Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I had a 5 different of invoices from the Spring that were paid by my client for hours delivered. We later re-negotiated and we agreed to reduce each of them between 8 and 8.5 hours. We've continued to do work, billing weekly. In their most recent payment, they have withheld the total amount of all those payments. In other words, they reduced my most recent payment to account for overpayment. All of this is OK by me.

How do I record this in QB though? I've created a Credit Memo against the job and the hours. I don't understand how to apply it though.

In the Receive Payments window, bring up the client for whom you'd like to apply credits. You should see an icon on the top menu labeled "discounts and credits". If you click on that it should bring up those client's credit memos. Typically QB will apply the credits to the oldest invoices. You should be able to choose where you would like the credits to be applied.

Victoria

I see how I can do that against a new Customer Payment, but it doesn't make sense to me. I have a credit memo entered for the amount of the overpayment. My customer just made a payment that was less than what they currently owed minus the previous overpayment. I don't have an invoice to apply the credit against since the prior invoices were already paid back in the spring.

I'm here to help you today, stulk.

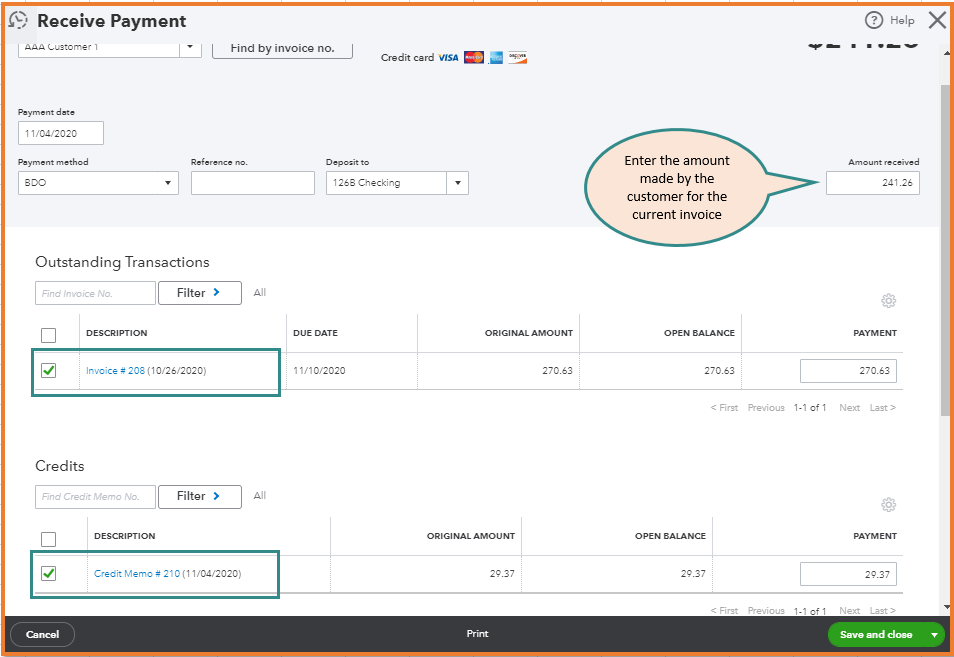

If you've recorded the invoice payment with the exact amount, then you can apply the credit memo to the current invoice. Here's how:

