Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have a customer that transferred money to a trust account. How do i set an account for it? what do i select as account type and detail type?

Any ideas how to do it? can someone help me please

Hello, kobiadato1603.

Here’s how to create a trust account in QuickBooks Online:

It’d still be best to consult your accountant to create the account properly.

Thanks for dropping by.

For trust accounting, you need to be able to answer the following 'tests' -

1) Does the trust bank account balance match the trust liability account balance (as of any given date)?

2) Do you have a report listing each client's trust balance, the total of which equals the trust bank account balance (as of any given date)?

3) Do you have a detailed ledger, for each client, which shows the specifics of the ins and outs of the trust monies (as of any given date)?

All of the above can be accomplished using QuickBooks (PC or Mac), but specific procedures (see below) need to be followed and reports need to be created to meet the required standards.

I do not recommend using QuickBooks Online for trust accounting, due to the reporting limitations of that program.

If you do want to use QBO, you need to use the PLUS version so that you can associate client monies (and costs, if applicable) on every applicable transaction.

Also, I do not recommend using the bank feed in QBO for the trust account, since every transaction needs to be posted as of actual date, not cleared date, and associated with the client name.

Trust accounting in QuickBooks is a little tricky and needs to be tracked using specific procedures in order to get good reporting for the Funds Held in Trust (escrow) detail by client.

Here is my general procedure for tracking trust accounts in QuickBooks -

Deposit the retainer/settlement check into the Trust/Escrow bank account, using a Funds Held in Trust (Escrow) liability account with the client name in the name field. I do this directly in the Make Deposit form, but you can enter a sales receipt, using an item which points to the liability account.

Then, write checks for any disbursements of those funds, using the Funds Held in Trust (Escrow) account on the expense tab of that check - with the client name in the name field on that line. Or, if you want the detail of how those disbursements are made, create separate items, all pointing to that account, to indicate what that 'paid out' is for - Insurance, taxes, fees, etc.

Then, if applicable, invoice the client. . .for the professional fees (time or flat fee billings) and any advanced costs (previously paid out of the operating account) as separate items. . .

Then, cut a check from the Trust/Escrow bank account to the business (law firm, or?), using the Funds Held in Trust (Escrow) account on the expense tab of that check - with the client name in the name field on that line.

Then, 'Receive payment', using the client name, and attach that payment to the open invoice.

Then, deposit the funds into the operating checking account, either directly from the payment, or via Undeposited Funds.

I have created a group of memorized reports to show the client trust activity and balances to use when reconciling/reporting client balances and/or the bank statement. These provide the necessary 3-way reconciliation (as of any given date):

Trust Bank = Funds Held in Trust (liability) = Total of individual Client Fund Balances, with ledger detail

These are two completely separate areas of your business and the transactions need to be recorded as such. . .so much so that some law firms track their trust accounting in a separate QuickBooks file (although I don't see the need for that myself).

Note: There is no way to automatically show the trust balance on an invoice. You can, however, create a custom field, or enter a line in the description field, to notate the remaining trust fund balance. The amount will have to be manually entered on each invoice. If you put the amount remaining in the memo field, it won't print on the invoice, but will show up on statements and in the customer center.

____________________________

Review the above procedure(s) step by step and confirm that this meets your state's regulations and reporting requirements.

If you still need help, I suggest that you contact someone directly for assistance.

You can search www.findaproadvisor.com if you want someone local.

Also - many of us work remotely and can be contacted via the info on our websites or profiles.

I hope this helps,

Laura DWhat version of QB should one have to do so?

Hi there, @Treasur2.

It’s nice to see you here in the Community. Allow me to join the conversation and answer your question about the version of QuickBooks you need to create a trust account.

The steps shared by my colleague are for QuickBooks Online. All QBO versions have the ability to create an Other Current Liabilities account with Trust Accounts as the detail type.

If you’re using QuickBooks Desktop, follow the steps below to set up this account.

Check out this article for more information: Create, edit, or delete account in QuickBooks.

That should answer your concern for today.

Reach out to me if you need anything else, I’m more than happy to help. Take care!

