Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowSolved! Go to Solution.

Hello, @sflaa1.

Thank you for the feedback on determining what A/R account to use when sending invoices.

In QuickBooks Online, there's only one default A/R account that everything goes to. If you're needing more than one account, a journal entry will be necessary when going from one A/R account to another.

I'm going to provide some steps below on how to create a journal entry:

1. In the left menu bar, select the Plus + icon.

2. In the column Other, choose Journal Entry.

Also, there's a link below with some additional information about journal entries as well:

I'm only a comment away if you have anymore questions. Have a great rest of your day!

You can not do that in QBO, in QBO there is one a/r account that is used. Even though QBO allows you to create more than one a/r or a/p account, the interface will not allow their use

Hi there, sflaa1.

We have two options you can take to determine the Accounts Receivable (A/R) account to use when invoicing. And I'd happy to share them with you.

Before we proceed, please know that your default and only A/R and A/P accounts are the ones that were created when you set up your company in QuickBooks Online. Thus, these default accounts will show when running a report.

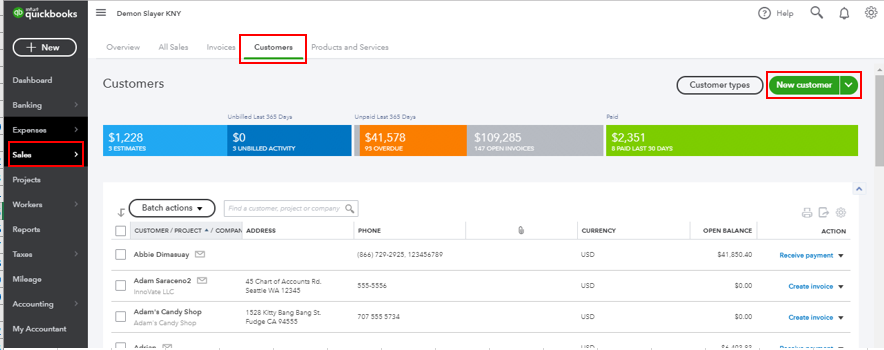

Your first option is to set up a parent and sub-customers to group your open receivables. This way, it'll allow you to group and sub-total your open receivables by the parent customer.

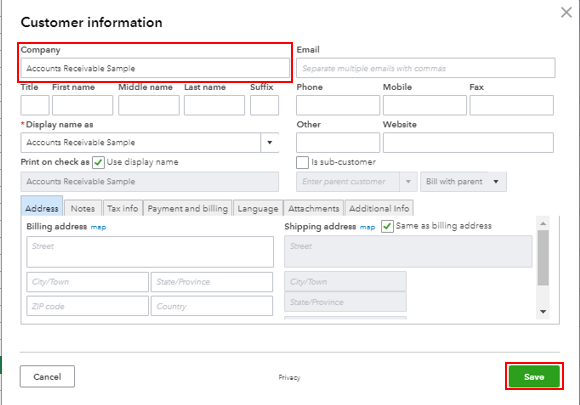

Here's how to create parent customers:

Then, you need to identify which customers are sub-customers of the parent you created.

Once done, you can run and customize any customer reports by the associated parent accounts to determine your open receivables.

