Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowMy "Cash Basis" P&L report is including partial amounts from unpaid invoices. As an example, an invoice with a $5.00 Delivery Fee has $2.08 showing up on the "Cash Basis" report. I cannot find a commonality between all the invoices that are doing this. Any ideas?

Solved! Go to Solution.

This will happen if you have a return/credit on the invoice, a negative line item that is not a "Discount" type item. When data is recorded in this way, it creates internal "links" on the invoice, and the credit treated as if it pays off other parts of the invoice.

Based on your example, the credit on the invoice amounts to about 42% of the invoice total before the negative line item(s).

For example, if you create an invoice for a product, and then add a line for a return of another product (presumably that the customer purchased on a prior sale), that return is considered 'final' - the end of the line for that transaction, and so it acts as a payment against the invoice total.

The same thing would happen if that return was entered as a credit memo and then the credit memo applied to the invoice.

This is true except for Discount type items, which are treated differently and considered part of the sale, and not as a return / not as something to apply to the sale before actual payment is received.

Hello Greg_C!

Thanks for reaching out to us. Let me explain how the "Cash Basis" works.

The Cash method of accounting shows all the money when it moves in and out of your business. This includes the partial payments from the invoices. Although the invoice is still open or not fully paid, the partial payment will still be included on the cash basis of P&L since you received the money already.

You'll want to check this article: Differentiate Cash and Accrual basis. This will help you to fully understand the difference between the two accounting methods.

In addition, please check these links if you need more financial reports:

Leave a comment below if you have other concerns. I'll be here!

Thanks for being so responsive, Alex. I don't think I was clear in my original post. There has not been any payment whatsoever applied to the problematic invoices. Where I was referring to "partial" is in reference to the amounts showing up on the P&L for the items which appear on the invoice. I understand cash basis reporting and would not expect to see any amounts from an unpaid invoice appearing on a cash basis report. Not only do I have amounts appearing, they are not the full amount of the item as it appears on the invoice. So ... I have an invoice with no applied payments which has a $5 delivery fee on it and on the cash basis P&L I am seeing $2.08 of that $5.00. Two questions in this issue: 1) Why is an invoice with no applied payments appearing on a cash basis report? And, 2) Why is only $2.08 of a $5.00 item from the invoice appearing on the report?

Thanks for getting back to us, @Greg_C.

You should only see income if you have received cash and expenses if you have paid cash on a cash basis reporting.

Since the unpaid invoices are still showing in the Profit & Loss report, I recommend running a rebuild and verify on the company file to check for data damages. Data damage can cause these types of issues with the reporting in QuickBooks Desktop (QBDT).

Here's how to do it:

Click OK if QuickBooks doesn't find any problems. Otherwise, tick Rebuild Now.

For more information about fixing data damages in QBDT, check out this article: Fix data damage on your QuickBooks Desktop company file.

Please don't hesitate to leave a comment if you have any further concerns or issues. I'll be more than willing to help. Have a wonderful day!

@FritzFthank you! I've gone through these steps (more than once) and still have the issue. Very perplexing.

Hi there, @Greg_C. Happy to chime in.

I've got some additional information and troubleshooting steps to share with you. First, let's take a closer look at your report.

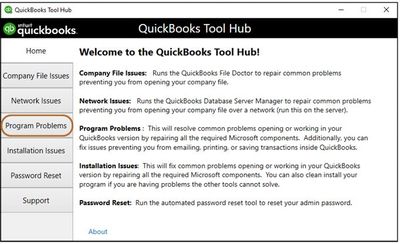

If it's unpaid and the amount is incorrect, follow these steps to perform a mini repair on your software:

From there, let's run the Quick Fix my Program tool from the Tool Hub.

If you're still getting the same issue, you can follow the additional steps outlined in this article: QuickBooks File Doctor.

Feel free to visit us again should you need more help with running reports. I'm always available to help

This will happen if you have a return/credit on the invoice, a negative line item that is not a "Discount" type item. When data is recorded in this way, it creates internal "links" on the invoice, and the credit treated as if it pays off other parts of the invoice.

Based on your example, the credit on the invoice amounts to about 42% of the invoice total before the negative line item(s).

For example, if you create an invoice for a product, and then add a line for a return of another product (presumably that the customer purchased on a prior sale), that return is considered 'final' - the end of the line for that transaction, and so it acts as a payment against the invoice total.

The same thing would happen if that return was entered as a credit memo and then the credit memo applied to the invoice.

This is true except for Discount type items, which are treated differently and considered part of the sale, and not as a return / not as something to apply to the sale before actual payment is received.

@BigRedConsulting bingo!! Thank you! You’ve resolved my issue.

@BigRedConsulting bingo! Thank you!! This was it and my issue is now resolved.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here