Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello

I just did my bank reconciliations on Quickbooks Desktop 2019 and then I ran my P&L statement and none of the cleared checks are in the P&L. I did a back up and also restarted the software and there still no where on the report. I even made sure that reconciliation saved and it did because all the checks that cleared the account have cleared check marks on the items.

please help I need this report so I can finally submit my findings to the board.

Hello there, @Soccertreasurer.

I appreciate the details you've shared. I'd be happy to show you what report you can use to present the cleared checks.

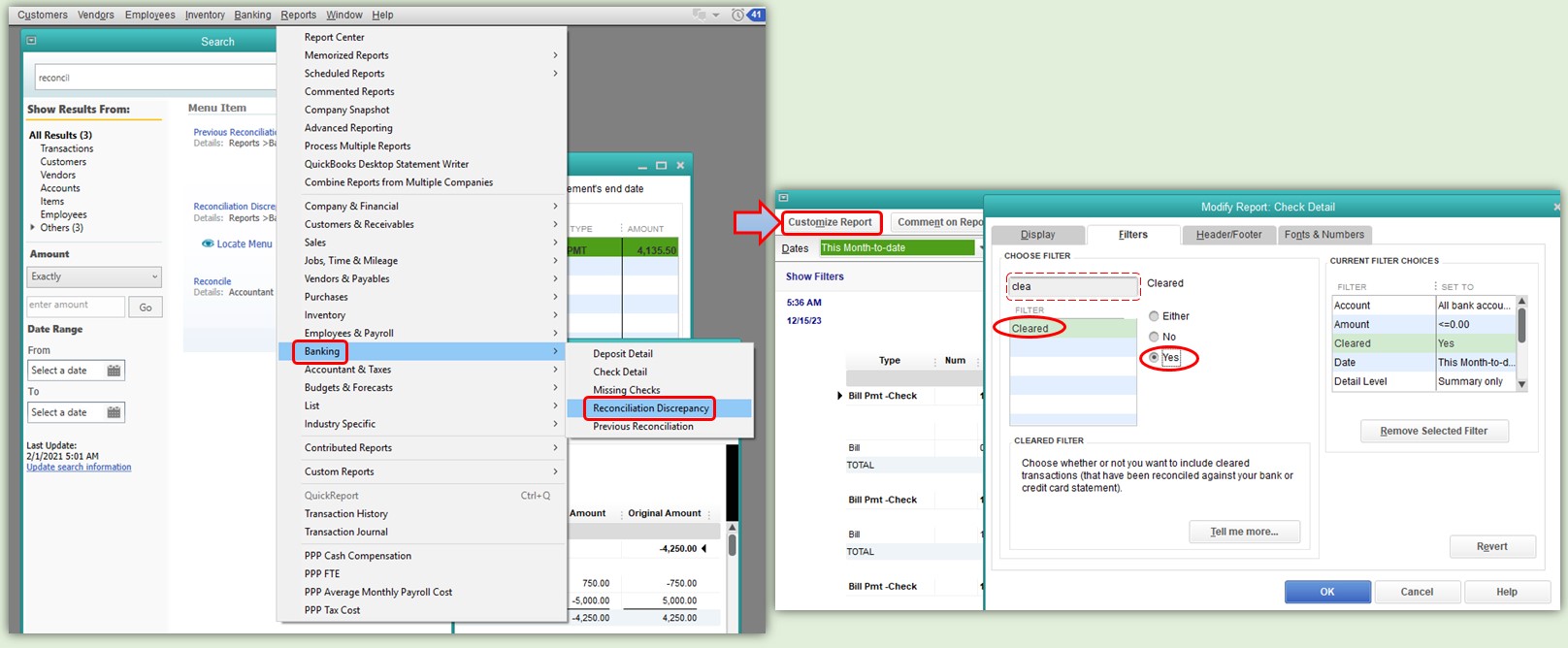

You may run Check Detail Report and include Cleared checks in the filter. I'll show you how to do that.

I've added this article in case you'll bump into any reconciliation issues in the future: Fix issues when you're reconciling in QuickBooks Desktop.

You can always get back in this thread if you need further assistance or if you have other questions. I'd be glad to be a part of your success.

Thanks for your reply. I already knew how to run a checks cleared report, the problem that I am facing is that my Profit & Loss report doesn't show the checks that cleared my account in Jan but it did on report that it did in December.

I feel like every time I get used to this software it throws a wrench in the works. I don't have the time to figure problems out every time QB doesn't give me what it used to the time before.

Feeling frustrated.

I can help you sort it out., @Soccertreasurer.

For you to clear the checks in January, you can change the Date in it.

You can run the report suggested by my colleague. From there, select the check in question and then change the Date. Ensure to save it afterward.

Adjust the reporting period of the Check Detail report to January.

Then go to the bank register to mark the payment as cleared (✓). You can then rerun the Profit and Loss report.

I'll be adding these references in case you need them again in the future. It shares insights on how to filter reports and memorize them:

Let me know if you have other QuickBooks concerns. I'm always around to help. Have a great day!

Hi Jovychris,

Before I begin I would like to take this opportunity in thanking you, I am not sure if its my explanation of my problem but I feel like the 2 replies that I have received are not the answers to my problem that I think will address my issue, so to that end I will explain.

I just did my Jan 2021 Bank reconciliation and it balanced to 0.00. I have a board meeting very soon and I don't have all the time in the world to get all my reports ready so I am starting them today.

