines item in the "Add funds to this deposit" section at the bottom. You can call them Bank Fees (I recommend including the name of the bank) or whatever you'd like, just make sure the fee goes into the same account as the associated transaction so the total (with the fee) now matches what's on your bank statement.

If you need more step by step instructions, we wrote an article about making deposits. Hope this helps!

THIS IS MY ANSWER I'VE BEEN LOOKING FOR ! ;) you ROCK!

Thank you.

I'm fixing old transactions and trying to match them up.... so is there a way to mark the difference of merchant fees at the bank reconciliation / transaction matching stage

Thanks for joining this thread, @DebGer. I'm here to help you fix and match your old transactions without any further delay!

You have two options on how to handle merchant fees. You can use the Resolve Difference option to fix your payment difference. This helps match your transaction through its difference until it will be equal to zero.

As another option, you can create a bank deposit for the merchant fee less than the amount of the invoice or sales receipt. This way, you can match this transaction to the downloaded bank transaction. You'll have to enter the merchant fee as a line item in the "Adds fund to this deposit" section. Then, select your new merchant fee expense account and enter a negative value that reflects the bank fee amount. For more detailed instruction, go to the What about recording Bank Fees? section in this article: Bank Deposits.

Once done, you can reconcile your account to make sure your books are accurate. Just go to the Accounting menu from the left pane and select Reconcile.

For more insights about this process, please refer to these articles:

Drop me a comment below if you have any other questions. I'll be happy to help you further. Have a great day.

Hi Alicia,

I was trying to follow your steps, but QB says that amount of the bank service fee could not be negative...

What I was doing wrong?

Thanks!

Irina

Hi Alicia,

I followed you instruction, but QB said that the bank service could not be negative

Please advise.

Thanks

Irina

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here