Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowSolved! Go to Solution.

I'll help you send your 1099s to the IRS, @springsbarb.

QuickBooks Self-Employed (QBSE) helps track your income, expenses, mileage, and tax info. However, creating 1099 forms for your contractors inside the program is unavailable.

Although, you can sign up to our E-file service (standalone) website. This way, you can add your contractor's details and file their 1099-MISC forms to the IRS.

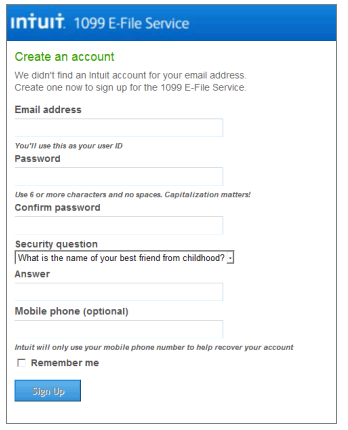

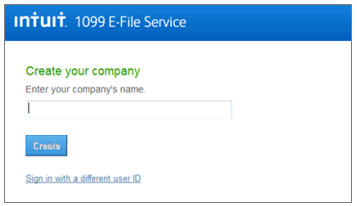

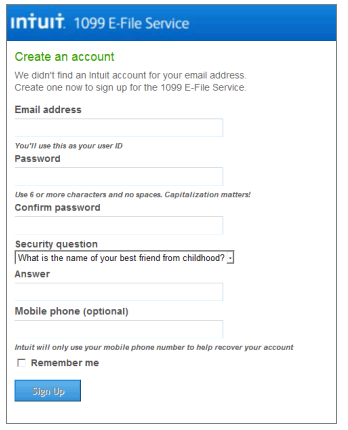

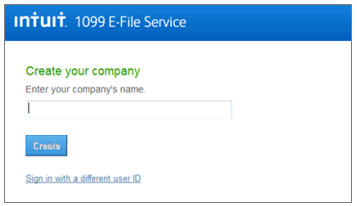

Here's how:

You can also check our 1099 E-file service fees on this link: http://payroll.intuit.com/additional-services/1099/efile-1099/.

For more details, please see this article: How to file 1099-MISC forms using an e-file service.

I'm still here if you have other questions in regards to filing taxes. Just post your questions here, I'll respond as soon as possible. Have a good day.

I'll help you send your 1099s to the IRS, @springsbarb.

QuickBooks Self-Employed (QBSE) helps track your income, expenses, mileage, and tax info. However, creating 1099 forms for your contractors inside the program is unavailable.

Although, you can sign up to our E-file service (standalone) website. This way, you can add your contractor's details and file their 1099-MISC forms to the IRS.

Here's how:

You can also check our 1099 E-file service fees on this link: http://payroll.intuit.com/additional-services/1099/efile-1099/.

For more details, please see this article: How to file 1099-MISC forms using an e-file service.

I'm still here if you have other questions in regards to filing taxes. Just post your questions here, I'll respond as soon as possible. Have a good day.

Thanks so much @ReymondO ! This is exactly what I was looking for. I appreciate your time!

hi,

I have an intuit account. However when I go thru the instructions you provided if says it did not recognize my email and asks me to sign up. However, when I fill out the form for signup, it says email is already in use.

So I am not able to proceed. Please advice.

Thanks for joining the thread, @rvrekhi.

Let me help you send your 1099s to the IRS.

Sometimes local internet cache files stored in the web can cause unexpected behavior when signing up. This can be the reason why your Intuit email isn't recognized when filling the form.

To isolate the issue, try opening the link in a private window. This browser doesn't save your local logins and password. Simply press the following shortcut keys to access this mode.

Once you're on the web, copy and open this link: https://iop.intuit.com/1099efile/signup.jsp?_ga=2.256823051.1042246564.1641251357-388741832.16406514...

Enter your information and check if you're able to create the account. If yes, go back to your regular browser and clear its cache. If you're still getting the same result, use another supported browser. The issue might steam from the browser itself.

If the issue persists, create another Intuit account. Simply go to this link to set up a new one: https://accounts.intuit.com/signup.html

This way, you can start a fresh account and enter your 1099-MISC information. Then, print or email copies to your contractors and e-file it with the IRS.

You can also check out this article for a complete guide: How to file 1099-MISC forms using an e-file service.

Just virtually tap me on the shoulder whenever you need help with 1099 forms by commenting below. I hope you're well today. Take care!

I'm working on submitting information for the 1099 and its asking for a Federal TIN. I'm a sole proprietor and don't have a TIN. The form doesn't accept my SSN. How should I proceed? ... but it works when I use the dashes. All good now. Thanks.

I am a bookkeeper who will be filing 1099s for a client who uses QB Self Employed. Will I use the clients information to create the account for the 1099 E-file service, or will I use my information?

Thank you for joining this thread, MKB2021.

You’ll be glad to know that accountants who use Intuit Online Payroll for Accounting Professionals can file for multiple clients. It includes unlimited 1099s for each one on the online payroll service. Aside from filing for current payroll clients, accountants can add 1099-only clients during the tax filing season.

If you’re not using the mentioned subscription, you have the option to use your information or the client. Also, check with them about the billing as well as the one who will receive the updates for 1099.

You can read through this resource to learn more about the Intuit E-File Service. It lists all the tasks you can do using the feature and answers to frequently asked questions (1099).

In addition, this article will guide how you prepare and file your federal 1099s if you have Intuit Online Payroll or not: Create and file 1099s.

Stay in touch if you have additional questions on how to process the tax forms. I’ll be right here ready to answer them for you. Wishing your business continued success.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here