So glad you asked and there are lots of good answers, here. At LeanLaw, we made some videos about how to do IOLTA trust accounting with QuickBooks Online alone and with QBO + LeanLaw (in the QB App Store). Here is the QBO stand alone video: https://youtu.be/iclN4_2TMME Here's the QBO + LeanLaw video: https://youtu.be/vB1B3VY2CeQ And here's the post with both of them together: https://www.leanlaw.co/chart-of-accounts-trust-accounting-qbo-video/ The post has all the instructions written, if you prefer your information that way. And check out LeanLaw. We've put a lot of thought into streamlining trust accounting so that it's easy on the accounting pro and you can even automatically put the trust balance into the invoice. www.leanlaw.co

We appreciate you joining in this thread, gulfsidebooks.

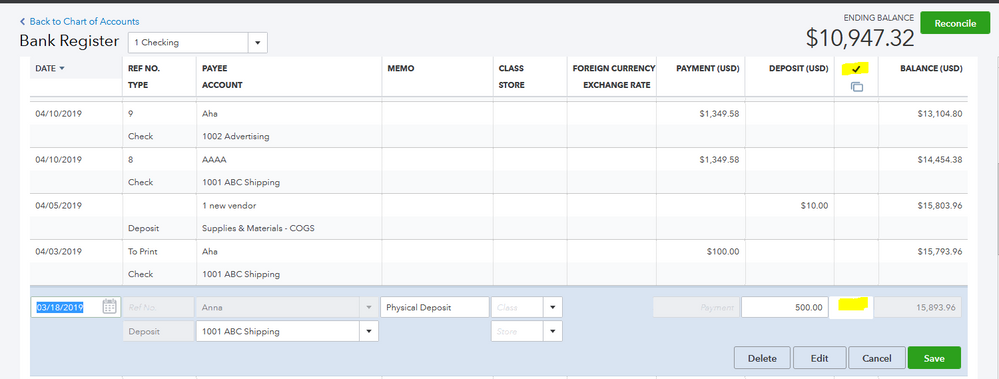

You can correct the deposit posted in the Operating account by editing the transaction in the register. Then, link the deposit to Trust account.

For more details, you can follow the steps below:

The correct amount will show in the balance sheet as long as you're not selecting other payments to be included in the deposit.

You can check out this article for more details about managing and recording bank deposits: Record and Manage Bank Deposits in QuickBooks Online.

If the deposit is matched to the downloaded transaction, you'll need to unmatch it first before you can change the account.

If the transaction is already reconciled, I'd suggest consulting your accountant for advice before editing it.

Just hit the Reply button if you need anything else with bank deposits. I'm here to help.

Thanks for commenting back in this thread, @gulfsidebooks.

We don't advise moving amounts that have been reconciled for it will mess up your accounting. You'll have to unreconcile it first. Once done, transfer the money and reconcile it again.

Here's how:

Once done, you can create a bank transfer to move the money:

Lastly, reconcile the correct bank again. Just follow the first instruction, but the status of the transfer should be R (reconciled).

For further details, you can refer to this article: How do I clear, unclear, reconcile or unreconcile transactions?.

In case you need tips and related articles in the future, visit our QuickBooks Community help website for reference: QBO Self-help.

Keep me updated in the comment section if you have follow-up questions about banking. I'll be around to help you more. Wishing you all the best!

It's nice to hear back from you, @gulfsidebooks.

You are very much welcome with the steps. I'm happy I came across your post and was able to address your concern. Should you have any other questions that I can help you with, feel free to mention me on your posts.

