Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello jabessa1958,

Thanks for reaching out to Community!

You can create a cash account in the Chart of Accounts. It's the same Category type as a bank account, but you can name it Cash on Hand or Petty Cash, anything you would like to use to associate it. Here's an article that'll guide you through the process:

https://community.intuit.com/articles/1145793

When entering expenses paid by cash, just choose the cash account you created in the Account field beside the Vendor's name. Here's another article for more details:

https://community.intuit.com/articles/1583125

Fill me in if you have further questions.

Hello jabessa1958,

Thanks for reaching out to Community!

You can create a cash account in the Chart of Accounts. It's the same Category type as a bank account, but you can name it Cash on Hand or Petty Cash, anything you would like to use to associate it. Here's an article that'll guide you through the process:

https://community.intuit.com/articles/1145793

When entering expenses paid by cash, just choose the cash account you created in the Account field beside the Vendor's name. Here's another article for more details:

https://community.intuit.com/articles/1583125

Fill me in if you have further questions.

Thank you VivienJ, I encountered this same question and found this post, it was exactly what I was looking for.

Very useful information for people, I think this is what everyone needs.

Hi

I hope I can follow up on this. I want my team to record their expenses ongoing throughout the month and then I will use their records to make a bank payment to them. Could this reconcile in QuickBooks? Thanks. Rebecca

Thanks for joining in on the thread, Rebecca.

Since the expenses of your team are reimbursable, you might want to set them up as a vendor. You can create individual vendor profiles or one for the whole team. Here's how:

Reimbursements to your team are expenses to your company. You can record the reimbursements as Expense or Bill:

If you use Bill, you still need to create a bill payment:

You might want to check out this article on how to your pay pays online: What is Online Bill Pay?.

I'd also recommend reaching out to your accountant when recording your team's expenses. They might have a better way of doing this.

After recording your team's expenses, you can already reconcile the account.

Feel free to let me know if you have follow-up questions about this. Have a great day!

Thanks for getting back and providing detailed information, Rebecca.

You can let your employee record his/her expenses by adding him/her as one of the users. The least access rights you can provide is Limited to Vendors. You might want to review this article before adding them: Understanding User Types and Permissions.

Take note that if you give this access rights, your employee can also do the following aside from creating bills:

You can also see what the user can and can't do upon selecting the Limited to Vendors access rights.

Here's how to add your employee as a user:

Once he/she accepts the invitation, he/she can already record the expense as Bills. Then, you'll be the one to record the bill payments.

Meanwhile, I'd recommend reaching out to your accountant again on how your employees can record their car travel. They know what's best for you and your books.

Let me know if you need anything else.

I have been looking everywhere for information on this topic for Quickbooks Desktop pro. I am wondering how to enter a bill which I paid with personal cash. I created a "cash" bank account, and entered the correct vendor and chose the cash bank account to pay from, however this makes my "cash" bank account a negative of the amount of the bill. Is this OK?

Hi there, quinn1.

I found a similar post on how to record this type of transaction in QuickBooks Desktop.

Let me share this link with you so you can follow the steps given by one of our Established Community Backers: https://quickbooks.intuit.com/learn-support/en-us/banking/business-expense-paid-with-personal-funds/....

Don't hesitate to visit us again if you have other questions.

The article you provided gave excellent instructions for what I was looking to do. I had a batch of transactions which were paid with personal funds. I recorded each expense into the expense lines on a no-named check, under each expense i entered another line with matched negative amounts, coming from Owners Equity Contributions account.

Next, I have a bank feed transaction to categorize, where I transferred this amount into my personal checking account as a reimbursement. Wondering the correct way to do so. I find articles on the topic, but i have a hard time finding any articles related to QB Desktop. I appreciate your time!!

Hey- I'm not sure if I create an expense when it was paid by cash in the receipts review. Does the expense only apply to my checking account that is linked- am I messing up the numbers by creating an expense after reviewing and no expense is found?

Hi there, @carrollbrothersgrading.

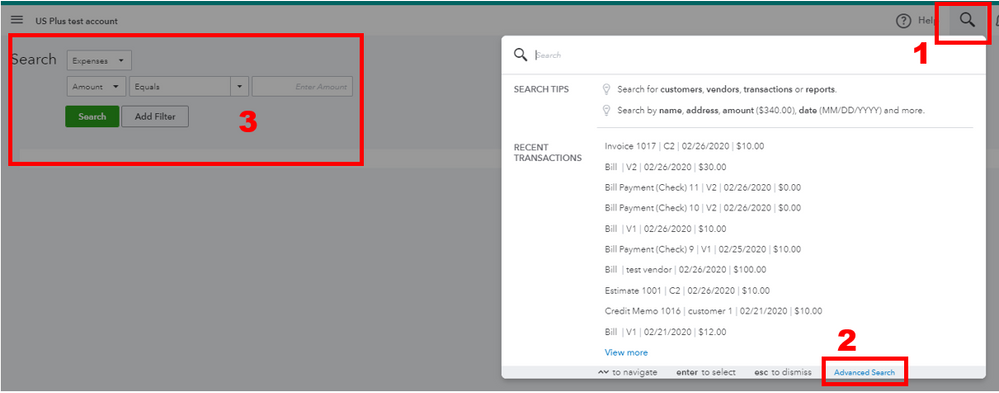

Also, you'll want to look for that expense using the advanced search feature in your QuickBooks Online (QBO) account. This way, you'll find the expense that matches your receipts. Here's how.

Here's an article you can read for more details: Search for transactions.

You can also go to your Audit Log and look for the expense transactions.

I'm also adding this great article in case you want to learn how reconciliation works in QBO: Reconcile an account in QuickBooks Online.

You're always welcome to leave a comment below if ever you have other concerns. Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here