Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

We received a Non-refundable credit for qualified sick and family leave wages (FFCRA) on our Q3 941 Worksheet 1 line 2j. I used the credit when paying our bi-weekly payroll taxes during Q4. We are also receiving a Non-refundable credit for qualified sick and family leave wages (FFCRA) on our Q4 941 Worksheet 1 line 2j. However, on page 2 of my Q4 941 report, it is showing a Balance Due ($2445.57), line 14, which is the difference between our credit from Q3 ($4414.01) and our credit in Q4 ($1968.44). I paid all payroll taxes with the exception of applying the credit from Q3 on the payment made on 10/30/2020. Can someone explain this to me?

What shows in the 941 form depends on how the payroll items are set up. To ensure everything is set up correctly, check this article for the steps to track FFCRA .How to track paid leave and sick time for the coronavirus

This article also discuss how to claim the credits on the form so your filing it correctly: What you need to know about the Families First Coronavirus Response Act

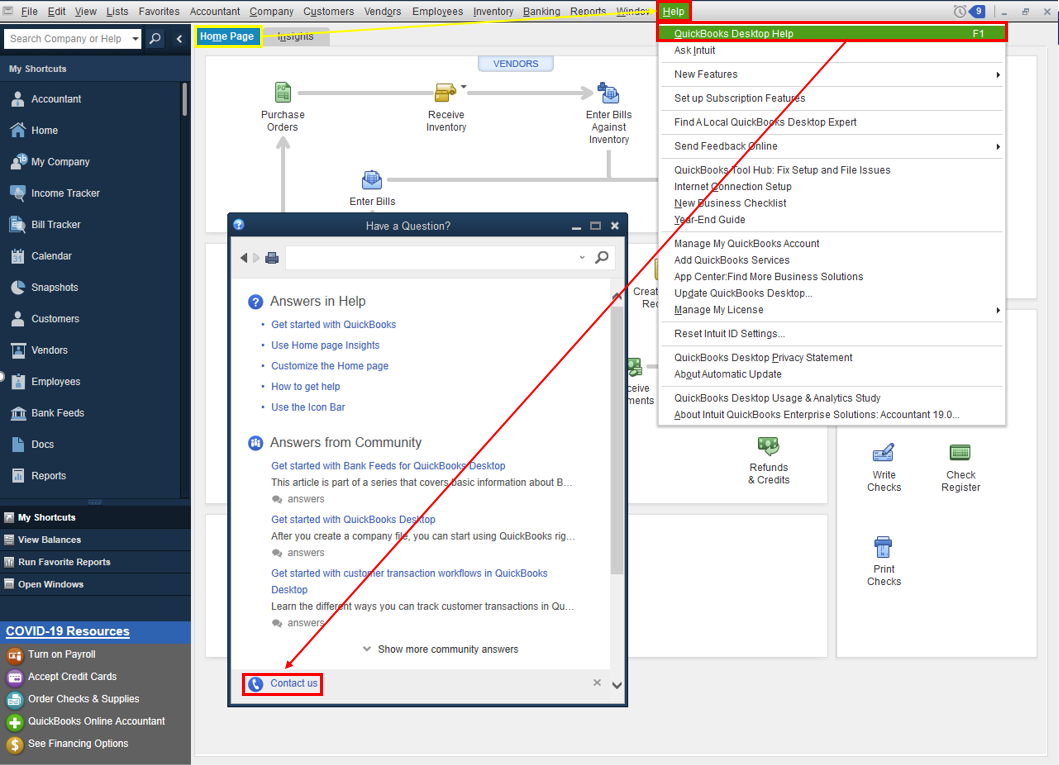

Also if you need someone to assist you on the line, I recommend reaching out to our Support Team. They can initiate a viewing session with you and can help further with your 941 reporting.

To get our Support, follow the steps below:

Refer to this article to learn more about our contact options and support availability: Contact QuickBooks Desktop support

Let me know how it goes in the comment, I want to make sure this is resolved for you. I'm also here to provide further assistance with your payroll forms.

In Step 4.8 In the Pre-tax deductions window, select the item that will reduce wages for this tax.

What do we select or do we select anything?

Hi there, @Eagle2442.

You can edit the payroll item that you possibly select, then check if the taxability reduce. Let me walk you through the steps on how to do it. Here's how:

Also, you can refer to this article for more information on how to modify the payroll item: How to edit a payroll item.

Once done, you can go back to the steps provided by my colleague and continue the setup.

You can check these articles for a reference on track paid leave and sick time for the coronavirus:

You can always reach me here for all of your QuickBooks needs. I want to ensure your success, and I'll be around anytime!

You state in Step 2 - Right-click on the appropriate item

What is the appropriate Payroll Item?

I'd be glad to show you the payroll types you can use on tracking your employee's paid leave, @Eagle2442.

Different types of paid leave fall under FFCRA. When applying it to the paycheck, you have to know the reason on what is the applicable pay type. Here are the following pay types you can choose and it's payroll item type when it's your first time setting it up:

To setup, this is how it looks like when adding a new payroll item:

Once you set up your payroll item, you'll have to ensure that your selected Tax Tracking Type is based on the paid leave type that falls under FFCRA. This way, we can ensure that the hours you’ve used in your tax credits will reflect on your payroll reports.

Here's how:

You can check out this article to know more details about the process: How to track paid leave and sick time for the coronavirus.

After you’ve run your payroll with the paid leave, you should be aware of how it affects your taxes. Under the FFCRA, you’ll get credit towards your Federal Tax deposit for the wages and Employer Paid Health Insurance premiums paid under this act.

You're always welcome to tag my name in the comment section if you need further assistance or other questions. Wishing you well.

I appreciate you for getting back to us and for sharing the steps you’ve performed to solve this, @Eagle2442.

In regards to what payroll item to choose that will reduce wages for the tax, I recommend working with your accountant for further guidance. This way, we can ensure your accounts is well accounted for after choosing a payroll item.

If you’re not affiliated with one, you can visit your ProAdvisor page and look for one from there. You can also visit this link to learn more about the Families First Coronavirus Response Act (FFCRA).

When you’re ready to run your employee's payroll, check out the Run payroll section in this article: Get started with Payroll. Then select QuickBooks Desktop for the complete details.

I’ll be around to assist you if you have other concerns or questions about managing your QuickBooks. Keeping you in working order is my top priority. Keep safe and take care.

For Q3, we received a credit due to qualified sick and family leave wages and requested the overpayment to be applied to our next return (on the 941).

I ran the Q4 941 and the credit does not appear anywhere. I've tried entering the amount on line 11b but the override is grayed out.

How do we apply this credit?

Hello, OGII.

Thank you for posting in the QuickBooks Community. I'd be happy to help share some information about how to enter the credit on the next quarter taxes.

Let's ensure you have QuickBooks updated to the latest required release and have the latest tax table. Then let's go ahead apply the credit to the next quarterly taxes.

Though, QuickBooks Desktop does not automatically apply the overpayment to the next quarter's Form 941. You must manually override line 11 of Form 941 to include the credit.

To include the credit using the manual override:

Prepare your 941 form.

See Prepare and print Form 941, Schedule B, and Form 940 for steps on how to prepare or edit the 941 form.

For more details, I've attached some articles for your reference:

If issue persists, I recommend contacting our Support Team to investigate why the line 11 override is grayed out.

Here's how:

Please know that I'm still here to help you more if you have other payroll questions. Just drop a comment below or mention my name. Wishing you all the best!

@AileneA As mentioned previously, there is no line 11. And lines 11a, b, c and d do not allow overrides. How can this credit be applied?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here