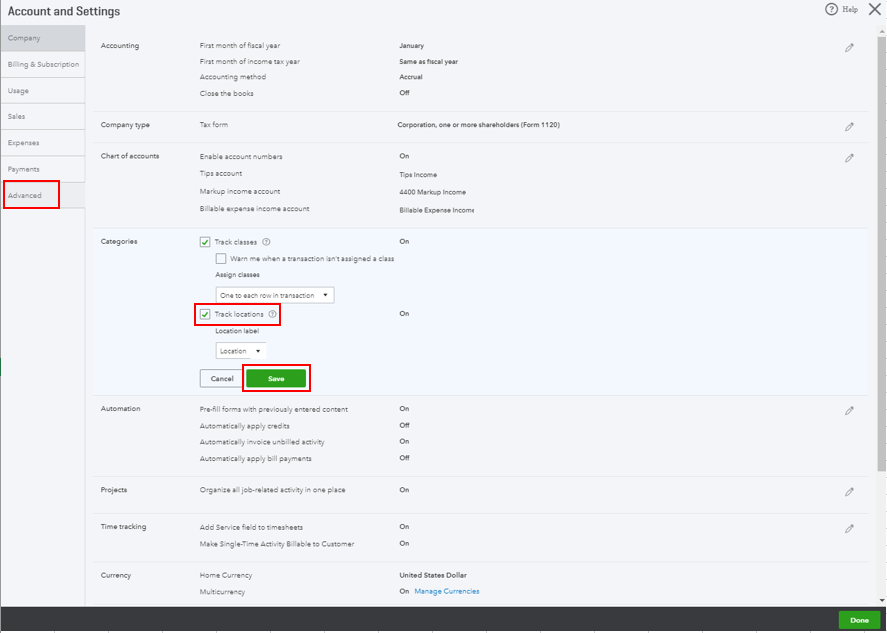

While your second option is to use the location tracking feature to group your receivables. Firstly, let's turn on the feature. Here's how:

Then, go to the All Lists page to set up different locations to use. Once done, you'll have to make sure that all transactions are assigned to a location associated with an Accounts Receivable type. And run the Customer Balance Detail report and customize it by location.

Here's an article you can read on for more details: How to Group Accounts Receivables Account Types.

However, I still encourage seeking help with your accountant. He/she could guide you which option to take based on your recording practice and business needs.

You might also want to check out this article to learn how to create memorized A/R reports with email reminders.

Just hit the Reply button below if you have additional questions with QuickBooks. I'm always here to help.

Thank you for your thorough explanation. Let me give you a little more background. I am using QBO to manage the finances of 3 separate condominium associations. I have set up a single company which I'm using as a parent company. I have set up 3 separate divisions within this company. All customers have been set up as members of 1 of these 3 locations. I ran some test transactions to see the result, and everything looks great on the reporting and the 3 are segregated by selecting the division I want to see. The only issue is, the balance sheet for each of the 3 divisions shows the same A/R account. I understand that this is what the uses as the default account. I'm thinking of a possible solution for the balance sheet. Make a journal entry transferring the appropriate amounts from the default A/R account to the ones that I set up for each division. Will this work without having any effect on A/R aging and similar reports? Thanks for your guidance.

Hello, @sflaa1.

Thank you for the feedback on determining what A/R account to use when sending invoices.

In QuickBooks Online, there's only one default A/R account that everything goes to. If you're needing more than one account, a journal entry will be necessary when going from one A/R account to another.

I'm going to provide some steps below on how to create a journal entry:

1. In the left menu bar, select the Plus + icon.

2. In the column Other, choose Journal Entry.

Also, there's a link below with some additional information about journal entries as well:

I'm only a comment away if you have anymore questions. Have a great rest of your day!

Thank you Kendra. I will use the Journal Entry method to move the A/R from the default account to the ones that I have created for the 3 divisions. Once we are "live" (starting Jan 1) I will do this and will reach out again if I run into any difficulties.

Happy Holidays to you and your family. Best regards, Steve

I'm so glad that we were able to provide you with the best information to help you determine the A/R account when invoicing, @sflaa1.

We're here to have your back, so if you have any other questions please feel free to comment below. Have a great weekend!

Ok. So what you're saying about having to make journal entries to different A/R accounts

shows that QBO is, yet again, an inferior program to desktop...

really?

Really?

a Journal Entry, for an action that was so easy in Desktop?

Another failure of QBO to be a real accounting program.

Who would I tak to about getting this changed?

Hello B-MUSIC-school,

I'll be sure to relay your suggestion to our product development team. That way, they can add an option to assign A/Rs to customers like in the desktop version.

As of now, we wouldn't recommend using journal entries. However, if you want to use that option, I would suggest consulting an accountant to make sure your records are correct.

You can visit our blog so you won't miss any updates in QuickBooks.

Let me know if you have additional questions about handling your receivables.

Thank you for even saying that you might have someone look at bringing QBO into 80 efficiency of the Desktop version..

You don't recommend a JE for parsing out AR accounts?

REALLY?

It was your TEAM-MATE KENDRA H who suggested that... ( Look Below)

I wish there was consistency in the "answering-team's" responses.

The help system is very poor... A simple question like "why will my audit log only show 388 entries" can't get an answer.

**********************************************

Hello, @sflaa1.

Thank you for the feedback on determining what A/R account to use when sending invoices.

