Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

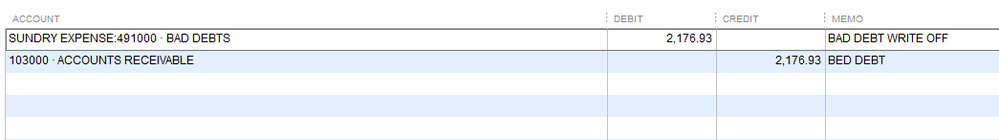

Buy nowI wrote off a bad debt in ihe GJ as shown.

When I run an aging report, it shows up as a positive and a negative. How do I get it to not show up at all on an

Solved! Go to Solution.

Hello gloriadeb204!

The reason why it shows positive and negative lines is because of the method you used, the journal entry. Let me show you how to properly write it off as bad debt.

Based on the screenshot, I'll assume you already have an expense account to track the bad debt. If so, proceed to these steps:

Once done, pull up the A/R Aging report again to verify.

Need more references on how to manage your business in QuickBooks Desktop? Check this link: QBDT All Articles.

Leave a reply below if you more of my help. I'll be here!

Hello gloriadeb204!

The reason why it shows positive and negative lines is because of the method you used, the journal entry. Let me show you how to properly write it off as bad debt.

Based on the screenshot, I'll assume you already have an expense account to track the bad debt. If so, proceed to these steps:

Once done, pull up the A/R Aging report again to verify.

Need more references on how to manage your business in QuickBooks Desktop? Check this link: QBDT All Articles.

Leave a reply below if you more of my help. I'll be here!

This happens when the journal isn't linked to the invoice it's writing down. Same thing will happen if you record a Payment received transaction and don't apply it to invoices.

To complete the transaction, open the Receive Payments window, select the customer, and then apply the outstanding credit to the open invoice(s).

Thank you

I will do this when I'm at work tomorrow.

SInce 2020 is at our acountants for tax purposes, will this change anything or affect the financials?

Thank you.

I will do this tomorrow when I get to work.

Since 2020 financials are at our accountant, will doing this affect the financials?

Yes, doing this will affect your financials, gloriadeb204.

In any case, accounting write-offs serve two purposes:

This process ensures your accounts receivable and net income stay up-to-date. I'd suggest working with your accountant to make sure your reports are accurate.

You can take a look at this article: Write off bad debt in QuickBooks Desktop. This will give you the step-by-step process of writing off bad debt.

Additionally, you can visit the following write-up: Sales and customers. This will provide you links on how to manage your company income as well as resources about other customer-related concerns.

I'm only a post away if I can be of additional assistance or need more help with QuickBooks. I'm always here to keep helping. Wishing you a wonderful rest of the week.

One last thing -

If we send an account to an attorney for collections, should it be written off?

Does "written off" mean it's done - there's no hope for any collection anymore?

I ask because the previous bookkeeper did write off debts that we still collect on. The money does not go to the attorney, they send it to us.

Thanks for your follow-up questions, @gloriadeb204. When you send an account to an attorney for collections, the collections will try to recover your receivables by sending a notice to the debtors to pay any outstanding balances.

Now, when it has been determined that collection efforts will not result in payment of the amount due, the account will be considered uncollectible or bad debts.

To acknowledge that a loss has occurred, you'll need to record them as bad debt and write them off. This is to ensure your accounts receivables and net income stay updated, and to balance your balance sheet.

For more insights and detailed steps, I'll share the link again suggested by my peer @Rose-A: Write off bad debt in QuickBooks Desktop.

I'd suggest you consult an accountant for further guidance in handling debts that the previous bookkeeper write-offs that you're still collecting on.

I've also got you this article will help you learn about the reconciliation workflow in QuickBooks.

Visit again and ask us more questions here in the Community. We're always around here to answer them for you to the best of our knowledge.

Thank you very much

I followed steps 1-2 but in Step 3, I do not see "Discounts and Credits" button anywhere on the screen

Good afternoon, @MercelleW.

Thanks for chiming in on this thread. Allow me to point you in the right direction to get this fixed.

Since you're unable to find the "Discounts and Credits" button, I suggest contacting our Customer Support Team for further assistance. They'll be able to walk you through the steps with a screen share tool. Here's how:

It's that easy!

Keep us updated on how the call goes. I'm only a post away if you need me. Take care!

I have followed the instructions, which indicates no dollar entry on the "receive payments" dialog box. In the "discounts and credit" box, I enter the amount to write off, and immediately met with another dialog box that says "warning - the discount amount cannot be more than the Amt. To Pay". Now what? The customer in question has 2 dozen invoices for the total I need to write off. Am I to do this exercise 24 times?

Hi there, JudyC61.

Thank you for visiting the QuickBooks Community. I'll provide some details you'll be able to sort the error message you received. Then, ensure that you can write off transactions.

When choosing invoices to be paid on the Receive Payments screen and the total of all invoices exceeds the figure in the Payment amount field, you'll get the message that indicates "You cannot apply an amount greater than the total payments plus any existing credits when creating a payment in QuickBooks".

To start with and to fix the issue, I recommend applying a discount or credit to one or more invoices.

Here's how:

If the issue persists, you can change which invoices are selected to be paid. You can open this article to see the steps on how to perform the process and follow solution two: Warning: You cannot apply an amount greater than the total payments plus any existing credits.

Lastly, you may open this article to view different ways on how you can track customer transactions in QuickBooks Desktop: Get started with customer transaction workflows in QuickBooks Desktop.