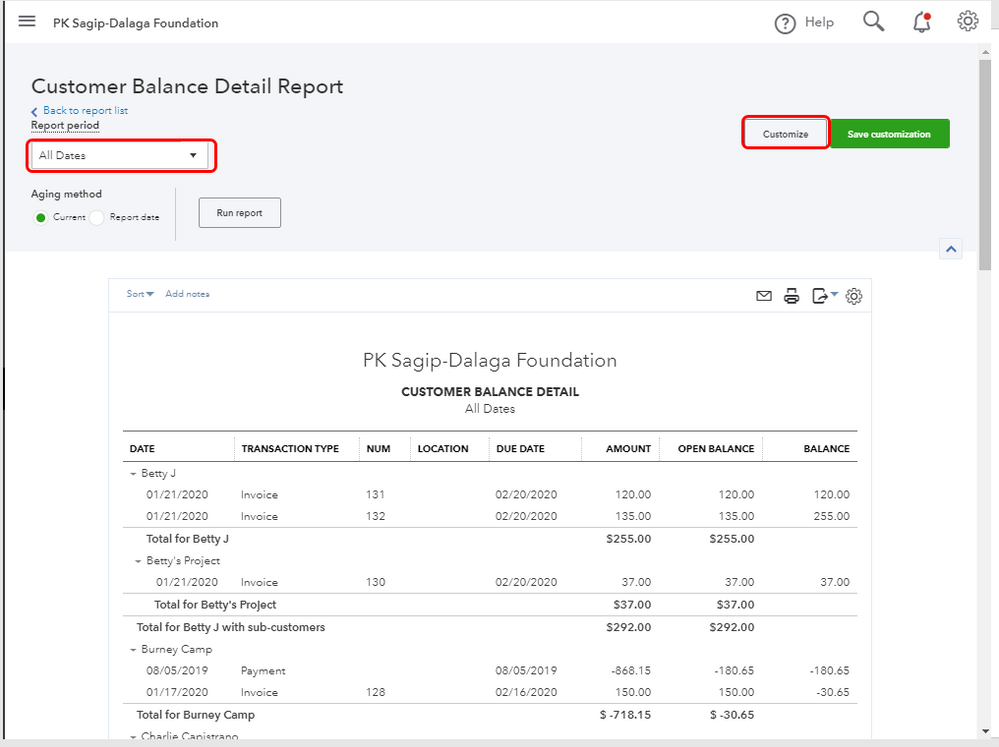

Which reports in qbo do use to get client activity balances at any given time?

Hello, Jaimee.

You can pull up and run the Customer Balance Detail report in QuickBooks Online.

Here's how:

The following resources can help guide you more in customizing a report in QuickBooks:

You can always get back to me if you have additional questions about QuickBooks reports. I'd be happy to lend a hand.

I appreciate you following the steps provided by my colleague, Beryl.

Thank you for the attached image on your post, it helps me identify that you're using the Quickbooks desktop. Yes, you are definitely on the right screen. Under the Account name box, you have to manually enter the account name which is Trust Account. That is the reason why you don't see it as a dropdown option.

You can refer to the steps above posted by @KhimG.

Also, you can create, edit, or delete account in QuickBooks Desktop.

Feel free to tag me for additional questions, have a good day!

Does QB Desktop offer a program specifically for Trust accounts. I am setting up my account separate from our checking account and need to make sure I get the accounts, sub accounts and entries, etc. correct.

Thanks for joining the conversation, Legaleagle2020.

At this time, QuickBooks Desktop doesn't specifically offer a program for Trust account but you have the option to set them up. Here's how:

Additionally, I want you to get the most out of QuickBooks for your business. You can check some articles that are designed to help you get acclimated to the software. They can be accessed at the following link: QuickBooks Tutorials.

Hit the Reply button if you have other questions about QuickBooks. I'll do whatever it takes to ensure your concerns are addressed. Enjoy the rest of your day.

I have had no luck finding an answer and I hope you can help.

Here is the transaction.

I receive funds from a client that I deposit into a savings account which I have identified as a Trust Account per other instructions on this forum.

I then need to reimburse the funds to the client. Becaue the Trust account has no checks, I transfer the money to my check account then write a check to the client to refund them. I might even write two checks: one to apply the funds to an invoice and a second transfer and check to refund the balance.

On first entering the first check deposit into the Trust Account I character it as Other Liability. On transferring the funds it becomes a deposit to the Checking Account. There is a risk the "deposit" will become "income" on a final P&L as it cannot be transferred as an Other Liability.