In QuickBooks Online, there's only one default A/R account that everything goes to. If you're needing more than one account, a journal entry will be necessary when going from one A/R account to another.

I'm going to provide some steps below on how to create a journal entry:

1. In the left menu bar, select the Plus + icon.

2. In the column Other, choose Journal Entry.

Also, there's a link below with some additional information about journal entries as well:

It's our priority to give you an accurate answer to your concerns, @B-MUSIC-school. And I'm here to make it up with you.

Creating a journal entry in QuickBooks is considered as the last resort if users won't agree with the default accounts. Thus, journal entry for the A/R account will just transfer the balances in QuickBooks Online (QBO).

As mentioned by my peer @Kendra H, QuickBooks only have one default A/R account. When every time your customer pays the invoice this default A/R account will still be used by QuickBooks. And you'll have to create another journal entry to transfer the invoices A/R.

Most importantly, I recommend seeking help from your accountant. This way, you'll get more information and suggestions suitable for this matter.

Please let me know if you need further clarification about this, or if there's anything else I can do for you. I'll be standing by for your response. Have a great day.

IN the Desktop Version, you can assign AR accounts. We find out that QBO, is unable to do that.

This makes QBO an inferior program to the Desktop version.

(Just like custom reports are inferior in QBO)

Yes. A overall/total listing of AR is desired. BUT - if you have divisions, seeing each AR for a specific division without a 5 step report, is desirable... Easier - takes less time....

ANd KENDRA H, is the one who suggested using JE...

I am the accountant.

This is not Solved.

ANy Idea about making QBO able to do what you can in Desktop, when it comes to assigning AR accounts?

I am hard pressed to recommend QBO, at the moment.

It seems like QBO is geared to a momandpop candy store with about 5 transactions a day.

Hi - I have a different issue with multiple A/R accounts, which has shown that QuickBooks will not always post to the default A/R account. One month I needed to accrue revenue for one customer. As I had previously used the desktop version for years, I created a second A/R account called Accrued Revenue. I only used this account with a journal entry. No invoice was created. Now all of my invoices post to this A/R account, not the original default account. I did not change any customer, item, or invoice settings. How do I get my invoices to post to the original A/R account?

Thank you.

Renee

Hi - I have a different issue with multiple A/R accounts that shows that QuickBooks Online does not always post invoices to the default A/R account. One month I needed to accrue revenue for a customer. As I have used QuickBooks Desktop for years, I did what I had done inthe past - I created a second A/R account called Accrued Revenue. I only posted a journal entry to this account. No invoices were created using it. And no settings for the accounts, invoices, or items were changed. Now all of our invoices are posting to this second A/R account instead of the original default A/R account. How can I change this? I obviously don't want invoices going here.

If I had known of this limitation, I would have created the Accrued Revenue account as an asset as a workaround.

Thank you.

Renee

Hello, @Renee23.

To further check why your transactions aren't posting to the default account, I suggest reaching out to our Customer Support.

They have the tools to get into your account in a safe and secure environment and resolve this error.

You can do it by going to the Help icon at the top right of your QuickBooks Online (QBO) account. Follow the steps below:

See this article for detailed guidance: Contact the QuickBooks Online Customer Support team. For more details, you can check out this article: How to Manage Default and Special Accounts in the Chart of Accounts.

Let me know if there's anything that I can help. I'm always here to assist. Have a great rest of the day!

As of October 2020, Has there been any progress with getting QBO to allow more than one default A/R account? Is there any improved suggestion than the journal entry process?

I hope you're doing well, alison20elim.

We don't have any news to allow multiple default Accounts Receivable in QBO. Our developers might still be considering on implementing it however. Though, it would be a nice feature to have just like in the Desktop version.

Aside from using the journal entry process, you can also group your receivables through location tracking or parent and sub-customers. My colleague, Mark_R, posted the steps above. Alternatively, visit this article to learn more about the process: How to group Accounts Receivable or Accounts Payable account types.

Also, there might be a third party app that changes the default Account Receivable for invoices. Go to the Apps menu in the left panel, then look for one using the search box.

We periodically post updates related to QuickBooks Online. Visit our blog page and look for "What's new in QBO" articles to stay tuned with the new features.

If you need help managing your customers and their transactions, you can check the articles in this page.

I'm more than willing to listen if you have concerns with QuickBooks Online. Just reply in this thread and I'll be glad to help you again.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here