Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi 307,

It's good to see you here in the Community.

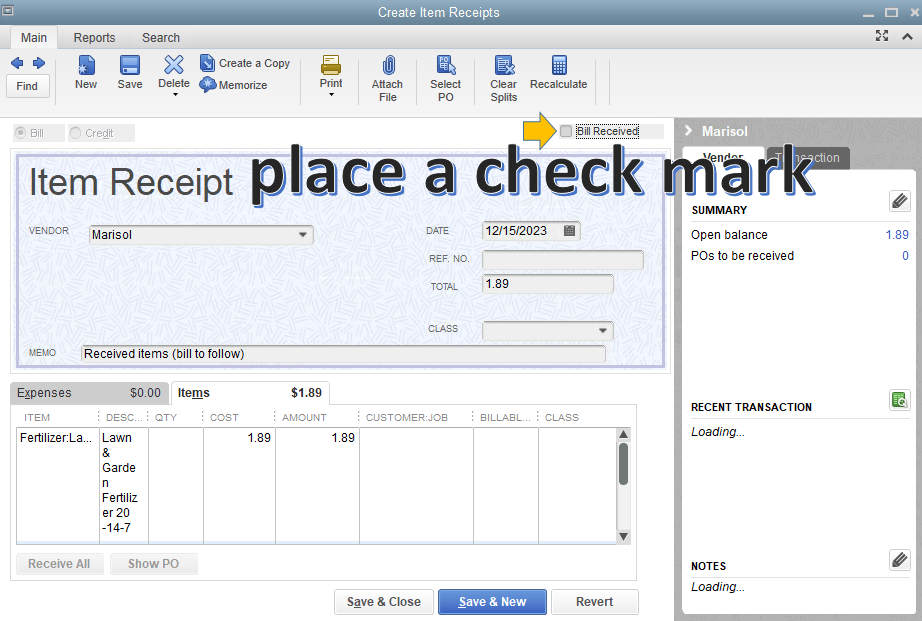

If you find that you have aged item receipts and have paid the vendor, you can check the Bill Received box to change it to the bill. Here's how:

You might want to check this thread for additional information: Item Receipt.

Also, you can receive inventory with or without a bill in QuickBooks Desktop after you record a purchase order. Please check this article for your future reference: Receive Inventory.

Let me know if you need anything else. I'll be right here to help.

I Have old receipts from years prior to 2019. If I click create bill won't it use the old date like 2018. Will this through off prior years numbers and they won't match the tax return?

Hi there, @Joey.

When creating a bill from your old receipts, the date used will default to the current year. However, you have the option to edit it. Please know that doing this will affect your balances and tax returns.

To record your old receipts properly, I suggest contacting your accountant. They'll be able to provide you the best course of action for your business and help you with the tax returns.

I'm also adding here a link about entering bills in QuickBooks Desktop for your reference: Enter bills

I'd be glad to provide further assistance should you have any questions. Take care.

Does changing the item receipt to a bill affect inventory in anyway? I have some extremely old item receipts and I just need to have them converted to bills to help me clear out the Bill Pay. The item receipts were paid without converting to Bills, and they were paid by just writing a check and not using the Bill Pay module.

Thanks!

Hi there, @CatDet5627.

Please allow me to join the thread and help share information about changing the item receipt to a bill.

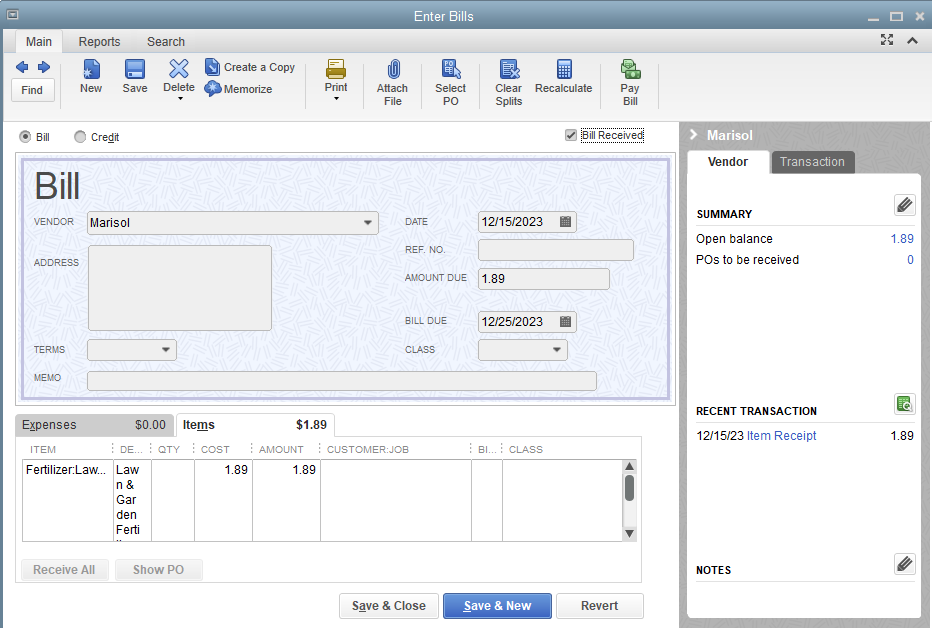

When the item receipt already paid, it won't affect your inventory when you convert it to the bill. If you have Item Receipt, you see it has a box to check-mark to become the bill same transaction, different status, and never change the date. Let me walk you through how.

Once done, you can run a report to double check it.

For additional information on this, I recommend the following article:

Just incase, in the future you may want to read about restrictions when turning on the Enhanced Inventory Receiving (EIR)

If you have any other questions, don’t hesitate to comment below. Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here