Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowI'll make sure you won't be charged again, Michael.

You can categorize your commission as personal income. This way, you won't need to repay the taxes and avoid getting charged again.

Before we begin, please ensure you've turned on the Personal Categories feature. This way, we can categorize your commission as Personal income. Here's how:

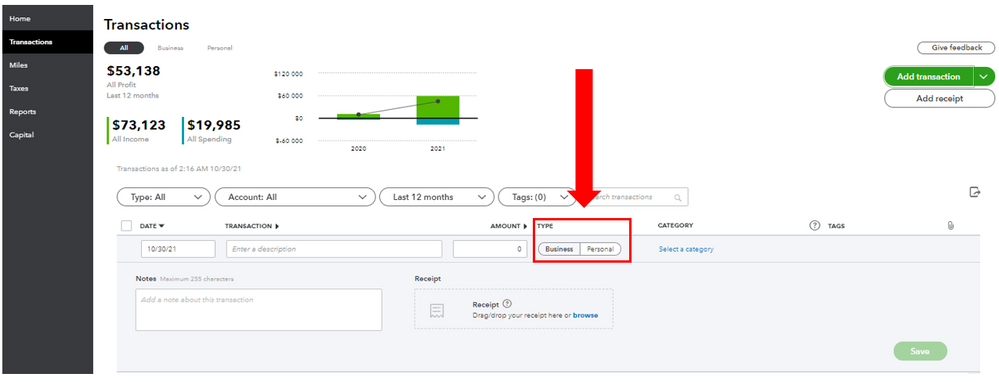

Once done, you can now enter your commission and categorize it as personal income. Let me guide you how:

I'd also recommend working with your accountant for further guidance in recording this. They'll be able to advise you on other ways to record this and ensure the accuracy of your accounts. If you're not affiliated with one, you can visit our ProAdvisor page and we'll help you look for one from there.

Additionally, I've added these resources that can guide you in filing your taxes seamlessly:

I'm all ears if you have any other questions about recording your commission and filing your taxes. It's always my pleasure to help and ensure you're on the right track. Have a good one and keep safe!

Great, this helps. How do I make sure it categorizes that it still needs to be queue into Self-employed estimated taxes.

Thanks for getting back to us, Michael.

Personal income and personal expenses will not be included in the calculation of your estimated tax.

You'll want to categorize them in the correct line of your Schedule C to be included in the calculations. You can also see this article for more details about Self-Employment taxes: How QuickBooks Self-Employed tracks self-employment taxes.

Furthermore, I recommend working with your accountant for further guidance. They'll be able to advise you on using the best category.

Once you're all set, you might want to check out this link for guidance in paying your taxes in the future: Pay federal estimated quarterly taxes in QuickBooks Self-Employed.

You're always welcome to get back to me if you have other follow-up questions about estimated taxes. I'll be here more than happy to help you out. Take care and always stay healthy!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.