Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Issue: When I am creating an invoice with the discount, this discount is linked to the "Other long term liabilities" and not deducted from the Revenue.

I tried using the Accountant Tool for reclassifying, but that does not allow me to do so.

Question: How do I correct this issue? Also why did this happen in the 1st place?

I would really appreciate help on this matter.

Hey there, Amal Saleem.

Let me help you go over to your invoices and have these discounts corrected. The reason why it's happening is you might using an incorrect account for the discount.

To correct this, you'll need to change the account linked to the service item through the Account and Settings section.

However, if you've created a discount item, you can modify the account through the Products and Services.

However, this is not a retroactive process. You'll need to delete and re-create those invoices whose discounts are deducted from the revenue.

You can give discounts to your customers in fix price or a percentage discount, see the following articles for your reference:

If I can be of help while working in QuickBooks, feel free to let me know by adding a comment below. I'll be more than happy to assist you. Have a good one, Amal Saleem!

Hello @Rose-A

Thank you for your reply!

I realized that the discount account was not linked to the service item through the Account and Settings section. I didnt want to add discount as another line item but wanted to show on the discount field. And you answer help resolve my issue. :)

Thanks for getting back to me, Amal Saleem.

I'm glad I came across your post and was able to address your concern.

Know that you can always visit our Help Articles page for QuickBooks Accountant Online in case you need some reference for your future tasks.

The Community is always in your corner if you ever need assistance again in the future. Take care.

Good Morning, I am having a similar issue. Here's my scenario: In a Restaurant there are often times that we use cash to run to the store for smaller items. When I invoice the Restaurant (there are 3 different ones under one company) I need to reduce the invoice by the amount of the cash receipt. I assumed discount, however, It is not tracked on the GL (which should be Purchase expense..) Can you help me figure out how to track these receipts in the invoice?

I appreciate any help I can get.

Veronica

I'm here to ensure you're able to track these cash receipts in your invoice, @TheLittleGrille.

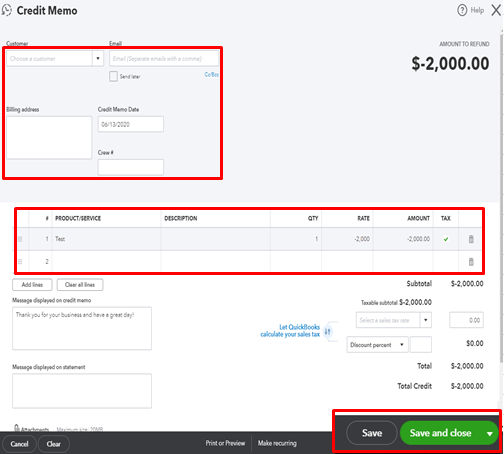

You have two options on how to record them in QuickBooks Online (QBO). First, you can create a service item with a negative value and use an expense account. Second, you can use a credit memo with a negative amount. This way, its amount will deduct from the total invoice value once applied and you can track it in your General Ledger (GL).

Let's start on the first option. To create a service item, here's how:

For the second option, follow the steps below on how to make a credit memo:

For more info about credit memo in QuickBooks Online (QBO), please refer to this article: Understanding credit memo in QBO.

Once done, you can now choose which option you prefer. Then, you're all set applying the negative amount to your invoice.

Also, I've got a great resource that you can use to gain more insights on how to customize your invoices in QBO. This way, you're able to personalize its formats and info so it becomes more appealing to your customers. Please read through this article for more details about it. It contains the steps on how to create and design your invoice templates, etc.: How to customize my invoices in QBO?.

I'm around the Community if you need more help with managing your invoices in QBO. Just leave a comment below and I'll get back to you. Take care and stay safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here