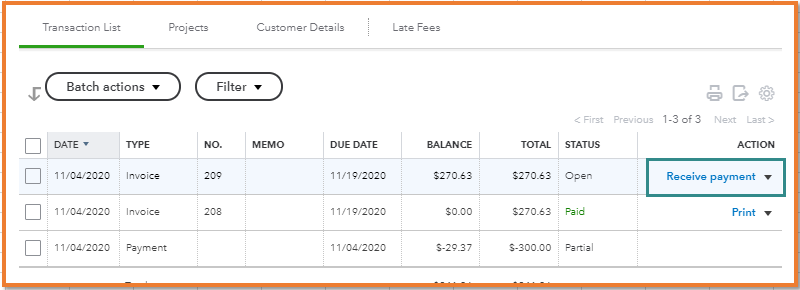

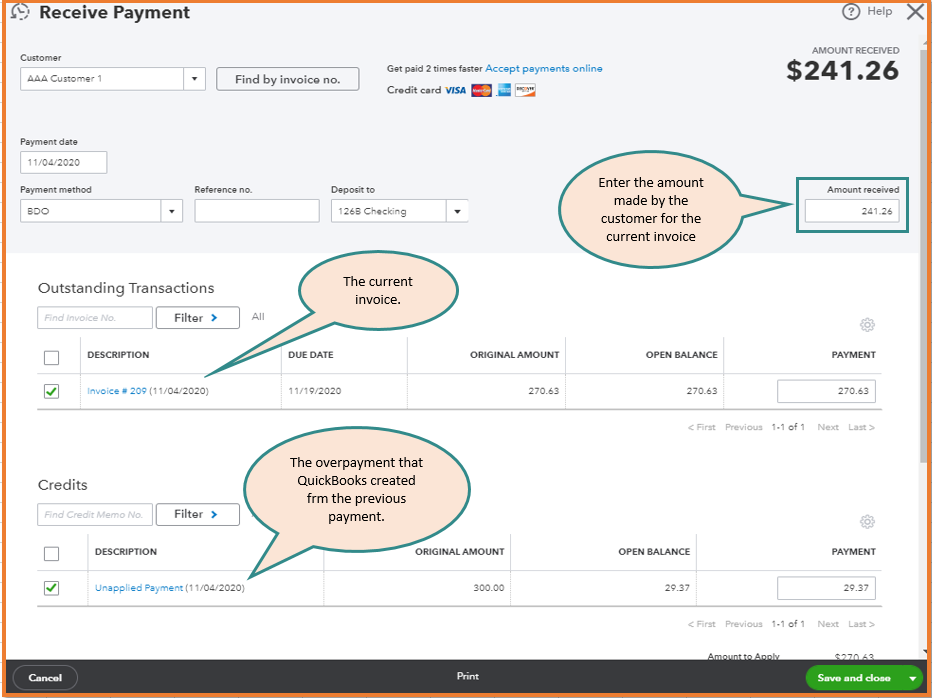

If not, I recommend deleting the credit memo and apply the exact amount paid by the customer to the previous invoice. QuickBooks will automatically create a credit on the customer's account.

To the next invoice, you have the option to link the credit when record the payment. Let me show you how:

I've added this article for more details: Create and apply credit memos or delayed credits in QuickBooks Online.

Let me know if you need additional information about the steps above. Just tag my name, and I'll get back to you.

Did you create an invoice for the payment you just received? If not, how were you applying the payment?

I am using Quickbooks Premier Professional Services Edition 2019 Desktop on PC - so I'm not sure if it's the same or not.

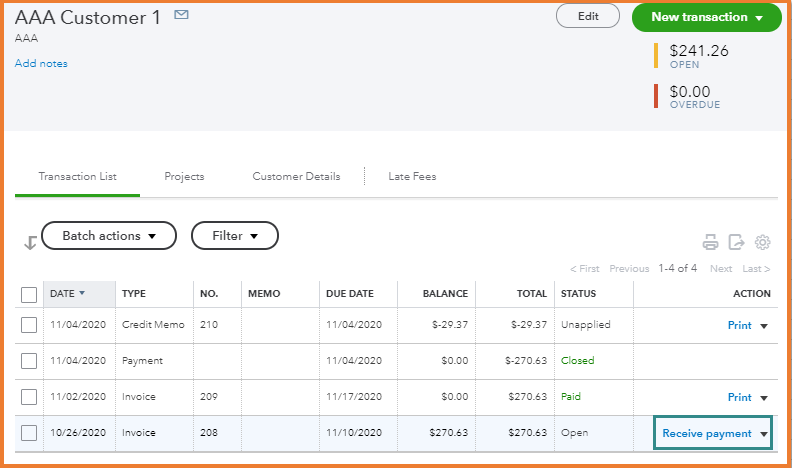

I do not see the Credit Memo in what I think is the equivalent Receive Payment window. I do see the Credit Memo in the list of Transactions under Customer Information

In the Customer Payment window, where I enter the Payment Amount when I click "Discounts and Credits" or "Apply Credits" I do not see the Credit Memo.

Should I be doing this to the original invoices (that were paid in full at the time)?

It may be that you do not see it bc QB is applying it automatically.

From the customer window where you can see the credit memo, can you double click it? If so, you can see its history under Reports (next to Formatting, in the credit memo window).

Yes you should have applied credits to the original invoice, but applying them to current invoices should be fine.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here