Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI would like to generate a customer income report (invoices and expenses by customer) that also has the hours for that customer that is generated by quicktime.

You definitely can, @BrockB88. I've got here a great method for you to pull up a customer income report with hours from Quicktime in QuickBooks Desktop (QBDT).

To clarify, are you referring to QuickBooks Time? If not, you’ll want to contact the app to learn how you can sync them. You can also ask for suggestion about what other report you can generate.

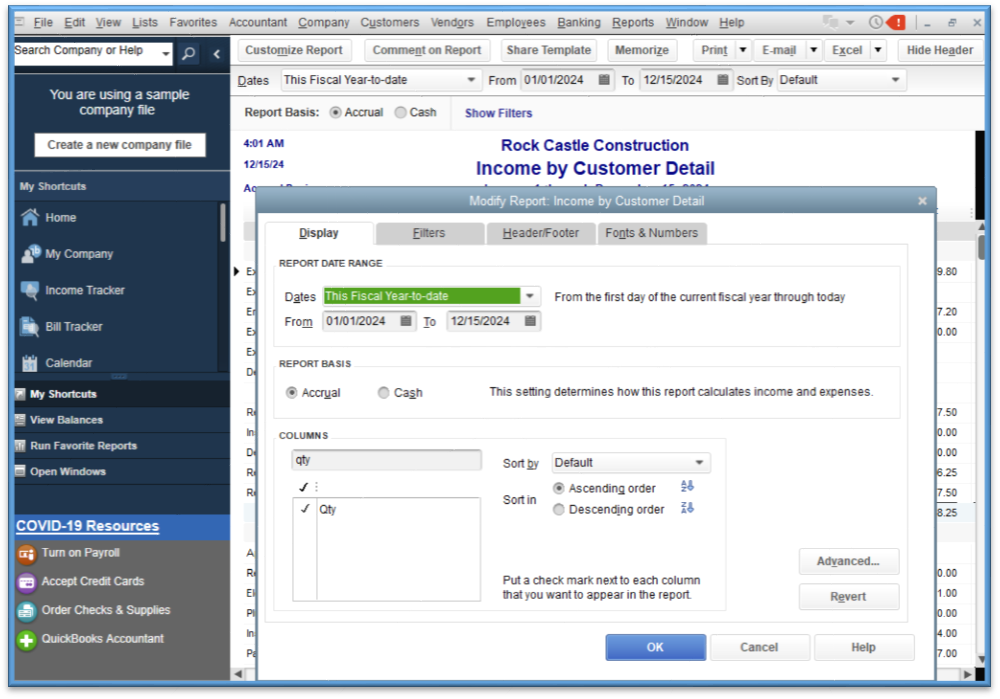

If you’ve synced the app to QBDT, you can run the Income by Customer Detail report. From there, let’s filter it to show the hours and other data you need. To do so, follow the steps below:

For additional reference, check out this article about adding total hours worked by employee report in QuickBooks Desktop.

You can check this resource page for future reference in case you want to learn more about the recording of timesheets by an employee in QuickBooks Desktop: Create and print timesheets.

Keep me posted on what report you're currently pulling up so I can help you filter it. If you need further assistance with modifying the report mentioned above, please mention me anytime. I'll be more than glad to share additional insights with you. Have a nice day!

Thank you @JamaicaA but that didn't give me the hours for the customer. It just gave me a number 1 in the "Qty" column for every customer invoice line and nothing else. We do not create invoices based on the hours. The only reports i can see the imported hours on is under the "Jobs, Time and Mileage" reports, in the "time" section. I would like them to show up in the income by customer detail for job tracking purposes.

I appreciate your prompt response and for following the steps mentioned by my colleague above, @BrockB88. Allow me to chime in and provide additional information on running Income by customer detail report in QuickBooks Desktop (QBDT).

Since we're using the Income by customer detail report, we'll first need to create sales transactions like invoices to enable the hours to be present on the said report and track its billable time.

Yes, you're right. Since timesheets are non-posting entries, let's export both Jobs, Time & Mileage, and Income by customer detail reports as a workaround. Then, you can manually add the number of hours in the Income by customer detail report. Doing so will allow you to track the customers' job hours on record.

To export the report in an Excel file, follow the steps below:

Moreover, you can check out these helpful resources to ensure an accurate record of your job costs: Track job costs in QuickBooks Desktop. This way, it allows you to track and compare the expenses for a job and those expenses to your revenue.

If you need further assistance modifying the reports, you're always welcome to get back to this thread. I'm here to help. Keep safe!

Thank you. I was hoping to be able to generate a report with all the information on it and not have to manually manipulate spreadsheets each time. Does the contractor edition offer anything that would help with this? Is there something simple that can be done with entries to let the hours show up? A separate question is how do i enter job costs for materials that are bought in bulk but not for a specific job? For example if we buy 60 yards of mulch, then use 5 yards for John Smiths job, i want to enter the cost for the 5 yards in quickbooks so it shows up on the income by customer detail.

I can share some information about reports and billable expenses, @BrockB88.

The option to generate customer and income information with hours in one report would be a great addition to the current features that we have. I invite you to provide input to our developers so that this feature can be added to future releases. Rest assured, I'll do the same on my end.

Here's how:

Refer to this article on how to customize the info showing in your reports and add or delete columns based on what you need: Customize reports in QuickBooks Desktop.

About your second question, you'll just have to set the cost of 5 yards as billable when creating the bill. Once done, you can now add this to your job when creating an invoice.

Here's how to create the bill:

For more information about when to use an expense or items, check out this article: Enter bills in QuickBooks Desktop.

Here's how to create an invoice:

See this article for more information about tracking customer transactions: Create an invoice in QuickBooks Desktop. Then, follow the outlined steps in this article when recording customer payments: Record the invoice payment.

Let me know if you have further questions about reports and recording transactions in QuickBooks. I'm always here ready to help! Have a wonderful day!

Thank you. I submitted the feedback. For my second question; i do not want to bill the items on an invoice. I just want a way to enter several items specific to a customer job and a price so they show up on the customer income detail. I do not want them to be part of a credit or bank account. They will have been entered as a bill and paid in bulk. I also do not want to go to the extra work of creating and tracking inventory. Would a journal entry be a way to do this?

Hi there, @BrockB88. I can see the importance of tracking all the happenings in your business.

When you create a Journal entry in QuickBooks, it only affects accounts, not items. To know some reasons when to make a journal entry, see the information below:

In your case, I suggest consulting your accountant or tax professional for guidance. They can provide more expert advice in dealing with this concern. You can use our Find an Accountant tool if you don't have one.

If you need tips and related articles when managing your account in the future, feel free to visit our Community website for more insights.

If you have any more questions or concerns, please don't hesitate to comment below. Have a good rest of your day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here