Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello,

It all depends on HOW your 3rd party app is importing the info into QBO. Can you change the settings on your 3rd party app to just post it as income? Or another option is maybe your 3rd party app has a setting to import the invoices as sales receipts, BUT have them be deposited to your checking account instead of undeposited funds.

Yet ANOTHER option I've seen some 3rd party apps have is it will create an invoice, create a payment to close the invoice and you can set the payment to go to your bank account or undeposited funds.

In short, since you're using a 3rd party app to bring the info into QuickBooks, you need to see what settings are available in the app itself.

Thanks for your reply. You're placing the onus on the 3rd party app, and that seems incorrect to me. Hopefully I'm not using the term 3rd party app incorrectly; I am simply referring to an app that I have linked to quickbooks. The app only allows me to assign one account (from the chart of accounts) to a transaction; it can't tell quickbooks the other account to debit/credit, that is quickbook's job, and in this case it is debiting undeposited funds. UF is apparently quickbook's default.

Your second suggestion is what I'm trying to do; bypass undeposited funds and put the (paid in full invoice) funds directly into some other asset account. From what I can tell, the only way to bypass undeposited funds is to post a sales receipt. The problem is that I don't want to go into every single invoice and create a sales receipt for two reasons:

1. This would be very time consuming

2. This would be redundant since quickbooks (not my app) is already importing invoices (correctly) as paid.

So again, I'm trying to bypass undeposited funds without having to post a sales receipt, which is redundant and time consuming.

Thoughts?

@martin6 wrote:

I'm trying to bypass undeposited funds without having to post a sales receipt, which is redundant and time consuming.

You post a Sales Receipt for cash sales. It's either that or an Invoice for credit sales. What type of sales are you referring to ?

What is the name of the app you're using?

I do not want any payments to land in undeposited funds for the following reasons:

1) we receive most payments through QBO on credit cards. The payments appear in my bank feed and I categorize them there, effectively 'depositing' the funds.

2) if we do receive a check, I immediately deposit the check on my mobile banking app and the funds are tracked and automatically deposited into my bank account (plus, they deposit appears on my bank feed - through QBO - so QB has already deemed the payment a deposit,

3) money sitting in undeposited funds appears on my balance sheet and the transactions are duplicates of what has ALREADY been deposited in my bank. I've had to go back to payments made after a reconciliation and then QB has made an automatic adjustment that throws my current balance off, making the next reconciliation a mess.

Please tell me how to skip and / or delete the undeposited funds account. It is an unnecessary step for most businesses. It is time consuming and frankly irritating that I can't easily find a way to skip it in my accounting.

Hello MR88!

It seems that you're referring to QuickBooks Payments. If so, the account where the funds are tracked is based on which one you've selected in the setting. Let me show you how to update it.

Do you need to update some details on your QuickBooks Payments account? Check these links:

Change your business info for your QuickBooks Payments account

Common questions about payments deposits in QuickBooks Online

I'd be glad to help you if you have other concerns. Have a great day!

I've checked and double checked that my payments are deposited to my bank account, and that is the setting I have, and have had since we started using QB on Jan 1 of this year. Any other ideas?

I can help share additional information on why you have duplicate transactions on the register, MR88.

You'll want to match the deposits that are cleared from the bank instead. Matching these deposits prevent you from having a duplicate transaction on your register.

Please check this out:

QuickBooks now knows the downloaded transaction is the same one you already entered.

If you need help categorizing your downloaded bank transactions, please check it here.

Please let me know if you have any additional banking concerns. I'm happy to help.

I can't seem to find any way to do this on Quickbooks 2020. They tried to upsell me the automatic connection to my bank account, but since I need to document each of the payments as a part of an invoice and then move the undeposited funds to my bank, this feature is almost completely useless and doesn't save much time at all. If I could use the row in the bank register to create a payment, then this might have some value...

Hello there, climatelog. Thanks for joining this thread and sharing your experience.

We can bypass the Undeposited funds by clearing the Use Undeposited Funds as a default deposit to account feature in the preferences. It helps to get your transactions done seamlessly. Here's how:

Also, I see it could help you more to add an option convenient for your needs, especially creating a payment using the row in the register.

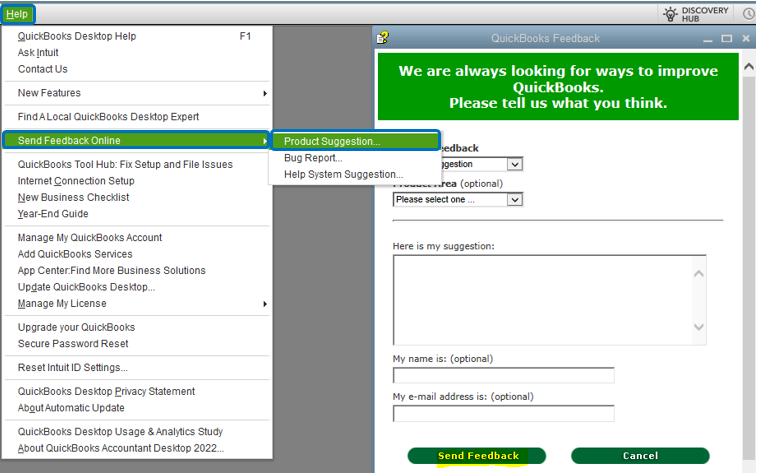

Since it's unavailable now, we can pass this along to our product developers and let them know how this option benefits you and your business. Doing this would be a big help getting this implemented in the future. The steps below will guide you on how we can send your suggestion.

I've gathered a few articles. Each of them contains details about managing banking transactions and payments:

We always want to hear your ideas. Also, if you have other concerns about creating or recording transactions within your company file, please comment below. I'll be around to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here