Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowenter all zero's as the number

to prevent this from happening again, you should have any vendor fill out and return the IRS form W-9, and if they will not do that, find another vendor.

I also have the same issue. I tried to enter all zeros it will not allow me to save and continue. It says invalid value. What can I do?

It's great to have you here, @Andyjr2683.

@Rustler is correct! Allow me to share more details on how you can send 1099 to your contractor who doesn't have a Social Security Number (SSN).

Yes, you can enter zeros as temporary SSN. If your contractor is a non-U.S. person, there's no need to send 1099 form at all. However, you'll need them to accomplished the W-8BEN form. By signing Form W-8BEN, the foreign contractor is certifying that he or she is not a U.S. person. On the other hand, if your contractor has a Tax Identification Number or TIN, you can use this in creating and sending the 1099 form.

If your contractor cannot provide his or her SSN nor TIN by the time of filling your Forms 1099-MISC, you should leave the identification number box empty, but still submit the report to the IRS. They will be the one who will send a notice stating that the number is missing. This notice must be sent along with a backup withholding notice and W-9 form to the subcontractor.

For additional insights, you may check out this article: 1099 E-File Service: QuickBooks Online setup, troubleshooting, & FAQs.

Feel free to click the Reply button if you have other questions about preparing and filling the 1099 form of your contractors in QuickBooks. I'm always here to lend a hand.

This information is helpful. However, QB Online does not allow me to save the contractor's information without the SSN and when I put in [removed] or leaving it blank, it will say the number is invalid. So, I cannot proceed.

Hi there, @peterchanbyuh.

Thank you for joining this thread and adding some details. I can share some insights about entering the Social Security Number (SSN) in QBO.

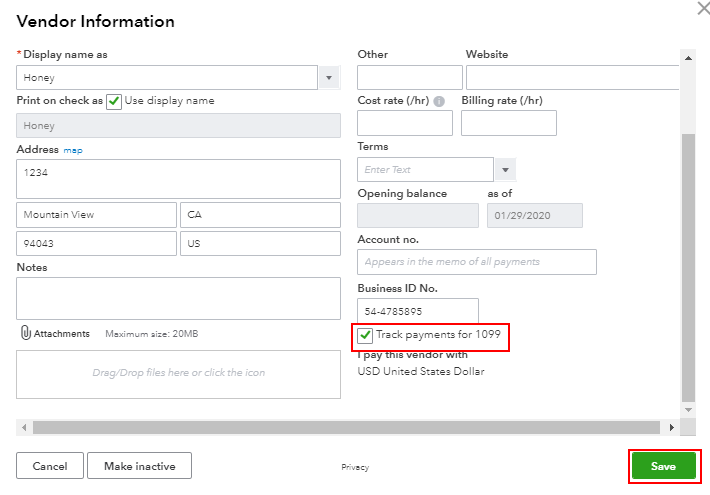

The option to enter a dummy SSN is only available on the vendor's profile. If you're already accessing or filing the 1099s, you will have to enter the correct SSN to proceed with the process and avoid receiving notice from IRS.

You have to get in touch with your vendor or let them reach out to IRS to get their SSN.

Keep me posted if you have other payroll questions for me. I'm still here to help you more. Have a nice day ahead.

Hi, I'm trying to prepare 1099's for my husband, a building contractor, to send to his subcontractors, and he doesn't have an EIN because he does not have employees. The online quickbooks program will not let me continue if I enter his social security number. How can I use this program to print the 1099 forms?

Hi Magwitch,

Your husband can enter his SSN in the company settings. That way, the number will just auto-populate when you prepare 1099 forms for his sub contractors on his behalf.

If you have an active payroll (trial or paid), you'll only see EIN in the company setting. QuickBooks thinks that you have employees and you have EIN because you have payroll. If your husband accidentally included the payroll feature in QuickBooks, he can cancel it to show the SSN option back in the company setting.

Please get back to us here if you have other questions.

Hi, thanks for answering. He does NOT have payroll--it says Canceled in red--and the only field available to him when I try to edit his company info is EIN. This is the online version of Quickbooks, Quickbooks Simple Start. When I try to enter his SSN in the field, it won't let me save it.

Please help, I have to file these by tomorrow!

Hello there,@Magwitch.

I've responded to your comment in your other Community thread and provided you other ways to resolve your problem on entering an SSN.

Here's the link to that thread: https://quickbooks.intuit.com/community/Taxes/Prepare-1099-s-with-No-EIN-Quickbooks-won-t-allow-SSN/....

Feel free to click on the Reply button if you have other concerns.

Hi. So I tried putting in the dummy tax id number for a vendor that I don't have a tax id for (they have not responded to my request for a W-9) and QBO accepted it but in the Intuit 1099 E-File service it is showing as an invalid tax id. How can I send them a 1099 without their tax id?