I ran my Profit & Loss report and only 1 of the 5 checks that cleared my bank account actually showed on my P&L the other 4 checks didn't. Which to me is very strange. 3 of these 4 checks were issued last year and just cleared by bank account but the last check was issued and cashed in January. Thus Quickbooks P&L is making it look that my profits are larger than they should be.

I understand how the cashed checks report works and I have issues in there as well because all my bills that I receive I enter them in the "Enter Bills" then pay them obviously in the "Pay Bills" when paying the bills they are either Debit Card Transaction or actual checks that I cut to pay them but either way the debit card bills receive a DC normally in the check number field and when I run the outstand checks these debit card transations appear in it, that why I dont really want to use it.

Your solution I think you were attempting to fix check that had cleared in the wrong month thats why you are having my change the date but that's not what my problem is.

My problem is that the P&L does not show cleared checks that came out of my account, when it used to.

I have attached to PDF

1st PDF : Shows the 2 checks issued in Jan and cleared in january but only one of them shows up in the P&L for January. The other checks that cleared my account were issued in 2020 and cleared this month (Jan2021)

2nd Attachhment is the P&l that only shows the $216.00 check that cleared the account the other checks are nowhere to be seen on the report.

I hope that this explains my problem.

Thanks Ever so much

Ed

Before I add my reply I would liked to take this oppertunity to thank you for your assistance.

I am not sure if I am ultimately explain my problem thoroughly, so I will try again.

GOAL: I need my Profit & Loss report to show all the checks that cleared my bank account Jan, because its only showing 1 of 5 checks. I have attached my P&L for you to look at below.

Today I did my January 2021 bank reconciliation and it balanced to the penny. But not all checks that I reconciled show on my P&L ??????????

Below you can see the 5 checks that cleared my Bank A/C but only the $216 is showing on my P&L. To fix this I don't want to run a separate report for cleared checks because it should show up on 1 report as it used to do (the P&L). The checks issued date are correct and the cashed date is also correct, I am not sure why you provided me instruction on change the dates of the checks.

| 1/11/2021 | Referee Payroll | $ 20.00 |

| 1/15/2021 | Equipment Purchase (We Got Soccer) | $ 216.00 |

| 1/19/2021 | Referee Payroll | $ 115.00 |

| 1/19/2021 | Referee Payroll | $ 75.00 |

| 1/29/2021 | We Got Soccer | $ 2,020.00 |

I appreciate all the details and screenshots you've provided, Soccertreasurer.

As I’ve read your concern, it looks like the issue could possibly be a potential data damage. This might've caused the transactions not to show on the Profit and Loss report.

If the date and accounting method selected on the report is correct, what we can do is completely close the program and restart your computer. Then, come back and rerun the report.

If doing a total restart doesn't resolve the issue, let's make sure your QuickBooks Desktop is updated to the latest release. Then do the Verify and Rebuild Data in QuickBooks Desktop to repair any damaged data in your company file.

Please let me know if this helps. I'll be around to provide assistance until a solution is found. Thanks.

I get it I’m such a idiot I just need to change the bill dates and the check date to this month and they showed up in the P&L I just always thought that once I reconciled the check it would automatically show up in my p&l ..

although I am extremely happy that you figured this out QB should be automatically doing that and I am just dealing with a few checks what was to happen if I was dealing with a payroll run of checks , unless I’m messing something . What’s the point of having a reconcilement every month if these checks don’t show up in my reports.

Hello there, Soccertreasurer.

The reports being displayed will depend on the reporting period you set, how the transaction was recorded and the accounting method either it's Cash or Accrual. Feel free to look into these articles for more details in running reports and reconciling your accounts:

Keep us posted if there's anything else that you need help with. Take care!

I have a similar question along these same lines. I am just trying to figure out what the profit and loss report includes- such as, does it include everything on the chart of accounts, to include paid or unpaid invoices/receipts/etc? I am asking bc I am trying to figure out how to get an accurate profit and loss statement as I receive multiple insurance payments & copays as payment from several different insurance companies/clients, so there are small amounts of income coming in all over the place. In addition to that, insurance companies and the company I run the credit cards through bulk pay those small amounts- so I'll receive like $500 for 10 different claims. I do not want to have to match all 10 claims to the $500 to reconcile the account- I just want to check off the $500 bulk payment into the account to reconcile it. But this leaves all the individual invoices recorded not reconciled. So if I'm reconciling the account only with the bulk insurance/copay payments and leaving all the invoices/receipts, then is it double counting everything and the profit/loss statement is off? Or is the profit/loss statement strictly on the reconciled accounts which would be a correct profit/loss statement for me? Thank you.

Allow me to share a few information about what is included in the Profit and Loss report, jen76177.

A Profit and Loss (P & L) statement measures a company's sales and expenses during a specified period of time. The function of a P & L is to total all sources of revenue and subtract all expenses related to the revenue. It shows a company's financial progress during the time period being examined. On the other hand, the Chart of Accounts is the complete list of all the company’s accounts and balances. You'll want to run the Balance Sheet report to get the information on the company's assets, liabilities, and shareholders' equity.

Also, you'll have to reconcile your accounts to make sure that they match your real-life accounts and find out if there are any differences between the two cash balances. For more information, please check this article: Add and match Bank Feed transactions in QuickBooks Desktop. In addition, if you want to get additional information on reconciliation alone, you can run the previous reconciliation report in QuickBooks Desktop.

Fill me in and keep in touch if you need additional information P&L Report. I'll always make sure to get back to you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here