Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

In my business, I order and pay for items 6-8 months before I receive them. I am trying to figure out the correct way of recording these transactions.

If I create a purchase order, followed by creating an expense, it will mark the purchase order as closed, but it is still open as the items have not been received. What is the best way for me to log the order / expense of a prepaid order for inventory that I have not yet received?

Hi there, @Need2Learn. I've got all the instructions you'll need on how to record your prepaid expenses.

You can use the Check to Accounts Payable method in recording your prepaid expenses with vendors. With this method, you'll use Checks or Expenses. Then, select the Accounts Payable in the Category field. This will show a negative vendor balance to reflect that they owe you until you receive the items.

Here's how:

Once you received the items, copy the purchase order to the bill. Here's how:

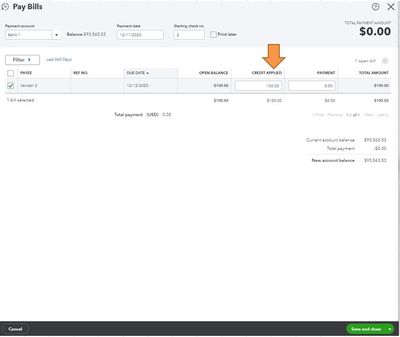

The last step is to apply the Accounts Payable check to the bill you entered. Follow these steps:

You can also check out this article on how to record vendor credits: Handle vendor credits and refunds.

I'm just a post away if you need further assistance with entering your prepayments. Have a great day.

This is where you lost me:

Once you received the items, copy the purchase order to the bill. Here's how:

#4 you say 'adjust the quantity or amount for each line item to reflect the portion you received or plan to pay for... when you create a bill, it closes out the purchase order and marks the items as received right? The issue is I pay for the inventory that I have yet to receive, so by creating this bill, its going to mark it as paid but its going to also close out the PO and mark the inventory as received, right?

Also, what is the proper way to record the account paid from if I paid using my paypal account but my paypal account bills my credit card?

Hello Need2Learn!

Let me further assist you in recording prepaid inventory.

You're correct. When you create a bill from the PO, it closes the PO and mark the items as received. However, you only need to create a bill if you physically received the items.

We create a check or expense transaction to record the payment. Then, we can apply it as a payment to close a bill once you converted the PO.

I suggest you check this link for the detailed steps on how to track the items that you’ve paid but haven't received yet: How to track your prepaid inventory

I added this link if you need help in running, customizing, and saving a report: Run reports in QuickBooks Online.

Don't hesitate to post again if you have more questions. I'm looking forward to assisting you again.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here