Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowGlad you made it here, bwetherellconstr.

You got me here to help share some information about recording purchases made on credit cards and how you record payments in QuickBooks Online. Anything you buy with a debit card, credit card, online payment, or bank transfer is called an expense in QuickBooks. Please be reminded that QBO has a special type account called Credit Card type. You may use that when paying for something. I'll show you how to properly record them in QBO.

To record purchases:

Go to the (+) New and choose Expense.

Choose a Payee.

Choose an Account the money for this purchase came from.

Enter the necessarily required fields.

Click Save and close when you're done.

Once done, QBO allows you to record credit card payments. Here are the steps:

You can learn more details on how to record your payments to credit cards in this article.

Please keep me posted on the results. I want to make sure everything is taken care of for you. If you have any follow up questions, please add a comment below. I'll be glad to assist you further.

I have the sane question in Quickbooks Desktop! Costs essentially are recognized twice. Help!

Hello, newbie2this.

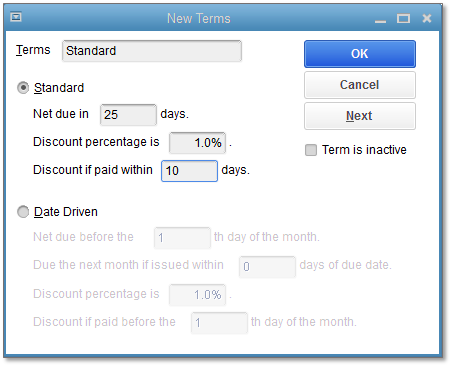

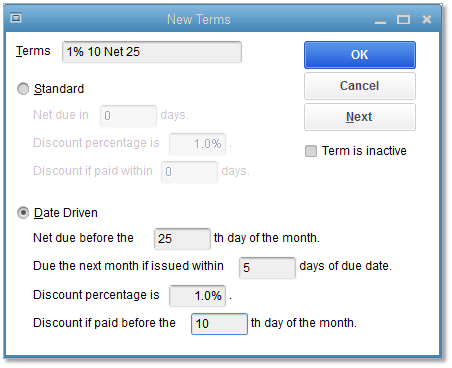

Thanks for stopping by today, I'm happy to help. What I suggest is to reconcile your accounts up to this point that way you can be sure your books are correct on record. Then you can set up payment terms so that that won't happen again.

Here's how:

For further information on the payment terms, I suggest checking out this article: Set up Payment terms.

If you have any other questions or concerns, feel free to post them below, thank you for your time and have a nice weekend.

Were you ever able to resolve this? I have the same problem. My credit card payments are showing up as an expense, essentially doubling the total in my expense ledger. The payment is paying off everything that is already registering as an expense. The "help" response is not helpful.

Thanks for joining the thread, @CookieMonster.

I want to ensure this is taken care of, but before I do, may I know what product are you using? This way, I can give you the right steps to resolve the issue.

You can also follow the steps given by @GlinetteC for QuickBooks Online and @Nick_M for QuickBooks Desktop.

I've also added this article about recording payments in QuickBooks Online: Record your payments to credit cards.

Don't hesitate to drop a comment below if you have other questions. I'm always here to help.

I use QuickBooks Online. I ended up figuring this out. The transaction was being shown as a "credit card payment" in my checking account. I had to undo the transaction in both the checking account and the credit card account. I changed the transaction to be categorized as a "transfer" in the checking account. Then I matched the transaction in the credit card account. After doing this, the credit card payment is no longer listed as a line item in my expense ledger.

Thanks for getting back to us, @CookieMonster.

You can create a Credit card credit item and choose the correct bank account where the transfer came from. Let me guide you how:

Once you selected a credit card in the line item, both the payment and the charge have the Credit Card Credit. You can read through these articles to learn more about managing your downloaded bank transactions:

Lastly, I'd recommend reaching out to your accountant to help you decide on the best route to take in recording the credit card credits you've received and choosing the accounts impacted.

If there's anything else you need from me, feel free to comment below. I'm always here to help in any way I can. Have a great rest of your day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.