It was so complicated that I changed my Trust Account nad opened a checking Account to hold those funds so I could write checks back to the client and also to myself to pay invoices. HOWEVER, when I transferred the funds from the Trust Account (as distinct transfers assigned to the relevant client) to the new Checking Account it is essentially a null event. Not income and not a second liability.

I do not know how to characterize these transfers so they do not show up as income unless any of it is income (applied to an invoice). Help! attached are screenshots and explanation of what I've done and where I run into trouble

Hello,

I have a trust account with the sale of a home. The home sold for 400,000 but there are closing cost I need to capture. I have set up a fixed asset account for the sale of the home after closing cost but realize I need to capture the sale price in its entirety. What account should I add it to since the only cash that the bank account was opened with was the sale less the closing cost.

Thanks in advance

@LauraDion wrote:For trust accounting, you need to be able to answer the following 'tests' -

1) Does the trust bank account balance match the trust liability account balance (as of any given date)?

2) Do you have a report listing each client's trust balance, the total of which equals the trust bank account balance (as of any given date)?

3) Do you have a detailed ledger, for each client, which shows the specifics of the ins and outs of the trust monies (as of any given date)?

All of the above can be accomplished using QuickBooks (PC or Mac), but specific procedures (see below) need to be followed and reports need to be created to meet the required standards.

I do not recommend using QuickBooks Online for trust accounting, due to the reporting limitations of that program.

If you do want to use QBO, you need to use the PLUS version so that you can associate client monies (and costs, if applicable) on every applicable transaction.

Also, I do not recommend using the bank feed in QBO for the trust account, since every transaction needs to be posted as of actual date, not cleared date, and associated with the client name.

Trust accounting in QuickBooks is a little tricky and needs to be tracked using specific procedures in order to get good reporting for the Funds Held in Trust (escrow) detail by client.

Here is my general procedure for tracking trust accounts in QuickBooks -

Deposit the retainer/settlement check into the Trust/Escrow bank account, using a Funds Held in Trust (Escrow) liability account with the client name in the name field. I do this directly in the Make Deposit form, but you can enter a sales receipt, using an item which points to the liability account.

Then, write checks for any disbursements of those funds, using the Funds Held in Trust (Escrow) account on the expense tab of that check - with the client name in the name field on that line. Or, if you want the detail of how those disbursements are made, create separate items, all pointing to that account, to indicate what that 'paid out' is for - Insurance, taxes, fees, etc.

Then, if applicable, invoice the client. . .for the professional fees (time or flat fee billings) and any advanced costs (previously paid out of the operating account) as separate items. . .

Then, cut a check from the Trust/Escrow bank account to the business (law firm, or?), using the Funds Held in Trust (Escrow) account on the expense tab of that check - with the client name in the name field on that line.

Then, 'Receive payment', using the client name, and attach that payment to the open invoice.

Then, deposit the funds into the operating checking account, either directly from the payment, or via Undeposited Funds.

I have created a group of memorized reports to show the client trust activity and balances to use when reconciling/reporting client balances and/or the bank statement. These provide the necessary 3-way reconciliation (as of any given date):

Trust Bank = Funds Held in Trust (liability) = Total of individual Client Fund Balances, with ledger detail

These are two completely separate areas of your business and the transactions need to be recorded as such. . .so much so that some law firms track their trust accounting in a separate QuickBooks file (although I don't see the need for that myself).

Note: There is no way to automatically show the trust balance on an invoice. You can, however, create a custom field, or enter a line in the description field, to notate the remaining trust fund balance. The amount will have to be manually entered on each invoice. If you put the amount remaining in the memo field, it won't print on the invoice, but will show up on statements and in the customer center.

____________________________

Review the above procedure(s) step by step and confirm that this meets your state's regulations and reporting requirements.

If you still need help, I suggest that you contact someone directly for assistance.

You can search www.findaproadvisor.com if you want someone local.

Also - many of us work remotely and can be contacted via the info on our websites or profiles.I hope this helps,

Laura D**The biggest problem with using QBO for trust accounting is that your auditor will be requesting bank reconciliation reports, which you cannot get from QBO. Yes, you can get bank rec reports, but they will not be updated with any changes that have happened to your data since you did the bank rec, which in 'real life' is an unreasonable expectation.