Hi there, @Accountant Julie,

The Invalid tax ID error in the 1099 E-File Service occurs when you assign a Social Security Number in the vendor's profile. The IRS will not accept 1099’s with SSN's formatted as XX-XXXXXXX, as it recognizes the difference between an SSN and a valid EIN.

To fix this, we recommend using a valid Tax ID for vendors eligible for 1099 reporting. For contractors who don't have these digits, they can use their SSN entered with three fields separated by hyphens: XXX-XX-XXXX.

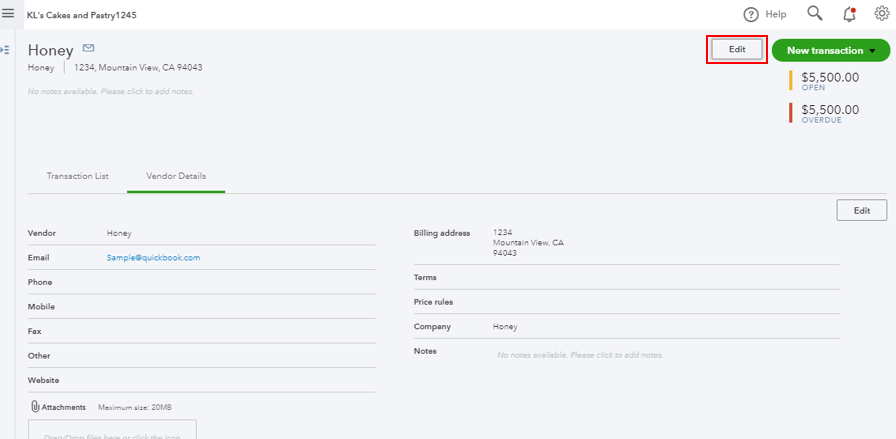

Here's how:

I also recommend seeking a tax advisor or the IRS to verify this accordingly. To avoid any issues with the tax filings or not sure if you want to update the Tax ID format, you can always print and mail the 1099’s rather than E-file.

Here's an article to further explain the 1099 error you're getting: 1099 Invalid Information (Invalid tax ID).

If you need further help or clarification about this topic, please let me know in the comment. I'm always here to help when you need additional assistance. Have a wonderful day!

I'm also having this issue. It will not let me e-file without the tax ID. I have 2 contractors to pay but only have the SSN of one of them. He will not give me his SSN but I still need to file. It is also not letting me proceed to send a 1099 to the one I do have the information on without filling out the other's information.

I read on a help thread to put in [removed] but this is not working.

Hi there, @nikkibeth12.

Let's first remove the contractor who doesn't have an SSN. Then, e-file the 1099 form of the other contractor with SSN.

Before we proceed, please know that the IRS requires you submit 1099 with SSN information of your contractor.

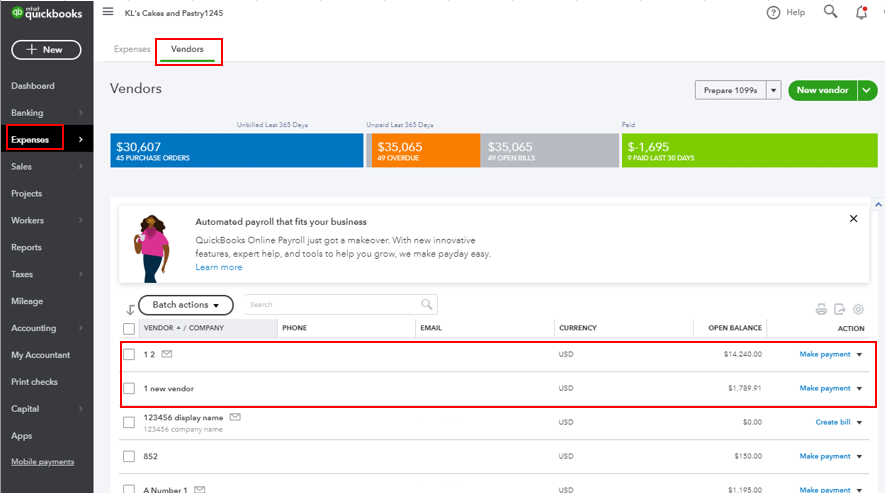

Here's how:

Once done, you can now prepare and e-file your contractor's 1099 with the SSN information. For your reference, you can check out this article for more guidance: Prepare and file 1099s.

Also, for the contractor who doesn't have an SSN, you can manually file or mail the 1099 form outside QuickBooks to the IRS. But as mentioned by @Rustler above, you should have a vendor that filled out and returned the IRS W-9 form to prevent this in the future.

You might also want to read this article to know more about 1099: Common questions about 1099s.

Please touch base with me here for all of your QuickBooks needs, I'm always happy to help. Have a good one.

The irs may give you a penalty if you don't include the social security number on the 1099. Here is a video explaining the problem https://youtu.be/VlNHO3jLmic

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here