Let me know if you still have questions or concerns about achieving a write-off in QuickBooks. I'll be around for you. Take care and have a good one.

Hi,

if the discount option is not available, is there any other way to clear the items on bad debt account ? if so what are the steps on QB online.

thank you

Good to see you on the thread, @mgonzalez86.

The discount option to write off bad debt provided above is for QuickBooks Desktop (QBDT). Allow me to give you some insight on how to clear the items on a bad debt account in QuickBooks Online (QBO).

When the invoices you send to your customers become uncollectible, you need to record them as a bad debt and write them off. This ensures your accounts receivable and net income stay up to date.

To do this, you'll need first to create an expense account. Here's how:

Second, create a bad debt item:

Third, create a credit memo for the bad debt.:

Lastly, apply the credit memo to the invoice:

After that, the uncollectible receivable now appears on your Profit and Loss report under the Bad Debts expense account.

To learn more about recording uncollectible accounts in QBO, see this article: Write off bad debt in QuickBooks Online. It also contains information on how you can run a bad debts report.

For future help, if you need to check your sales report and see your cash flow from your customers, I recommend checking out the articles from our Sales reports topic page.

Feel free to visit the Community with any other questions you may have. Or if you run into any trouble along the way. I’m more than happy to assist further. Wishing your business continued success.

Unfortunately I've done this and am now seeing the Invoices on the P&L in the Income, and as the Bad Debt Expenses (therefore Income doesn't balance/ is inaccurate, and the outcome of credit & debt = net $0 / defeats the purpose). PLEASE advise how to correct this.

Thanks for checking in with us, AmyOfficePro.

The uncollectible receivable amount on your Profit and Loss report under the Bad Debts expense account is affected by how you record the bad debt. If you are using QuickBooks Online (QBO) and your business uses accrual method accounting, we write off bad debt as a deduction. Here's an article you can refer to for more insights about bad debt from the IRS.

We can run an Account QuickReport to check all the receivables you marked as bad debt to review the bad debt transactions. To accomplish this:

Then, by adding a note to their name, you can distinguish a bad-debt entity from your other customers. Here's how it's done:

You can check out this article for more details about writing off bad debt: Write off bad debt in QuickBooks Online. If the same thing happens, we can run some basic troubleshooting tests to figure out what's going on. Launch a private browser and rerun the Profit and Loss report. The private mode prevents the cache from being retained while the website is up and running, which may cause issues. Here's a list of shortcut keys that you can use to get to one:

and Microsoft Edge

and Microsoft Edge

If it works fine, go back to your original browser and clear its cache to start fresh. Moreover, you can use another supported and up-to-date browser to narrow down the result.

Feel free to visit this article to see various details on how the Sales page shows you a great at-a-glance view of all the status of sales transactions like open and paid invoices: View sales transactions.

If you have any further questions or want to refer to something else, please click the Reply button below. Please know that I am always available to assist you with any QuickBooks issues you may be experiencing. Take care always.

Assuming you're cash basis, when an invoice is determined to be uncollectible and the bad debt expense is applied to the invoice, both the income from the invoice and the related bad debt expense will hit your P&L and will offset. That is proper accounting. Is that not what you're seeing?

No is not working / I do not want to see in Income. (?) (so Income Balances; I do a separate spreadsheet from Bank Statements Deposits, to verify in Balance, as in past the way QB Online was posting, it wasn't showing certain items from Invoices/ payments received)

I'm still seeing the Invoices on the P&L in the Income ("Contract Deposits" and as the Bad Debt Expense (therefore Income doesn't balance/ is inaccurate)..

As instruction shows: I created a "Credit Memo" selecting the "Bad Debt" Item, that I'd created to post to Expense "Bad Debt and Settled Invoices" - Re-reviewing that, I recall I chose "Non-inventory" and I tried selecting "I purchase this product/service from a vendor" to be able to see "Expense Account" and select "Bad Debt and Settled Invoices" and that wasn't posting accurately, so I tried (and currently is showing) checked box "I sell this product/service to my customers" to see the "Income account" drop-down, to select "Bad Debt and Settled Invoices" - This must be the issue = I tried changing back to "Expense Account" and it isn't changing anything.

For now I've done Journal Entries to debit the "Contract Deposits" (so Income Balances), and posted the credit to an "Other Expense" I have "Ask Tax Accountant," therefore that shows at bottom of P&L. - A resolution would be greatly appreciated.

~ Amy

I'm writing off a bad debt but I do not have "Discounts and Credits". What do I do?

Hello there, peggylaughery.

Let's figure out why you don't have a Discounts and Credits option. Then, perform the necessary steps to fix it.

Before anything else, can you share the exact steps you've taken when trying to write off the bad debt? Can you confirm if you're using QuickBooks Desktop?

The Discount and Credit option is under the Main section after clicking the Receive Payment under the Customers menu. Please see the sample screenshot below.

If the Discounts and Credits option is grayed out, it's because there are no open invoices when you attempt to receive the payment.

However, if you don't see the said option even though there's an open invoice, let's make sure to update the program to the latest release. This way, you always get our newest security patches and bug fixes. The steps below will guide you through the process.

In case it won't work, I recommend repairing your QuickBooks Desktop for Windows.

Additionally, you can visit the following article: Managing Sales and Customers. This provides links on how to handle company income and resources for other customer-related concerns.

If you have any specific questions, need troubleshooting assistance, or seek general guidance, the Community is always available to ensure your QuickBooks experience is seamless.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here