Hello,

Hoping you can help me please. How do I do the steps that Laura Dion outlined in her response in QuickBooks Desktop, please? Can you share the detailed steps of how to set up the Trust account info and record deposits, payment of expenses, payout to the firm, etc in QBDT. Please be specific and detailed as I am a newbie.

Thanks so much.

Hello,

Hoping you can help me please. How do I do the steps that Laura Dion outlined in her response in QuickBooks Desktop, please? Can you share the detailed steps of how to set up the Trust account info and record deposits, payment of expenses, payout to the firm, etc in QBDT. Please be specific and detailed as I am a newbie.

Thanks so much.

Good day, @virtualbizss,

Don't worry, I'll try to replicate the things discussed by LauraDion for you to set it up in your QBDT company file.

Before anything else, create a liability account using the steps shared by KhimG. For the next step, create a deposit or sales receipt for the retainer/settlement check into the Trust/Escrow bank account.

I will outline the steps below and select the method you want to use.

Bank Deposit:

Sales Receipt:

Now, write a check for the disbursements by going to the Banking menu then Write Checks. Use the Funds Held in Trust (Escrow) account for this. If you need to invoice customers for fees, create an invoice for it. The steps to create an invoice and apply a payment is found here:

Next, cut another check from the Trust/Escrow bank account to the business, using the Funds Held in Trust (Escrow) account on the expense tab of that check. Add the client name in the name field on that line.

Let me know if I miss something or if you need further guidance with the steps. I'll be right here if you need anything else. Have a good one!

Thank you Jen_D. I think I am getting a little confused with semantics/terminology. When you refer to the "Funds Held In Trust" acct, is this the same bank accout as the checking Client Trust Acct?

Thank you, Jen_D,

I think I am a little confused on a couple of things:

1. It looks like you suggest making a deposit before creating a sales receipt? IDoes that matter? Is that ok and doesn't mess up anything behind the scenes?

2. I think I am a little confused on terminology/semantics -

"Now, write a check for the disbursements by going to the Banking menu then Write Checks. Use the Funds Held in Trust (Escrow) account for this" Is this the same as the Client Trust Liability account (other current liability) in my chart of accounts?

3. "Next, cut another check from the Trust/Escrow bank account to the business, using the Funds Held in Trust (Escrow) account on the expense tab of that check. Add the client name in the name field on that line"

Is this the same the Client Trust Checking Account (Bank) that I have in my chart of accounts?

Thank you, for responding.

I think I am a little confused on a couple of things:

1. It looks like you suggest making a deposit before creating a sales receipt? IDoes that matter? Is that ok and doesn't mess up anything behind the scenes?

2. I think I am a little confused on terminology/semantics -

"Now, write a check for the disbursements by going to the Banking menu then Write Checks. Use the Funds Held in Trust (Escrow) account for this" Is this the same as the Client Trust Liability account (other current liability) in my chart of accounts?

3. "Next, cut another check from the Trust/Escrow bank account to the business, using the Funds Held in Trust (Escrow) account on the expense tab of that check. Add the client name in the name field on that line"

Is this the same the Client Trust Checking Account (Bank) that I have in my chart of accounts?

Thanks again for responding.

Thanks for coming back for more support, @virtualbizss. It's my pleasure to answer all your questions today.

The steps shared by my peer @Jen_D above are the correct process to achieve your goal of setting up the trust account inf and recording the transactions.

Escrow in banking terms refers to a bank type of account used to hold funds from a lender. You can either set this up as a liability or an asset account depending on how you want to post your records.

To make sure your books are accurate, I'd recommend seeking help from a professional accountant in setting up this account. They can guide you with the specific type that fits your business.

For future reference, read through this article: Chart of accounts in QuickBooks. It helps you learn about the different account types available in the Chart of Accounts.

Visit again and post some more of your concerns here in the Community. I'd be happy to answer your next posts.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here